UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2013

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-11692

Ethan Allen Interiors Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

06-1275288 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| Ethan Allen Drive, Danbury, CT | 0681 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's telephone number, including area code | (203) 743-8000 |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of Each Class | Name of Each Exchange On Which Registered |

| Common Stock, $.01 par value | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [X] Yes [ ] No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

Large accelerated filer[ ] |

Accelerated filer[X] |

|

Non-accelerated filer[ ] |

Smaller reporting company[ ] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X] No

The aggregate market value of the Registrant’s common stock, par value $.01 per share, held by non-affiliates (based upon the closing sale price on the New York Stock Exchange) on December 31, 2012, (the last day of the Registrant’s most recently completed second fiscal quarter) was approximately $670,953,921. As of July 31, 2013, there were 28,909,611 shares of the Registrant’s common stock, par value $.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Certain information contained in the Registrant’s definitive Proxy Statement for the 2013 Annual Meeting of stockholders, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A of the Securities Exchange Act of 1934, is incorporated by reference into Part III hereof.

TABLE OF CONTENTS

| Item | Page | |

| PART I | ||

|

1. |

Business |

3 |

|

1A. |

Risk Factors |

11 |

|

1B. |

Unresolved Staff Comments |

16 |

|

2. |

Properties |

16 |

|

3. |

Legal Proceedings |

17 |

|

4. |

Mine Safety Disclosures |

17 |

|

PART II | ||

|

5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

17 |

|

6. |

Selected Financial Data |

19 |

|

7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

21 |

|

7A. |

Quantitative and Qualitative Disclosures About Market Risk |

33 |

|

8. |

Financial Statements and Supplementary Data |

33 |

|

9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

65 |

|

9A. |

Controls and Procedures |

65 |

|

9B. |

Other Information |

66 |

|

PART III | ||

|

10. |

Directors, Executive Officers and Corporate Governance |

66 |

|

11. |

Executive Compensation |

66 |

|

12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

66 |

|

13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

|

14. |

Principal Accountant Fees and Services |

66 |

|

PART IV | ||

|

15. |

Exhibits and Financial Statement Schedules |

67 |

|

|

Signatures |

71 |

PART I

Item 1. Business

Background

Incorporated in Delaware in 1989, Ethan Allen Interiors Inc., through its wholly-owned subsidiary, Ethan Allen Global, Inc., and Ethan Allen Global, Inc.’s subsidiaries (collectively, "We," "Us," "Our," "Ethan Allen" or the "Company"), is a leading manufacturer and retailer of quality home furnishings and accessories, offering a full complement of home decorating and design solutions through one of the country’s largest home furnishing retail networks. We refer to our Ethan Allen retail outlets as "design centers" instead of "stores" to better reflect these expanded capabilities. We have made, and continue to make, considerable investment in our business in order to expand and improve our interior design capabilities and to leverage our Company operated manufacturing and logistics operations. The Company was founded in 1932 and has sold products under the Ethan Allen brand name since 1937.

Mission Statement

Our primary business objective is to provide our customers with a convenient, full-service, one-stop shopping solution for their home decorating needs by offering stylish, high-quality products at good value. In order to meet our stated objective, we have developed and adhere to a focused and comprehensive business strategy. The elements of this strategy, each of which is integral to our solutions-based philosophy, include (i) our vertically integrated operating structure, (ii) our stylish products and related marketing initiatives, (iii) our retail design center network, (iv) our people, and (v) our focus on providing design solutions.

Operating Segments

Our products are sold through a dedicated global network of approximately 300 retail design centers. As of June 30, 2013, the Company operated 147 design centers (our retail segment) and our independent retailers operated 148 design centers (as compared to 147 and 151, respectively, at the end of the prior fiscal year). Our wholesale segment net sales include sales to our retail segment and sales to our independent retailers. Our retail segment net sales accounted for 79% of our consolidated net sales in fiscal 2013. Our wholesale segment net sales to independent retailers accounted for 21%, including approximately 10% of our net sales in fiscal 2013 to the ten largest independent retailers, who operate 89 design centers. Our independent retailer in China operated 68 of these locations at the end of fiscal 2013.

Our wholesale and retail operating segments represent strategic business areas of our vertically integrated business that operate separately and provide their own distinctive services (further outlined below). This enables us to more effectively offer our complete line of home furnishings and accessories and more efficiently control quality and cost. For certain financial information regarding our operating segments, see Note 15 to the Consolidated Financial Statements included under Item 8 of this Annual Report and incorporated herein by reference.

Our home furnishings and accessories are marketed and sold in a similar manner in our wholesale and retail segments, although the type of customer (wholesale versus retail) and the specific services that each operating segment provides are different. Within the wholesale segment, we maintain revenue information according to each respective product line (i.e. case goods, upholstery, or home accessories and other). Case goods include items such as beds, dressers, armoires, tables, chairs, buffets, entertainment units, home office furniture, and wooden accents. Upholstery items include sleepers, recliners, chairs, sofas, loveseats, cut fabrics and leather. Skilled craftsmen cut, sew and upholster custom-designed upholstery items which are available in a variety of frame and fabric options. Home accessory and other items include window treatments, wall decor, lighting, clocks, bedding and bedspreads, decorative accessories, area rugs, and home and garden furnishings. The allocation of retail sales by product line follows that of the wholesale segment (see table of wholesale net sales allocated by product line in the Wholesale Segment Overview below).

We evaluate performance of the respective segments based upon revenues and operating income. Inter-segment transactions result, primarily, from the wholesale sale of inventory to the retail segment, including the related profit margin.

Wholesale Segment Overview:

Wholesale net sales for each of the last three fiscal years are summarized below (in millions):

|

Fiscal Year Ended June 30, |

||||||||||||

|

2013 |

2012 |

2011 |

||||||||||

|

Wholesale net sales |

$ | 434.4 | $ | 456.9 | $ | 422.9 | ||||||

Wholesale net sales for each of the last three fiscal years, allocated by product line, were as follows:

|

Fiscal Year Ended June 30, |

||||||||||||

|

2013 |

2012 |

2011 |

||||||||||

|

Case Goods |

37 | % | 38 | % | 39 | % | ||||||

|

Upholstered Products |

48 | % | 44 | % | 46 | % | ||||||

|

Home Accessories and Other |

15 | % | 18 | % | 15 | % | ||||||

| 100 | % | 100 | % | 100 | % | |||||||

The wholesale segment, principally involved in the development of the Ethan Allen brand, encompasses all aspects of design, manufacture, sourcing, sale, and distribution of our broad range of home furnishings and accessories. Wholesale revenue is generated upon the wholesale sale and shipment of our products to our network of independently operated design centers and Company operated design centers (see Company operated retail comments below) through its national distribution center and one other smaller fulfillment center.

During the past year, independent retailers opened 11 new design centers, (two of which were relocations), acquired two from the Company, closed 12, and sold two to the Company. We continue to promote the growth and expansion of our independent retailers through ongoing support in the areas of market analysis, site selection, and business development. As in the past, our independent retailers are required to enter into license agreements with us, which (i) authorize the use of certain Ethan Allen trademarks and (ii) require adherence to certain standards of operation, including a requirement to fulfill related warranty service agreements. We are not subject to any territorial or exclusive retailer agreements in North America. The wholesale segment also develops and implements related marketing and brand awareness programs.

