UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant o

|

|

Check the appropriate box:

|

|

x

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

ETHAN ALLEN INTERIORS INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| |

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

(5)

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

(3)

|

|

| |

(4)

|

|

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

October __, 2011

Dear Stockholder:

You are cordially invited to attend the 2011 Annual Meeting of stockholders of Ethan Allen Interiors Inc. This meeting will be held at the Ethan Allen International Corporate Headquarters, Ethan Allen Drive, Danbury, Connecticut 06811 at 9:00 A.M., local time, on Tuesday, November 15, 2011.

In connection with the meeting, we have prepared a notice of the meeting, a proxy statement, and our 2011 annual report to stockholders, which provide detailed information relating to our activities and operating performance. On October ___, 2011, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials containing instructions on how to access these materials online. We believe electronic delivery will expedite the receipt of materials, while lowering costs and reducing the environmental impact of our annual meeting, by reducing printing and mailing of full sets of materials.

You will find information about the matters to be voted on at the meeting in the formal Notice Regarding the Availability of Proxy Materials and the Proxy Statement.

Your vote is very important and we hope you will be able to attend the meeting. To ensure your representation at the meeting, even if you anticipate attending in person, we urge you to vote. If you attend, you will, of course, be entitled to vote in person.

Whether or not you plan to attend the annual meeting of stockholders, we encourage you to vote your shares.

Sincerely,

M. Farooq Kathwari

Chairman of the Board,

President and Principal Executive Officer

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

NOTICE OF 2011 ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

The Annual Meeting of stockholders of Ethan Allen Interiors Inc. will be held at the Ethan Allen International Corporate Headquarters on Tuesday, November 15, 2011 at 9:00 A.M., local time, for the purpose of considering and acting upon the following:

|

|

1.

|

The election of directors;

|

|

|

2.

|

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the 2012 fiscal year; ;

|

|

|

3.

|

Ratify the Amendment to the Shareholders’ Rights Plan;

|

|

|

4.

|

To approve, by non-binding vote, executive compensation;

|

|

|

5.

|

To recommend, by non-binding vote, the frequency of executive compensation votes; and

|

|

|

6.

|

Such other business as may properly come before the meeting.