Wholesale profitability includes (i) the wholesale gross margin, which represents the difference between the wholesale net sales price and the cost associated with manufacturing and/or sourcing the related product, and (ii) other operating costs associated with wholesale segment activities.

Approximately 70% of the products sold by the Company are manufactured in its North American plants. During fiscal 2013, the Company’s manufacturing footprint remained stable, while increasing throughput in our two newest Company operated North American plants in Mexico and Honduras by adding skilled workers and state-of-the-art manufacturing equipment. We operate four case good plants (two in Vermont including one sawmill, one in North Carolina, and one in Honduras), three upholstery plants (two in our North Carolina campus, and one in Mexico) and one home accessory plant in New Jersey. We also source selected case goods, upholstery, and home accessory items from third-party suppliers domestically and abroad.

As of June 30, 2013, our wholesale backlog was $48.0 million (as compared to $49.5 million as of June 30, 2012) which is anticipated to be serviced in the first quarter of fiscal 2014. This backlog fluctuates based on the timing of net orders booked, manufacturing schedules and efficiency, the timing of sourced product receipts, and the timing and volume of wholesale shipments. Because orders may be rescheduled and/or canceled and the sourcing timing may change, the measure of backlog at a point in time may not necessarily be indicative of future sales performance.

For the twelve months ended June 30, 2013, net orders booked at the wholesale level, which includes orders generated by independently operated and Company operated design centers, totaled $434.1 million as compared to $442.3 million for the twelve months ended June 30, 2012. In any given period, net orders booked may be impacted by the timing of floor sample orders received in connection with new product introductions which were significant during the prior fiscal year ended June 30, 2012. New product offerings may be made available to the retail network at any time during the year, including in connection with our periodic retailer conferences.

Retail Segment Overview:

Retail net sales for each of the last three fiscal years are summarized below (in millions):

|

Fiscal Year Ended June 30, |

||||||||||||

|

2013 |

2012 |

2011 |

||||||||||

|

Retail net sales |

$ | 578.3 | $ | 559.4 | $ | 505.9 | ||||||

The retail segment sells home furnishings and accessories to consumers through a network of Company operated design centers. During fiscal 2013, we opened seven design centers (three of which were relocations), acquired two from independent retailers, closed four design centers and sold two to our independent retailers. The Company also offers access to its products to qualified independent interior designers through our interior design affiliate (“IDA”) program. Retail revenue is generated upon the retail sale and delivery of our products to our retail customers through our network of service centers. Retail profitability reflects (i) the retail gross margin, which represents the difference between the retail net sales price and the cost of goods, purchased primarily from the wholesale segment, and (ii) other operating costs associated with retail segment activities.

We measure the performance of our design centers based on net sales and written orders booked on a comparable period to period basis. Comparable design centers are those which have been operating for at least 15 months. During the first three months of operations of newly opened (including relocated) design centers, written orders are booked but minimal net sales are achieved through the delivery of products. Design centers we acquire from independent retailers are included in comparable design center sales in their 13th full month of Ethan Allen-owned operations. The frequency of our promotional events as well as the timing of the end of those events can also affect the comparability of orders booked during a given period.

We pursue further expansion of the Company operated retail business by adding interior design professionals and expanding the IDA program, opening new design centers, relocating existing design centers and, when appropriate, acquiring design centers from independent retailers. During fiscal 2013, we opened one new design center in Canada and two in Belgium. We also launched www.ethanallen.ca, our new multi-lingual website and near the end of the fiscal year moved the Company’s U.S. based website onto a cloud based platform. These are our first Company operated design centers in non-English speaking international markets. The geographic distribution of retail design center locations is included under Item 2 of Part I of this Annual Report.

Products

Our strategy has been to position Ethan Allen as a preferred brand with superior style, quality and value while, at the same time, providing consumers with a comprehensive, one-stop shopping solution for their home furnishing and design needs. In carrying out our strategy, we continue to expand our reach to a broader consumer base through a diverse selection of attractively priced products, designed to complement one another, reflecting the popular trend toward eclectic home decorating. During fiscal 2013, the Company introduced new Fresh Colors and American Color finishes and the Impressions product line that take advantage of the Company’s custom manufacturing capabilities in its North American plants. These introductions follow a significant change in products begun in fiscal 2012, when the Company introduced significantly more new products than normal, refreshing a broad range of its products. Regular product introductions, a broad range of styles and selections within our custom upholstery and case good lines, new finishes for, and redesigns of, previous product introductions, and expanded product offerings to accommodate today’s home decorating trends, continue to redefine Ethan Allen, positioning us as a leader in style.

All of our case goods, upholstered products, and home accessories are styled with distinct design characteristics. Home accessories play an important role in our marketing strategy as they enable us to offer the consumer the convenience of one-stop shopping by creating a comprehensive home furnishing solution. The interior of our design centers is organized to facilitate display of our product offerings, both in room settings that project the category lifestyle and by product grouping to facilitate comparisons of the styles and tastes of our clients. To further enhance the experience, technology is used to expand the range of products viewed by including content from our award-winning website and advanced large touch-screen flat panel displays.

We continuously monitor changes in home design trends through attendance at international industry events and fashion shows, internal market research, and regular communication with our retailers and design center design consultants who provide valuable input on consumer tendencies. We believe that the observations and input gathered enable us to incorporate appropriate style details into our products to react quickly to changing consumer tastes.

Product Sourcing Activities

Using on staff and outsourced artisans, we design the majority of the products we sell; all of which are branded Ethan Allen. This important facet of our vertically integrated business enables us to control the design specifications and establish consistent levels of quality across our product offerings. We manufacture and / or assemble approximately 70% of the products we sell in our own North American plants making us one of the largest manufacturers of home furnishings in the United States. Our main manufacturing facilities are located in the Northeast and Southeast regions of the United States supported by an upholstery plant in Mexico and a case goods plant in Honduras. Our plants are located near sources of raw materials and / or skilled craftspeople. We source approximately 30% of the products we sell from third-party suppliers, most of which are located outside the United States, primarily in Asia. We carefully select our sourcing partners and require them to provide products according to our specifications and quality standards. We believe that relatively minor strategic investments in our manufacturing facilities balanced with outsourcing from foreign and domestic suppliers will accommodate significant future sales growth and allow us to maintain an appropriate degree of control over cost, quality and service to our customers.

We take pride in our “green” initiatives including but not limited to the use of responsibly harvested Appalachian woods, water based finishes, organic cotton textiles and recycled materials in our products. We have also reduced our carbon footprint by using the wooden waste from our case goods manufacturing plants to generate heat and electricity for our plants in the Northeast. This led to receipt in 2013 of the Vermont Governor’s Award for Environmental Excellence. This year we expanded our voluntary participation in the Enhancing Furniture’s Environmental Culture (EFEC) program sponsored by the American Home Furnishing Alliance, already in place in our manufacturing facilities. This program requires participating companies to analyze and better understand the environmental impact of processes, raw materials and finished products on a facility-by-facility basis.

Raw Materials and Other Suppliers

The most important raw materials we use in furniture manufacturing are lumber, veneers, plywood, hardware, glue, finishing materials, glass, mirrored glass, laminates, fabrics, foam, and filling material. The various types of wood used in our products include cherry, ash, oak, maple, prima vera, mahogany, birch and pine; substantially all of which are purchased domestically.

Fabrics and other raw materials are purchased both domestically and outside the United States. We have no significant long-term supply contracts, and have sufficient alternate sources of supply to prevent disruption in supplying our operations. We maintain a number of sources for our raw materials, which we believe contribute to our ability to obtain competitive pricing. Lumber prices fluctuate over time based on factors such as weather and demand, which, in turn, impact availability. The cost of some of our raw materials (such as foam) and the shipping costs on purchased finished goods are dependent on petroleum cost. Higher material prices, cost of petroleum, and purchased finished goods prices could have an adverse effect on margins.

Appropriate amounts of lumber and fabric inventory are typically stocked to maintain adequate production levels. We believe that our sources of supply for these materials are sufficient and that we are not dependent on any one supplier. Within our existing case goods manufacturing sites, we have “supermarkets of parts” housing the components used in our custom manufacturing of those products.

We enter into standard purchase agreements with certain foreign and domestic suppliers to source selected case goods, upholstery, and home accessory items. The terms of these arrangements are customary for the industry and do not contain any long-term contractual obligations on our behalf. We believe we maintain good relationships with our suppliers.

Distribution and Logistics

We distribute our products through one primary distribution center, owned by the Company, strategically located in Virginia. This national distribution center is supported by a smaller Company owned order fulfillment center located in Oklahoma. Our primary distribution center provides efficient cross-dock operations to receive and ship product from our manufacturing facilities and third-party suppliers to our network of Company and independently operated retail service centers. Retail service centers prepare products for delivery into clients’ homes. At June 30, 2013, the Company operated retail design centers were supported by 13 Company operated retail service centers plus nine third party service companies.

While we manufacture to custom order the majority of our products, we also stock selected case goods, upholstery and accessories to provide for quick delivery of in-stock items and to allow for more efficient production runs. Ethan Allen Express, a program that markets a selection of attractively priced products held in stock for faster delivery, further enhances our ability to reduce lead times for our clients. Wholesale shipments utilize our own fleet of trucks and trailers or are subcontracted with independent carriers. Approximately 89% of our fleet (trucks and trailers) is owned, with the remainder under operating and capital lease agreements with remaining terms ranging from less than one to five years.

Our practice has been to sell our products at the same delivered cost to all Company and independently operated design centers nationwide, regardless of their shipping point. This policy creates pricing credibility with our wholesale customers while providing our retail network the opportunity to achieve more consistent margins by removing fluctuations attributable to the cost of shipping. Further, this policy eliminates the need for our independent retailers to carry significant amounts of inventory in their own warehouses. As a result, we obtain more accurate consumer product demand information.

Marketing Programs

Our marketing and advertising strategies are developed to drive traffic into our network of design centers and to ethanallen.com. We believe these strategies give Ethan Allen a strong competitive advantage in the home furnishings industry. We create and coordinate print, digital and television campaigns nationally, as well as assist in international and local marketing and promotional efforts. The Company’s network of approximately 300 retail design centers and approximately 4,000 independent members of the Interior Design Affiliate program benefit from these marketing efforts, and we believe these efforts position us to consistently fulfill our brand promise.

Our team of advertising specialists sends consistent, clear messages that Ethan Allen is a leader in style and service, with everything for the well designed home. We use several forms of media to accomplish this, including television (national and local), direct mail, newspapers, regional shelter magazines, social media, email, and online advertising. These messages are also conveyed on our website at ethanallen.com. A strong email marketing campaign delivers promotional messages, inspiration, design ideas and product brochures to a growing database of clients.

Our national television, social media, online and print advertising campaigns are designed to leverage our strong brand equity, finding creative and compelling ways to remind consumers of our tremendous range of products, services, special programs, and custom options. Coordinated local television and print advertising also serve to support our national programs.

The Ethan Allen direct mail magazine, which emphasizes the eclectic mix of our wide breadth of products, and our services, is one of our most important marketing tools. We publish these magazines and sell them to Company and independently operated design centers who use demographic information collected through independent market research to target potential clients. Given the importance of this advertising medium, direct mail marketing lists are continually refined to target those consumers who are most likely to purchase, and improve the return on direct mail expenditures. Approximately 15 million copies of our direct mail magazine were distributed to consumers during fiscal 2013.

Our television advertising and direct mail efforts are supported by strong print campaigns. We also update our Style Book approximately every six months. The Style Book is a celebration of Ethan Allen’s rich history, as well as a catalog of our case goods, upholstery and accent products. Throughout the Style Book, we tell the stories of some inspiring associates, provide inspirational photos, and detail the attributes that have become Ethan Allen hallmarks over the years; fine craftsmanship, exceptional quality, great prices, style, personal service, white glove delivery and remarkable functionality, while maintaining the ability to produce about 70% of our offerings in our own workshops. This publication is a comprehensive and effective resource for our clients.

Ethanallen.com provides our clients and our associates with the tools they need to shop and design. The website features a series of helpful tabs with videos, feature stories, design and style solutions, and fresh, new looks. Those looking to shop our site can do so by lifestyle, by product, or by room in an easy-to-navigate format. The site's “My Projects” tool lets visitors create idea boards and room plans, and even gives them the option of consulting with a design professional from their local Ethan Allen design center. Visitors to ethanallen.com will also find all our latest news and promotional information. Nearly all of Ethan Allen’s products are available for purchase online, and our list of on-line products are expanding. At the end of fiscal 2013, we migrated our website onto a “cloud” platform, further enhancing search and usability features of the site.

To enhance the Ethan Allen client experience, our Design Centers have interactive touchscreens, where users can take our Style Quiz, browse our full product catalog, check out hundreds of fully designed rooms, print product descriptions, learn about promotions, and much more.

Our social media content is updated regularly and offers fans and followers inspirational images, trend information, and design ideas, as well as tips for how to bring distinctive Ethan Allen style to their homes.

We also have a robust and informative extranet available to our retailers and design professionals. It is the primary source of communication in and among members of our retail network. It provides information about every aspect of the retail business at Ethan Allen, including advertising materials, prototype floor plan displays, and extensive product details. Some of our design consultants utilize customized tablets so they can be more productive in our clients’ homes.

Retail Design Center Network

Ethan Allen design centers are typically located in busy urban settings as freestanding destinations or as part of suburban strip malls, depending upon the real estate opportunities in a particular market. Our design centers average approximately 16,000 square feet in size but range from approximately 3,000 square feet to 35,000 square feet.

We maximize uniformity of presentation throughout the retail design center network through a comprehensive set of standards and display planning assistance. These standard interior design formats assist each design center in presenting a high quality image by using focused lifestyle settings and select product category groupings to display our products and information to facilitate design solutions and to educate consumers. We also create a uniform design center image with consistent exterior facades in addition to the interior layouts. The adherence to all of these standards have helped position Ethan Allen as a leader in home furnishings retailing.

We continue to strengthen the retail network with many initiatives, including the opening of new and relocating design centers in desirable locations, updating presentations and floor plans, strengthening of the professionalism of our designers through training and certification, and the consolidation of certain design centers and service centers.

People

At June 30, 2013, the Company had approximately 4,900 employees (“associates”), approximately one percent of whom are represented by unions whose collective bargaining agreements expire within the next year. We expect no significant changes in our relations with the unions and believe we maintain good relationships with our employees.