|

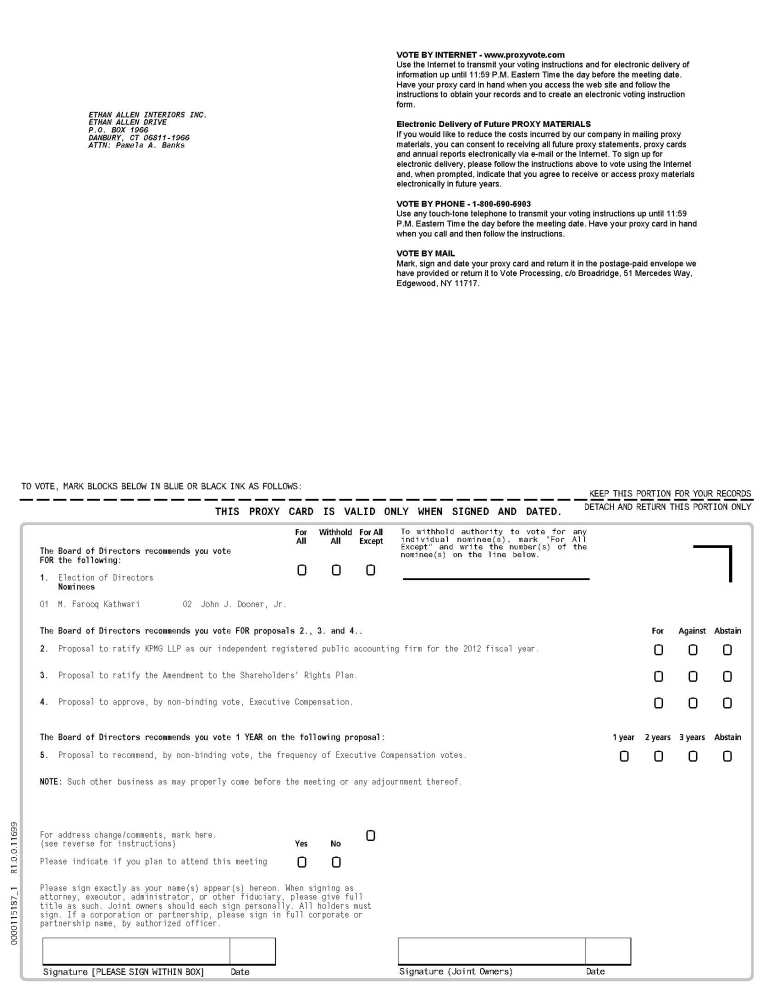

The Board of Directors has fixed September 20, 2011 as the record date for determining stockholders entitled to notice of, and to vote at, the meeting. It is important that your shares be represented and voted at the meeting. If you received the proxy materials by mail, you can vote your shares by completing, signing, dating, and returning your completed proxy card, or you may vote by telephone or over the Internet. If you received the proxy materials over the Internet, a proxy card was not sent to you, and you may vote your shares by telephone or over the Internet. To vote by telephone or Internet, follow the instructions included in the formal Notice Regarding the Availability of Proxy

Materials, Proxy Statement or on the Internet. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the Proxy Statement.

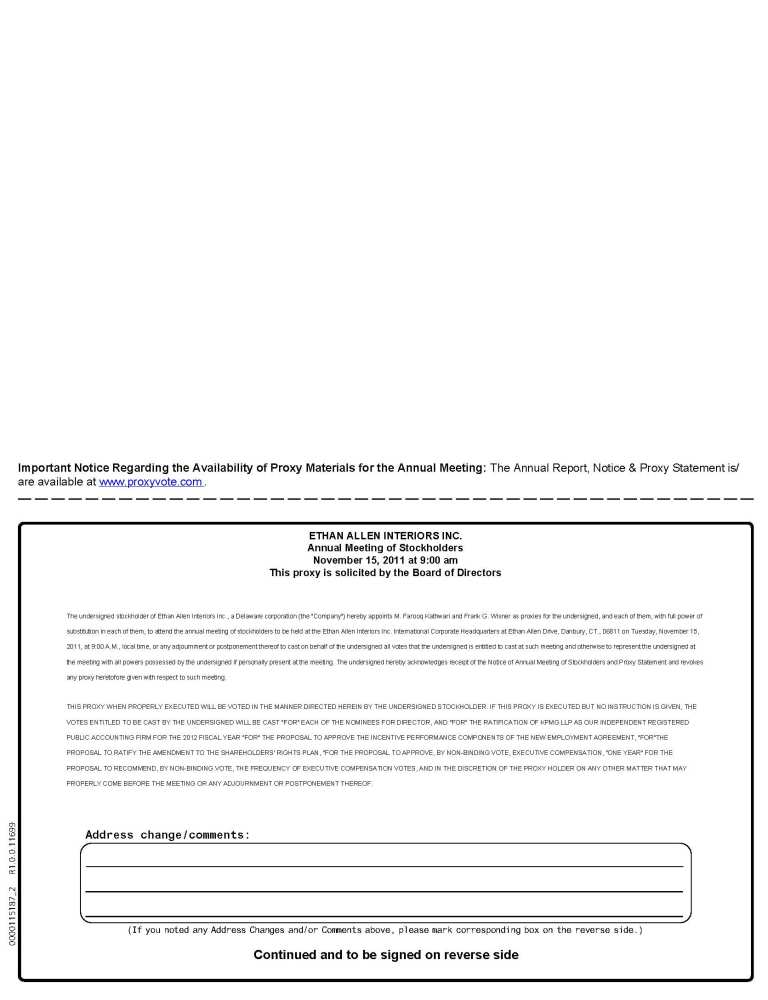

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on November 15, 2011—the proxy statement and the annual report are available at http://materials.proxyvote.com/297602

| |

By Order of the Board of Directors,

Pamela A. Banks

Corporate Secretary

|

October ___, 2011

Ethan Allen Interiors Inc.

Ethan Allen Drive

Danbury, Connecticut 06811

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

Questions and Answers

|

A:

|

A proxy is a document, also referred to as a “proxy card,” on which you authorize someone else to vote for you at the upcoming Annual Meeting in the way that you want to vote. You also may choose to abstain from voting. Ethan Allen Interiors Inc.’s board of directors is soliciting the proxy card.

|

|

Q:

|

What are the purposes of this annual meeting?

|

|

A:

|

At the Annual Meeting, stockholders will elect two Class I directors for a three-year term expiring in 2014. The Board of Directors’ Class I nominees for election are: M. Farooq Kathwari and John J. Dooner, Jr. Stockholders will also vote on: (i) ratifying our appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for fiscal year 2012; (ii) ratifying the amendment to the Shareholders’ Rights Plan; (iii) approving, by non-binding vote, executive compensation; and (iv)recommending the frequency of stockholder non-binding vote on executive compensation. Other than routine or procedural matters, we do not expect any other business will be brought up at the meeting, but if any other business is properly

brought up, the persons named in the proxy card will have authority to vote as they see fit.

|

|

Q:

|

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

|

|

A:

|

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), rather than mailing a printed copy of our proxy materials to each stockholder of record, we may now send some or all of our stockholders a Notice Regarding the Availability of Proxy Materials (“Notice”), which indicates how our stockholders may:

|

|

|

•

|

access their proxy materials and vote their proxies over the Internet or by telephone; or

|

|

|

•

|

request a paper copy of the materials, including a proxy card.

|

|

Q:

|

How can I get electronic access to the proxy materials?

|

|

A:

|

The Notice provides you with instructions regarding how to:

|

|

|

•

|

view our proxy materials for the Annual Meeting over the Internet; and

|

|

|

•

|

instruct us to send our future proxy materials to you electronically, by email, instead of sending you printed copies by mail.

|

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our Annual Meeting of stockholders on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it. The Annual Report and the Form 10-K accompany the proxy materials but are not considered part of the proxy soliciting materials.

|

Q:

|

Who is entitled to vote?

|

|

A:

|

Only record holders of our common shares of stock at the close of business on the record date for the meeting, September 20, 2011, are entitled to vote at the Annual Meeting. Each common share has one vote.

|

|

A:

|

You can vote either in person at the Annual Meeting or by proxy whether or not you attend the Annual Meeting. You can vote by proxy in three ways:

|

|

|

•

|

By mail—If you received your proxy materials by mail, you can vote using the proxy card;

|

|

|

•

|

By telephone—In the United States and Canada, you can vote by telephone by following the instructions in the Notice, on the Internet or on your proxy card if you received your materials by mail; or

|

|

|

•

|

By Internet—You can vote over the Internet by following the instructions on the Notice or on your proxy card if you received your materials by mail.

|

If you vote by proxy, your shares will be voted at the Annual Meeting in the manner you indicate. If your shares are held in your name (but not in nominee name through a broker) and if you sign your proxy card, but do not specify how you want your shares to be voted, they will be voted as the Board of Directors recommends.

|

Q:

|

Can I change my vote after I have voted?

|

|

A:

|

A later vote by any means will cancel any earlier vote. For example, if you vote by telephone and later vote differently on the Internet, the Internet vote will count, and the telephone vote will be canceled. If you wish to change your vote by mail, you should write our Corporate Secretary, at the address set forth at the beginning of the Questions and Answers, and request a new proxy card. The last vote we receive before the meeting will be the one counted. You also may change your vote by voting in person at the meeting.

|

|

Q:

|

What does it mean if I get more than one proxy card?

|

|

A:

|

It means that your shares are registered in more than one way. Sign and return all proxy cards or vote each group of shares by mail, telephone or over the Internet to ensure that all your shares are voted.

|

|

Q:

|

What is a Broker Non-Vote?

|

|

A:

|

The SEC approved a New York Stock Exchange (NYSE) amendment to Rule 452 prohibiting brokers from exercising “discretionary voting” in all director elections. The amendment applies to shareholder meetings held on or after January 1, 2010. Therefore, if your shares are held in nominee name by your broker and you do not provide instructions to your broker on how you want your shares voted in director elections, your broker is prohibited from exercising discretionary voting and voting those shares in the director elections.

|

|

Q:

|

What is Electronic Access?

|

|

A:

|

Our proxy statement and our 2011 annual report are available on an Internet site at http://materials.proxyvote.com/297602. Most stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. If you are a registered stockholder, you can choose this option and save the Company the cost of producing and mailing these documents by following the instructions provided on your proxy card or following the prompt if you choose to vote over the Internet. If you hold your stock in nominee name (such as through a bank or broker), check the information provided by your nominee for instructions on how to elect to view future proxy statements and annual reports over the Internet. If you are a registered stockholder and have chosen to

view future proxy statements and annual reports over the Internet, you will receive an e-mail with instructions containing the Internet address of those materials.