The retail network, which includes both Company and independently operated design centers, is staffed with a sales force of design consultants and service professionals who provide customers with effective home decorating solutions at no additional charge. Our interior design associates receive specialty training with respect to the distinctive design and quality features inherent in each of our products and programs. This enables them to more effectively communicate the elements of style and value that serve to differentiate us from our competition. As such, we believe our design consultants, and the complimentary service they provide, create a distinct competitive advantage over other home furnishing retailers. We continue to strengthen the level of service, professionalism, interior design competence, efficiency, and effectiveness of retail design center associates.

The Company’s interior design affiliate program now has over 4,000 qualified professional interior design affiliates, who add strength and breadth to our interior design reach. We believe that this program augments the Company and independent retailer design staffs to reach more clients and improve market penetration.

We recognize the importance of our retail design center network to our long-term success. Accordingly, we believe we (i) have established a strong management team within Company operated design centers and (ii) continue to work closely with our independent retailers in order to assist them. With this in mind, we make our services available to every design center, whether independently operated or Company operated, in support of their marketing efforts, including coordinated advertising, merchandising and display programs, and extensive training seminars and educational materials. We believe that the development of design consultants, service and delivery personnel, and retailers is important for the growth of our business. As a result, we have committed to make available comprehensive retail training programs intended to increase the customer service capabilities of each individual.

Customer Service Offerings

We offer numerous customer service programs, each of which has been developed and introduced to consumers in an effort to make their shopping experience easier and more enjoyable.

Gift Card

This program allows customers to purchase gift cards through our website or at any participating retail design center, which can be redeemed for any of our products or services.

On-Line Room Planning

On our website, we offer an interactive on-line room planning resource which serves to further assist consumers with their home decorating needs. Through the use of this web-based tool, customers can determine which of our product offerings best fit their particular needs based on their own individual home floor plan.

Ethan Allen Consumer Credit Programs

The Ethan Allen Finance Plus program offers consumers (clients) a menu of custom financing options. Financing offered is administered by a third-party financial institution and is granted to our customers on a non-recourse basis to the Company. Clients may apply for an Ethan Allen Finance Plus card at any participating design center or on-line at ethanallen.com.

Competition

The domestic and global home furnishings industry faces numerous challenges, which include an influx of low-priced products from overseas. As a result, there is a high degree of competition in our markets. The “Great Recession’ of 2008-2009 resulted in many small and medium sized furniture retailers going out of business, and other well-established competitors resorting to heavy discounts to attract customers. We differentiate ourselves as a preferred brand by adhering to a business strategy focused on providing (i) high-quality, well designed and often custom, handmade products at good value, (ii) a comprehensive complement of home furnishing design solutions, including our complimentary design service, and (iii) excellence in customer service. We consider our vertical integration a significant competitive advantage in the current environment as it allows us to design, manufacture and source, distribute, market, and sell our products through one of the industry’s largest single-source retail networks.

The internet also provides a highly competitive medium for the sale of a significant amount of home furnishings each year. Much of that product is sold through commodity oriented, low priced and low service retailers. At Ethan Allen, the ultimate goal of our internet strategy is to drive traffic into our network of design centers by coupling technology with excellent personal service. At ethanallen.com, customers have the opportunity to buy our products online but we take the process further. With so much of our product offering being custom, we encourage our website customers to get online help from our network of interior design professionals. This complimentary interior design support creates a competitive advantage through our excellent personal service. This enhances the experience and regularly leads to internet customers becoming clients of our network of interior design centers.

Industry globalization has provided us an opportunity to adhere to a blended sourcing strategy, establishing relationships with certain manufacturers, both domestically and outside the United States, to source selected case goods, upholstery, and home accessory items. We intend to continue to balance our domestic production with opportunities to source from foreign and domestic manufacturers, as appropriate, in order to maintain our competitive advantage.

We believe the home furnishings industry competes primarily on the basis of product styling and quality, personal service, prompt delivery, product availability and price. We further believe that we effectively compete on the basis of each of these factors and that, more specifically, our product presentations, website, and complimentary design service create a distinct competitive advantage, further supporting our mission of providing consumers with a complete home decorating and design solution. We also believe that we differentiate ourselves further with the quality of our design service through our intensive training. Our objective is to continue to develop and strengthen our retail network by (i) expanding the Company operated retail business through the repositioning of our design centers, and (ii) obtaining and retaining independent retailers, encouraging such retailers to expand their business through the opening or relocation of new design centers with the objective of increasing the volume of their sales and (iii) further expanding our sales network through our IDA program.

Trademarks

We currently hold, or have registration applications pending for, numerous trademarks, service marks and design patents for the Ethan Allen name, logos and designs in a broad range of classes for both products and services in the United States and in many foreign countries. In addition, we have registered, or have applications pending for certain of our slogans utilized in connection with promoting brand awareness, retail sales and other services and certain collection names. We view such trademarks and service marks as valuable assets and have an ongoing program to diligently monitor and defend, through appropriate action, against their unauthorized use.

Available Information

We make available, free of charge via our website, all Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with, or furnished to, the Securities and Exchange Commission (the "SEC" or the "Commission"), including amendments to such reports. This information is available at www.ethanallen.com/investors as soon as reasonably practicable after it is electronically filed with, or furnished to, the SEC. In addition, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding companies that file electronically with the Commission. This information is available at www.sec.gov.

In addition, charters of all committees of our Board of Directors, as well as our Corporate Governance guidelines, are available on our website at www.ethanallen.com/governance or, upon written request, in printed hardcopy form. Written requests should be sent to Office of the Secretary, Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, Connecticut 06811.

Item 1A. Risk Factors

The following information describes certain significant risks and uncertainties inherent in our business that should be carefully considered, along with other information contained elsewhere in this report and in other filings, when making an investment decision with respect to us. If one or more of these risks actually occurs, the impact on our business, including our financial condition, results of operations, and cash flows could be adverse.

An economic downturn may materially adversely affect our business.

Our business and results of operations are affected by international, national and regional economic conditions. The United States and many other international economies experienced a major recession, which reduced the available market size for our industry from historic peak levels. While we have recalibrated the footprint of our vertically integrated enterprise to be profitable with lower revenues than achieved at our historic peak, an economic downturn of significance or extended duration may materially affect our business performance, profitability, and cash flows.

Access to consumer credit could be interrupted and reduce sales and profitability.

Our ability to continue to access consumer credit for our clients could be negatively affected by conditions outside our control. If capital market conditions were to worsen meaningfully, there is a risk that our business partner that issues our private label credit card program under a contract that expires July 2014 may not be able to fulfill its obligations under that agreement. In addition, further tightening of credit markets may restrict our customers’ ability and willingness to make purchases.

We may be unable to obtain sufficient external funding to finance our operations and growth.

Historically, we have relied upon our cash from operations to fund our operations and growth. As we operate and expand our business, we may rely on external funding sources, including the proceeds from the issuance of debt or the $50 million revolving bank line of credit under our existing credit facility. Any unexpected reduction in cash flow from operations could increase our external funding requirements to levels above those currently available. The credit rating agencies Moody’s Corporation and Standard and Poor’s most recent rating of our corporate and senior unsecured credit is Ba2 and BB- respectively. If our credit ratings were lowered further, the Company’s access to debt could be negatively impacted. There can be no assurance that we will not experience unexpected cash flow shortfalls in the future or that any increase in external funding required by such shortfalls will be available on acceptable terms or at all.

Operating losses could reduce our liquidity and impact our dividend policy.

Historically, we have relied on our cash from operations to fund our operations and the payment of cash dividends. If the Company’s financial performance were to deteriorate resulting in financial losses we may not be able to fund a shortfall from operations and would require external funding. Some financing instruments used by the Company historically may not be available to the Company in the future. We cannot assure that additional sources of financing would be available to the Company on commercially favorable terms should the Company's capital requirements exceed cash available from operations and existing cash and cash equivalents. In such circumstances, the Company may reduce its quarterly dividends.

Additional impairment charges could reduce our profitability.

We have significant long-lived tangible and intangible assets recorded on our balance sheets. If our operating results decline, we may incur impairment charges in the future, which could have a material impact on our financial results. We evaluate the recoverability of the carrying amount of our long-lived tangible and intangible assets on an ongoing basis. There can be no assurance that the outcome of such future reviews will not result in substantial impairment charges. Impairment assessment inherently involves judgments as to assumptions about expected future cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact our assumptions as to prices, costs or other factors that may result in changes in our estimates of future cash flows. Although we believe the assumptions we use in testing for impairment are reasonable, significant changes in any of our assumptions could produce a significantly different result.

We face changes in global and local economic conditions that may adversely affect consumer demand and spending, our manufacturing operations or sources of merchandise.

Historically, the home furnishings industry has been subject to cyclical variations in the general economy and to uncertainty regarding future economic prospects. Such uncertainty, as well as other variations in global economic conditions such as rising fuel costs, wage and benefit inflation, currency fluctuations, and increasing interest rates, may continue to cause inconsistent and unpredictable consumer spending habits, while increasing our own input costs. These risks, as well as industrial accidents or work stoppages, could also severely disrupt our manufacturing operations, which could have a material adverse effect on our financial performance.

We import a portion of our merchandise from foreign countries and operate manufacturing plants in Mexico and Honduras. As a result, our ability to obtain adequate supplies or to control our costs may be adversely affected by events affecting international commerce and businesses located outside the United States, including natural disasters, changes in international trade, central bank actions, changes in the relationship of the U.S. dollar versus other currencies, labor availability and cost, and other governmental policies of the U.S. and the countries from which we import our merchandise or in which we operate facilities. The inability to import products from certain foreign countries or the imposition of significant tariffs could have a material adverse effect on our results of operations.

Competition from overseas manufacturers and domestic retailers may adversely affect our business, operating results or financial condition.

Our wholesale business segment is involved in the development of our brand, which encompasses the design, manufacture, sourcing, sales and distribution of our home furnishings products, and competes with other U.S. and foreign manufacturers. Our retail network sells home furnishings to consumers through a network of Company operated design centers, and competes against a diverse group of retailers ranging from specialty stores to traditional furniture and department stores, any of which may operate locally, regionally and nationally, as well as over the internet. We also compete with these and other retailers for appropriate retail locations as well as for qualified design consultants and management personnel. Such competition could adversely affect our future financial performance.

Industry globalization has led to increased competitive pressures brought about by the increasing volume of imported finished goods and components, particularly for case good products, and the development of manufacturing capabilities in other countries, specifically within Asia. The increase in overseas production capacity has created over-capacity for many manufacturers, including us, which has led to industry-wide plant consolidation. In addition, because many foreign manufacturers are able to maintain substantially lower production costs, including the cost of labor and overhead, imported product may be capable of being sold at a lower price to consumers, which, in turn, could lead to some measure of further industry-wide price deflation.

We cannot provide assurance that we will be able to establish or maintain relationships with sufficient or appropriate manufacturers, whether foreign or domestic, to supply us with selected case goods, upholstery and home accessory items to enable us to maintain our competitive advantage. In addition, the emergence of foreign manufacturers has served to broaden the competitive landscape. Some of these competitors produce furniture types not manufactured by us and may have greater financial resources available to them or lower costs of operating. This competition could adversely affect our future financial performance.

Failure to successfully anticipate or respond to changes in consumer tastes and trends in a timely manner could adversely impact our business, operating results and financial condition.

Sales of our products are dependent upon consumer acceptance of our product designs, styles, quality and price. We continuously monitor changes in home design trends through attendance at international industry events and fashion shows, internal marketing research, and regular communication with our retailers and design consultants who provide valuable input on consumer tendencies. However, as with all retailers, our business is susceptible to changes in consumer tastes and trends. Such tastes and trends can change rapidly and any delay or failure to anticipate or respond to changing consumer tastes and trends in a timely manner could adversely impact our business, operating results and financial condition.

Our number of manufacturing and logistics sites may increase our exposure to business disruptions and could result in higher transportation costs.

We have reduced the number of manufacturing sites in our case good and upholstery operations, consolidated our distribution network into fewer centers for both wholesale and retail segments, and operate a single accessories plant. Our upholstery operations consist of two upholstery plants on our Maiden, North Carolina campus and one plant in Mexico. The Company operates three manufacturing plants (North Carolina, Vermont, and Honduras) and one sawmill in support of our case goods operations. Our plants require various raw materials and commodities such as logs and lumber for our case good plants and foam, springs and engineered hardwood board for our upholstery plants. As a result of the consolidation of our manufacturing operations into fewer facilities, if any of our manufacturing or logistics sites experience significant business interruption, our ability to manufacture products or deliver timely would likely be impacted. While we have long-standing relationships with multiple outside suppliers of our raw materials and commodities, there can be no assurance of their ability to fulfill our supply needs on a timely basis. The consolidation to fewer locations has resulted in longer distances for delivery and could result in higher costs to transport products if fuel costs increase significantly.

Our current and former manufacturing and retail operations and products are subject to increasingly stringent environmental, health and safety requirements.

We use and generate hazardous substances in our manufacturing and retail operations. In addition, both the manufacturing properties on which we currently operate and those on which we have ceased operations are and have been used for industrial purposes. Our manufacturing operations and, to a lesser extent, our retail operations involve risk of personal injury or death. We are subject to increasingly stringent environmental, health and safety laws and regulations relating to our products, current and former properties and our current operations. These laws and regulations provide for substantial fines and criminal sanctions for violations and sometimes require product recalls and/or redesign, the installation of costly pollution control or safety equipment, or costly changes in operations to limit pollution or decrease the likelihood of injuries. In addition, we may become subject to potentially material liabilities for the investigation and cleanup of contaminated properties and to claims alleging personal injury or property damage resulting from exposure to or releases of hazardous substances or personal injury because of an unsafe workplace.

In addition, noncompliance with, or stricter enforcement of, existing laws and regulations, adoption of more stringent new laws and regulations, discovery of previously unknown contamination or imposition of new or increased requirements could require us to incur costs or become the basis of new or increased liabilities that could be material.

Fluctuations in the price, availability and quality of raw materials could result in increased costs or cause production delays which might result in a decline in sales, either of which could adversely impact our earnings.