|

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board of Directors”) of Ethan Allen Interiors Inc., a Delaware corporation (the “Company”), of proxies for use at the 2011 Annual Meeting of stockholders (the “Annual Meeting”) to be held on Tuesday, November 15, 2011 at the Ethan Allen International Corporate Headquarters, Ethan Allen Drive, Danbury, Connecticut 06811 at 9:00 A.M., local time, or any adjournment thereof. The Proxy Statement and our Annual Report are first being made available electronically on or about October ___, 2011.

VOTING SECURITIES; PROXIES; REQUIRED VOTE

Voting Securities

The Board of Directors has fixed the close of business on September 20, 2011 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, the Company had outstanding 28,743,398 shares of common stock, par value $.01 per share (the “Common Stock”). The holders of Common Stock as of the Record Date are entitled to notice of, and to vote at, the Annual Meeting. Holders of Common Stock are entitled to one vote per share.

Proxies

Kristin Gamble and Frank G. Wisner, the persons named as proxies, were selected by the Board of Directors to serve in such capacity. Each properly executed and returned proxy card will be voted in accordance with the directions indicated thereon, or if no directions are indicated, such proxy will be voted in accordance with the recommendations of the Board of Directors contained in this Proxy Statement. In voting by proxy with regard to the election of directors, stockholders may vote in favor of all nominees, withhold their vote as to all nominees or withhold their vote as to a specific nominee(s). Each stockholder giving a proxy has the power to revoke it at any time before the shares it

represents are voted. Revocation of a proxy is effective upon receipt of a later vote by (i) telephone; (ii) Internet; or (iii) receipt by the Corporate Secretary of the Company of either: (a) an instrument revoking the proxy; or (b) a duly executed proxy card bearing a later date. Additionally, a stockholder may change or revoke a previously executed proxy by voting in person at the Annual Meeting.

Required Vote

The holders of at least one-third of the outstanding shares of Common Stock represented in person or by proxy will constitute a quorum at the Annual Meeting. Effective with annual meetings held after January 1, 2010, NYSE Rule 452 prohibits brokers from exercising “discretionary” voting on all director elections. At the Annual Meeting, the vote of a majority in interest of the stockholders present, in person or by proxy, and entitled to vote thereon is required (i) to elect or ratify directors; and (ii) to ratify the appointment of KPMG as the independent registered public accounting firm of the Company.

The election inspectors appointed for the Annual Meeting will tabulate the votes cast, in person or by proxy, at the Annual Meeting and will determine whether or not a quorum is present. The election inspectors will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. If a broker indicates on the proxy that it does not have discretionary authority to vote on a particular matter, as to certain shares, those shares will not be considered as present and entitled to vote with respect to that matter.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors is presently composed of seven members. The Restated Certificate of Incorporation of the Company divides the Board of Directors into three classes, with one class of directors elected each year for a three-year term. The term of the directors in Class I, which is currently composed of two directors, expires as of the Annual Meeting.

The Company nominated M. Farooq Kathwari and John J. Dooner, Jr. as the Class I directors to serve for a three year term.

If for any reason Mr. Kathwari or Mr. Dooner becomes unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies will have discretionary authority to vote for a substitute nominee(s). Alternatively, the Board of Directors may choose to reduce the size of the board, as permitted by our Amended and Restated By-laws (“By-laws”). It is not anticipated that Mr. Kathwari or Mr. Dooner will be unavailable or will decline to serve as director.

The following sets forth information as to Mr. Kathwari and Mr. Dooner and each director continuing in office, including his or her age, present principal occupation, specific expertise, qualifications and skills along with other business experience, directorships in other publicly held companies, membership on committees of the Board of Directors and period of service as a director of the Company.