We use various types of wood, foam, fibers, fabrics, leathers, and other raw materials in manufacturing our furniture. Certain of our raw materials, including fabrics, are purchased domestically and outside North America. Fluctuations in the price, availability and quality of raw materials could result in increased costs or a delay in manufacturing our products, which in turn could result in a delay in delivering products to our customers. For example, lumber prices fluctuate over time based on factors such as weather and demand, which in turn, impact availability. Production delays or upward trends in raw material prices could result in lower sales or margins, thereby adversely impacting our earnings.

In addition, certain suppliers may require extensive advance notice of our requirements in order to produce products in the quantities we desire. This long lead time may require us to place orders far in advance of the time when certain products will be offered for sale, thereby exposing us to risks relating to shifts in consumer demand and trends, and any significant downturn in the U.S. economy.

We depend on key personnel and could be affected by the loss of their services.

The success of our business depends upon the services of certain senior executives, and in particular, the services of M. Farooq Kathwari, Chairman of the Board, President and Chief Executive Officer, who is the only one of our senior executives who operates under a written employment agreement. The loss of any such person or other key personnel could have a material adverse effect on our business and results of operations.

Our business is sensitive to increasing labor costs, competitive labor markets, our continued ability to retain high-quality personnel and risks of work stoppages.

The market for qualified employees and personnel in the retail and manufacturing industries is highly competitive. Our success depends upon our ability to attract, retain and motivate qualified craftsmen, professional and clerical associates and upon the continued contributions of these individuals. We cannot provide assurance that we will be successful in attracting and retaining qualified personnel. A shortage of qualified personnel may require us to enhance our wage and benefits package in order to compete effectively in the hiring and retention of qualified employees. Our labor and benefit costs may continue to increase and such increases may not be recovered. In addition, some of our employees are covered by collective bargaining agreements with local labor unions. Although we do not anticipate any difficulty renegotiating these contracts as they expire, a labor-related stoppage by these unionized employees could adversely affect our business and results of operations. The loss of the services of such personnel or our failure to attract additional qualified personnel could have a material adverse effect on our business, operating results and financial condition.

Our success depends upon our brand, marketing and advertising efforts and pricing strategies. If we are not able to maintain and enhance our brand, or if we are not successful in these other efforts, our business and operating results could be adversely affected.

Maintaining and enhancing our brand is critical to our ability to expand our base of customers and may require us to make substantial investments. Our advertising campaign utilizes television, direct mail, newspapers, magazines and radio to maintain and enhance our existing brand equity. We cannot provide assurance that our marketing, advertising and other efforts to promote and maintain awareness of our brand will not require us to incur substantial costs. If these efforts are unsuccessful or we incur substantial costs in connection with these efforts, our business, operating results and financial condition could be adversely affected.

We may not be able to maintain our current design center locations at current costs. We may also fail to successfully select and secure design center locations.

Our design centers are typically located in busy urban settings as freestanding destinations or as part of suburban strip malls, depending upon the real estate opportunities in a particular market. Our business competes with other retailers and as a result, our success may be affected by our ability to renew current design center leases and to select and secure appropriate retail locations for existing and future design centers.

Our results of operations for any quarter are not necessarily indicative of our results of operations for a full year.

Sales of furniture and other home furnishing products fluctuate from quarter to quarter due to such factors as changes in global and regional economic conditions, changes in competitive conditions, changes in production schedules in response to seasonal changes in energy costs and weather conditions, and changes in consumer order patterns. From time to time, we have experienced, and may continue to experience, volatility with respect to demand for our home furnishing products. Accordingly, results of operations for any quarter are not necessarily indicative of the results of operations for a full year.

Failure to protect our intellectual property could adversely affect us.

We believe that our patents, trademarks, service marks, trade secrets, copyrights and all of our other intellectual property are important to our success. We rely on patent, trademark, copyright and trade secret laws, and confidentiality and restricted use agreements, to protect our intellectual property and may seek licenses to intellectual property of others. Some of our intellectual property is not covered by any patent, trademark, or copyright or any applications for the same. We cannot provide assurance that agreements designed to protect our intellectual property will not be breached, that we will have adequate remedies for any such breach, or that the efforts we take to protect our proprietary rights will be sufficient or effective. Any significant impairment of our intellectual property rights or failure to obtain licenses of intellectual property from third parties could harm our business or our ability to compete. Moreover, we cannot provide assurance that the use of our technology or proprietary know-how or information does not infringe the intellectual property rights of others. If we have to litigate to protect or defend any of our rights, such litigation could result in significant expense.

The Company relies heavily on information and technology to operate its business, and any disruption to its technology infrastructure or the internet could harm the Company's operations.

We operate many aspects of our business including financial reporting, and customer relationship management through server and web-based technologies, and store various types of data on such servers or with third-parties who in turn store it on servers and in the “cloud”. Any disruption to the internet or to the Company's or its service providers' global technology infrastructure, including malware, insecure coding, “Acts of God,” attempts to penetrate networks, data leakage and human error, could have adverse affects on the Company's operations. While we have invested and continue to invest in information technology risk management and disaster recovery plans, these measures cannot fully insulate the Company from technology disruptions or data loss and the resulting adverse effect on the Company's operations and financial results.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

Our corporate headquarters, located in Danbury, Connecticut, consists of one building containing 144,000 square feet, situated on approximately 18.0 acres of land, all of which is owned by us. Located adjacent to the corporate headquarters, and situated on approximately 5.4 acres, is the Ethan Allen Hotel and Conference Center, containing approximately 200 guestrooms. This hotel, owned by a wholly-owned subsidiary of Ethan Allen, is used in connection with Ethan Allen functions and training programs, as well as for functions and accommodations for the general public.

We operate eight manufacturing facilities located in the U.S., Mexico and Honduras. All of these facilities are owned by the Company and include four case good plants (including one sawmill) totaling 1,711,000 square feet, three upholstery furniture plants totaling 820,000 square feet, and one home accessory plant of 295,000 square feet. Our wholesale division also owns and operates one national distribution center supported by one owned small parcel and fulfillment center which are a combined 829,000 square feet. Two of our case goods manufacturing facilities are located in Vermont, one is in North Carolina and one is in Choloma, Honduras. We have two upholstery manufacturing facilities at our Maiden, North Carolina campus, and one in Guanajuato, Mexico. Our distribution facility is located in Virginia.

We own five and lease eight retail service centers, totaling 993,000 square feet. Our retail service centers are located throughout the United States and Canada and serve to support our various retail sales districts.

The geographic distribution of our retail design center network as of June 30, 2013 is as follows:

|

Retail Design Center Category |

||||||||

|

Company Operated |

Independently Operated |

|||||||

|

United States |

139 | 62 | ||||||

|

Canada |

6 | 3 | ||||||

|

Asia |

- | 79 | ||||||

|

Europe |

2 | - | ||||||

|

Middle East |

- | 4 | ||||||

|

Total |

147 | 148 | ||||||

Of the 147 Company operated retail design centers, 71 of the properties are owned and 76 of the properties are leased from independent third parties. Of the 71 owned design centers, 17 are subject to land leases. We own nine additional retail properties, two of which are leased to independent Ethan Allen retailers, and four of which are leased to unaffiliated third parties. See Note 7 to the Consolidated Financial Statements included under Item 8 of this Annual Report for more information with respect to our operating lease obligations.

We believe that all of our properties are well maintained and in good condition. We estimate that our manufacturing plants are currently operating at approximately 70% of capacity. We believe we have additional capacity at selected facilities, which we could utilize with minimal additional capital expenditures.

Item 3. Legal Proceedings

We are a party to various legal actions with customers, employees and others arising in the normal course of our business. We maintain liability insurance, which is deemed to be adequate for our needs and commensurate with other companies in the home furnishings industry. We believe that the final resolution of pending actions (including any potential liability not fully covered by insurance) will not have a material adverse effect on our financial condition, results of operations, or cash flows.

Environmental Matters

We and our subsidiaries are subject to various environmental laws and regulations. Under these laws, we and/or our subsidiaries are, or may be, required to remove or mitigate the effects on the environment of the disposal or release of certain hazardous materials. We believe our currently anticipated capital expenditures for environmental control facility matters are not material.

We are subject to other federal, state and local environmental protection laws and regulations and are involved, from time to time, in investigations and proceedings regarding environmental matters. Such investigations and proceedings typically concern air emissions, water discharges, and/or management of solid and hazardous wastes. We believe that our facilities are in material compliance with all applicable environmental laws and regulations.

Federal and state regulations provided the initiative for us to reformulate certain furniture finishes or institute process changes to reduce emissions of volatile organic compounds. Compliance with many of these requirements has been facilitated through the introduction of high solids coating technology and alternative formulations. In addition, we have instituted a variety of technical and procedural controls, including reformulation of finishing materials to reduce toxicity, implementation of high velocity low pressure spray systems, development of storm water protection plans and controls, and further development of related inspection/audit teams, all of which have served to reduce emissions per unit of production. We remain committed to implementing new waste minimization programs and/or enhancing existing programs with the objective of (i) reducing the total volume of waste, (ii) limiting the liability associated with waste disposal, and (iii) continuously improving environmental and job safety programs on the factory floor which serve to minimize emissions and safety risks for employees. We will continue to evaluate the most appropriate, cost effective, control technologies for finishing operations and design production methods to reduce the use of hazardous materials in the manufacturing process.

Item 4. Mine Safety Disclosures

Not applicable

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under ticker symbol "ETH". The following table sets forth, for each quarterly period during the past two fiscal years, (i) the intraday high and low sales prices of our common stock as reported on the New York Stock Exchange and (ii) the dividends per share paid by us:

|

Market Price |

Dividends | |||||||||||

|

High |

Low |

Per Share |

||||||||||

|

Fiscal 2013 |

||||||||||||

|

First Quarter |

$ | 25.30 | $ | 19.54 | $ | 0.09 | ||||||

|

Second Quarter |

30.29 | 21.48 | 0.50 | |||||||||

|

Third Quarter |

33.18 | 26.26 | 0.09 | |||||||||

|

Fourth Quarter |

33.36 | 26.76 | 0.09 | |||||||||

|

Fiscal 2012 |

||||||||||||

|

First Quarter |

$ | 22.32 | $ | 13.17 | $ | 0.07 | ||||||

|

Second Quarter |

24.40 | 12.30 | 0.07 | |||||||||

|

Third Quarter |

28.37 | 22.50 | 0.07 | |||||||||

|

Fourth Quarter |

25.60 | 18.00 | 0.09 | |||||||||

As of August 8, 2013, there were 267 shareholders of record of our common stock. Management estimates there are approximately 10,000 beneficial shareholders of the Company’s common stock. We expect to continue to declare quarterly dividends for the foreseeable future, business conditions permitting.

Equity Compensation Plan Information

The Equity Compensation Plan Information required by this Item will appear in the Ethan Allen Interiors Inc. proxy statement for the Annual Meeting of Shareholders scheduled to be held on November 19, 2013 and is incorporated herein by reference in the introductory paragraph of Part III of this Annual Report.

Issuer Purchases of Equity Securities

On November 21, 2002, our Board of Directors approved a share repurchase program authorizing us to repurchase up to 2,000,000 shares of our common stock, from time to time, either directly or through agents, in the open market at prices and on terms satisfactory to us. Subsequent to that date, the Board of Directors increased the remaining authorization on seven separate occasions, the last of which was on November 13, 2007. There were no share repurchases during the quarter ended June 30, 2013. As of June 30, 2013 we had a remaining Board authorization to repurchase 1,101,490 shares.

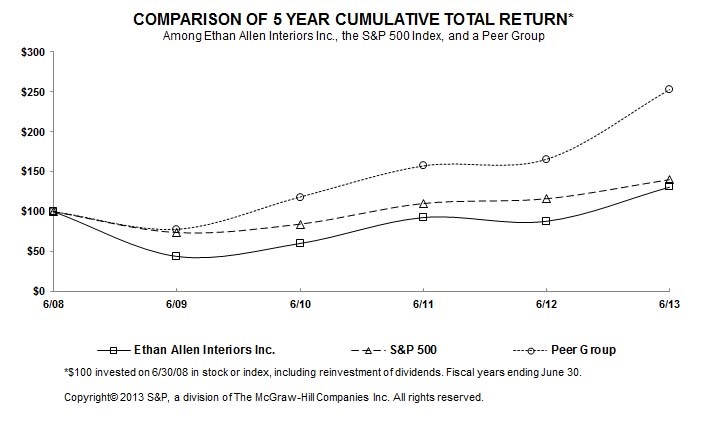

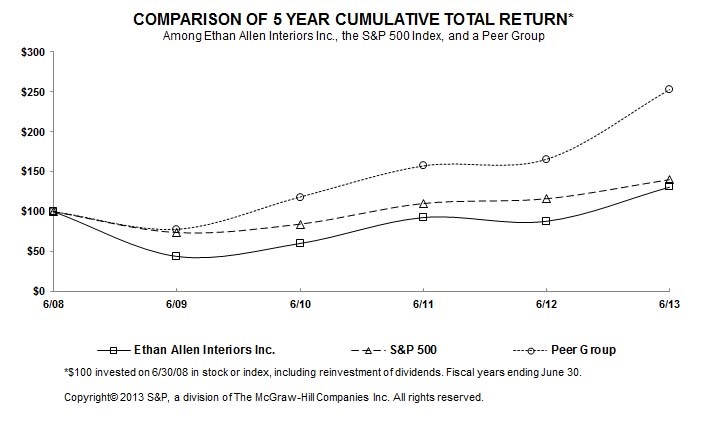

Comparative Company Performance

The following line graph compares cumulative total stockholder return for the Company with a performance indicator of the overall stock market, the Standard & Poor’s 500 Index, and an industry index, the Peer Issuer Group Index, assuming $100 was invested on June 30, 2008. The peer group includes Bassett Furniture Industries, Inc., Flexsteel Industries, Inc., Furniture Brands International, Inc., Haverty Furniture Companies, Inc., La-Z-boy Inc., Leggett & Platt, Inc., and Pier 1 Imports Inc. Chromcraft Revington has been removed from the peer group for all periods due to its delisting from the NYSE. The returns of each company have been weighted according to each company’s market capitalization.