Nominees for Election at this Annual Meeting to a Term Expiring in 2014

M. Farooq Kathwari, 67, is the Chairman, President and Principal Executive Officer of Ethan Allen Interiors Inc. He has been President of the Company since 1985 and Chairman and Principal Executive Officer since 1988. He received his B.A. degree from Kashmir University in English Literature and Political Science and an M.B.A. in International Marketing from New York University. Mr. Kathwari serves on several not-for-profit organizations, including: Director of Refugees International, Director of National Retail Federation, Director of International Rescue Committee, and a Director of the Institute for the Study of Diplomacy at

Georgetown University. He has received several recognitions, including the 2007 “Outstanding American by Choice” award from the United States Government, 2005 Eleanor Roosevelt Val-Kill Medal, “National Human Relations Awards” by the American Jewish Committee, Worth Magazine Recognition as one of 50 Best CEOs in USA, the National Retail Federation Gold Medal, recipient of the International First Freedom Award from the Council for America’s First Freedom, and Ernst & Young’s “Entrepreneur of the Year” Award. Mr. Kathwari has extensive experience and knowledge of the history of our Company and the furniture industry as well as extensive experience in growing and managing a business. He possesses insight into retailing, marketing, manufacturing, and strategic planning from

experience with the Company as well as his broad experience with both for-profit and not-for-profit organizations which has given him perspectives from other industries valuable to his service to the Company.

John J. Dooner, Jr., 62, was elected as a director of the Company on January 26, 2011. He serves as Chairman Emeritus of McCann Worldgroup (“McCann”), a company he formed in 1997 and of which he had been CEO from its founding until 2010. Under Mr. Dooner’s leadership, McCann grew to be one of the world’s largest marketing communications organizations, with operations in over 125 countries with a client roster that includes preeminent global marketers and many of the world’s most famous brands. Prior to assuming that position, Mr. Dooner was CEO of McCann Erickson Worldwide, a post

he assumed in 1992. Mr. Dooner serves on several not-for-profit organizations, including service as Chairman of the Board of Trustees of United Way Worldwide; Charter Member of the President’s Advisory Council of CARE and Past Chairman and Board Member of the Advertising Council. Mr. Dooner’s experience managing a publicly traded company, experience as an executive and his knowledge of marketing and communications, including internationally, provides the Company with insight and expertise in advertising and marketing to position and expand the market share of the Ellen Allen brand. Mr. Dooner’s strong leadership and entrepreneurship as the founder and CEO of McCann provides the Company with a wealth of knowledge in strategic planning, corporate finance and sales and marketing of consumer products. He is a member of the Audit

Committee.

Directors Whose Present Terms Will Continue Until 2012

James W. Schmotter, 64 was elected as a Director of the Company on April 20, 2010. Dr. Schmotter currently serves as President of Western Connecticut State University. He previously served as Western Michigan University’s Dean of the Haworth College of Business, the Dean of the College of Business and Economics at Lehigh University in Pennsylvania, as well as Associate Dean and Director of International Studies at the Johnson Graduate School of Management at Cornell University. Dr. Schmotter has consulted for a variety of organizations including IBM, TRW, the Institute for International Education, the Cleveland

Foundation, the Graduate Management Admission Council, the Educational Testing Service, United States Agency for International Development, and a number of universities in the U.S., Asia and Europe. He has served as Chairman of the Board of Trustees of the Graduate Management Admission Council, was the founding Vice Chair of the Board of the MBA Enterprise Corps, has been a member of many committees of the Association to Advance Collegiate Schools of Business and is a member of the Executive Committee of the NCAA. Dr. Schmotter is currently a director of the United Way of Western Connecticut and the Greater Danbury Chamber of Commerce. Dr. Schmotter’s strong leadership, educational and governmental background provides key insight and experience in strategic planning, international/global issues as well as communicating with younger customers which is valuable in his

service to the Company. He is a member of the Nomination/Corporate Governance Committee.

Frank G. Wisner, 73, was elected as a director of the Company on July 23, 2001. He is International Affairs Advisor of the law firm Patton Boggs LLP. He is former Vice Chairman, External Affairs, of American International Group (“AIG”), a United States-based mixed financial services and international insurance organization. Mr. Wisner is also on the board of directors of EOG Resources. He is also a member of the board of directors of the Commercial International Bank (CIB) in Cairo, Egypt and of Pangea 3, a New York based legal outsourcing company, privately held. Prior to joining AIG, he was the United States

Ambassador to India from July 1994 through July 1997. He retired from the United States Government with the rank of Career Ambassador, the highest grade in the Foreign Service. Mr. Wisner joined the State Department as a Foreign Service Officer in 1961 and served in a variety of overseas and Washington positions during his 36-year career. Among his other positions, Mr. Wisner served successively as United States Ambassador to Zambia, Egypt and the Philippines. Before being named United States Ambassador to India, his most recent assignment was as Under Secretary of Defense for Policy. Prior to that, he was Under Secretary of State for International Security Affairs. Ambassador Wisner’s global, diplomatic and governmental experience provides insights and perspectives valuable in the operations and strategic planning of the Company. He is Chair of the Company’s

Nominations/Corporate Governance Committee and a member of the Compensation Committee.