Item 6. Selected Financial Data

The following table presents selected financial data for the fiscal years ended June 30, 2013, 2012, 2011, 2010 and 2009 which has been derived from our consolidated financial statements (dollar amounts in thousands except per share data). The information set forth below should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations included under Item 7 of this Annual Report and our Consolidated Financial Statements (including the notes thereto) included under Item 8 of this Annual Report.

|

Fiscal Year Ended June 30, |

||||||||||||||||||||||||||||||

|

2013 |

2012 |

2011 |

2010 |

2009 |

||||||||||||||||||||||||||

|

Consolidated Operations Data |

||||||||||||||||||||||||||||||

|

Net Sales |

$ | 729,083 | $ | 729,373 | $ | 678,960 | $ | 590,054 | $ | 674,277 | ||||||||||||||||||||

|

Cost of Sales |

330,734 | 339,085 | 329,500 | 309,777 | 326,935 | |||||||||||||||||||||||||

|

Selling, general and administrative expenses |

337,912 | 340,591 | 317,527 | 289,575 | 353,112 | |||||||||||||||||||||||||

|

Restructuring and impairment charges, net |

- | - | - | 2,437 | 67,001 | |||||||||||||||||||||||||

|

Operating income (loss) |

60,437 | 49,697 | 31,933 | (11,735 | ) | (72,771 | ) | |||||||||||||||||||||||

|

Interest and other expense, net |

10,263 | 8,458 | 5,562 | 7,052 | 8,409 | |||||||||||||||||||||||||

|

Income (loss) before income tax expense |

50,174 | 41,239 | 26,371 | (18,787 | ) | (81,180 | ) | |||||||||||||||||||||||

|

Income tax expense (benefit) |

17,696 | (8,455 | ) | (2,879 | ) | 25,529 | (28,493 | ) | ||||||||||||||||||||||

|

Net income (loss) |

$ | 32,478 | $ | 49,694 | $ | 29,250 | $ | (44,316 | ) | $ | (52,687 | ) | ||||||||||||||||||

|

Per Share Data |

||||||||||||||||||||||||||||||

|

Net income (loss) per basic share |

$ | 1.13 | $ | 1.72 | $ | 1.02 | $ | (1.53 | ) | $ | (1.83 | ) | ||||||||||||||||||

|

Basic weighted average shares outstanding |

28,864 | 28,824 | 28,758 | 28,982 | 28,814 | |||||||||||||||||||||||||

|

Net income (loss) per diluted share |

$ | 1.11 | $ | 1.71 | $ | 1.01 | $ | (1.53 | ) | $ | (1.83 | ) | ||||||||||||||||||

|

Diluted weighted average shares outstanding |

29,239 | 29,109 | 28,966 | 28,982 | 28,814 | |||||||||||||||||||||||||

|

Cash dividends per share |

$ | 0.77 | $ | 0.30 | $ | 0.22 | $ | 0.20 | $ | 0.65 | ||||||||||||||||||||

|

Other Information |

||||||||||||||||||||||||||||||

|

Depreciation and amortization |

$ | 18,008 | $ | 18,581 | $ | 20,816 | $ | 29,398 | $ | 25,635 | ||||||||||||||||||||

|

Capital expenditures and acquisitions |

$ | 19,775 | $ | 23,404 | $ | 12,051 | $ | 9,972 | $ | 23,903 | ||||||||||||||||||||

|

Working capital |

$ | 127,631 | $ | 131,715 | $ | 113,912 | $ | 113,950 | $ | 139,239 | ||||||||||||||||||||

|

Current ratio |

1.96 | to | 1 | 1.87 | to | 1 | 1.74 | to | 1 | 1.78 | to | 1 | 2.24 | to | 1 | |||||||||||||||

|

Effective tax rate |

35.3 | % | -20.5 | % | -10.9 | % | -135.9 | % | 35.1 | % | ||||||||||||||||||||

|

Balance Sheet Data (at end of period) |

||||||||||||||||||||||||||||||

|

Total assets |

$ | 617,285 | $ | 644,788 | $ | 628,325 | $ | 631,777 | $ | 646,485 | ||||||||||||||||||||

|

Total debt, including capital lease obligations |

131,289 | 154,500 | 165,032 | 203,267 | 203,148 | |||||||||||||||||||||||||

|

Shareholders' equity |

$ | 334,357 | $ | 321,868 | $ | 281,687 | $ | 258,459 | $ | 305,923 | ||||||||||||||||||||

|

Debt as a percentage of equity |

39.3 | % | 48.0 | % | 58.6 | % | 78.6 | % | 66.4 | % | ||||||||||||||||||||

|

Debt as a percentage of capital |

28.2 | % | 32.4 | % | 36.9 | % | 44.0 | % | 39.9 | % | ||||||||||||||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation

The following discussion of financial condition and results of operations is based upon, and should be read in conjunction with, our Consolidated Financial Statements (including the notes thereto) included under Item 8 of this Annual Report.

Forward-Looking Statements

Management's discussion and analysis of financial condition and results of operations and other sections of this Annual Report contain forward-looking statements relating to our future results. Such forward-looking statements are identified by use of forward-looking words such as "anticipates", "believes", "plans", "estimates", "expects", and "intends" or words or phrases of similar expression. These forward-looking statements are subject to management decisions and various assumptions, risks and uncertainties, including, but not limited to: the potential effects of natural disasters affecting our suppliers or trading partners; the effects of labor strikes; weather conditions that may affect sales; volatility in fuel, utility, transportation and security costs; changes in global or regional political or economic conditions, including changes in governmental and central bank policies; changes in business conditions in the furniture industry, including changes in consumer spending patterns and demand for home furnishings; effects of our brand awareness and marketing programs, including changes in demand for our existing and new products; our ability to locate new design center sites and/or negotiate favorable lease terms for additional design centers or for the expansion of existing design centers; competitive factors, including changes in products or marketing efforts of others; pricing pressures; fluctuations in interest rates and the cost, availability and quality of raw materials; the effects of terrorist attacks or conflicts or wars involving the United States or its allies or trading partners; those matters discussed in Items 1A and 7A of this Annual Report and in our SEC filings; and our future decisions. Accordingly, actual circumstances and results could differ materially from those contemplated by the forward-looking statements.

Critical Accounting Policies

Our consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles that require, in some cases, that certain estimates and assumptions be made that affect the amounts and disclosures reported in those financial statements and the related accompanying notes. Estimates are based on currently known facts and circumstances, prior experience and other assumptions believed to be reasonable. We use our best judgment in valuing these estimates and may, as warranted, solicit external advice. Actual results could differ from these estimates, assumptions and judgments, and these differences could be material. The following critical accounting policies, some of which are impacted significantly by estimates, assumptions and judgments, affect our consolidated financial statements. For the years ended June 30, 2013, 2012 and 2011, the Company has presented selling, general and administrative expenses as a single line on the consolidated statements of Comprehensive Income to remove information we believe is not meaningful and to improve comparability with our peer companies. Selling expenses, general and administrative expenses, and restructuring and impairment charges had previously been presented separately in those years.

Inventories – Inventories (finished goods, work in process and raw materials) are stated at the lower of cost, determined on a first-in, first-out basis, or market. Cost is determined based solely on those charges incurred in the acquisition and production of the related inventory (i.e. material, labor and manufacturing overhead costs). We estimate an inventory reserve for excess quantities and obsolete items based on specific identification and historical write-downs, taking into account future demand and market conditions. If actual demand or market conditions in the future are less favorable than those estimated, additional inventory write-downs may be required.