Directors Whose Present Terms Will Continue Until 2013

Clinton A. Clark, 69, was elected as a director of the Company on June 30, 1989. He is the President and sole stockholder of CAC Investments, Inc. (“CAC”), a private investment company he founded in January 1986. Prior to founding CAC, Mr. Clark was Chairman, President and Chief Executive Officer of Long John Silver’s Restaurants, Inc. from 1990 through September 1993 and prior thereto was President and Chief Executive Officer of The Children’s Place, a retail children’s apparel chain he founded in 1968. Mr. Clark is also an investor and director of several private companies.

Mr. Clark’s experience managing a publicly-traded company, experience as an executive and his knowledge of the history of the Company has provided the Company with a wealth of knowledge in strategic planning, corporate finance, compensation, and sales and marketing in consumer related industries. He has the necessary skills to chair the Company’s Audit Committee and is a member of the Compensation Committee.

Kristin Gamble, 66, was elected as a director of the Company on July 28, 1992. Since 1984, she has been President of Flood, Gamble Associates, Inc., an investment counseling firm. Ms. Gamble was Senior Vice President responsible for equity strategy and economic research with Manufacturers Hanover Trust Company from 1981 to 1984. Prior to that, she held various management positions with Manufacturers Hanover (1977-1981), Foley, Warendorf & Co., a brokerage firm (1976-1977), Rothschild, Inc. (1971-1976) and Merrill, Lynch, Pierce, Fenner & Smith (1968-1971). Since May 1995, she has served as a member

of the Board of Trustees of Federal Realty Investment Trust. Through her roles and responsibilities Ms. Gamble has extensive experience and insight relevant to her service to the Company, including that of Trustee of a realty investment trust and her knowledge of real estate markets. Ms. Gamble’s knowledge of the history of the Company as well as her significant financial management experience has resulted in strong skills in corporate finance, accounting and compensation. She is the Chair of the Compensation Committee and a member of both the Company’s Audit Committee and Nominations/Corporate Governance Committee.

Don M. Wilson III, 63, was elected as a director of the Company on April 21, 2010. In 1973 Mr. Wilson joined Chemical Bank, a predecessor institution to J.P. Morgan Chase & Co”.” During his career he managed corporate finance activities, was the head of the bank’s East Asia business and later its European businesses. From 1991 to 2000 he headed the Global Trading Division and, after the acquisition of J.P. Morgan & Co., in 2000, was co-head of the Credit and Rates Division. From 2003 to 2006 he served as the firm’s Chief Risk Officer. Mr. Wilson is chairman of

Annual Giving at Tuck School at Dartmouth College and formerly vice chairman of Annual Leadership Giving at the Harvard College Fund. Mr. Wilson also serves on the Board at the Bank of Montreal and several non-profit organizations. Mr. Wilson’s extensive executive and financial experience provides the Company with expertise in capital markets, risk management, and corporate finance. He is a member of the Audit Committee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES FOR DIRECTOR NAMED ABOVE, WHICH IS DESIGNATED AS PROPOSAL NO. 1.

CORPORATE GOVERNANCE

The Board of Directors has determined that each of the following directors or director nominees comprising the six non-management directors meet the criteria for “independent” directors as defined in Section 303A.02 of the New York Stock Exchange Listed Company Manual (the “NYSE Listed Company Manual”) including, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”): Clinton A. Clark, John J. Dooner, Jr., Kristin Gamble, James W. Schmotter, Don M. Wilson, III and Frank G. Wisner.

Stockholder Communication with Directors

Stockholders or interested parties may communicate with the full Board of Directors, a full committee, individual committee members or individual directors by sending communications to the Office of the Secretary, Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, Connecticut 06811 for forwarding to the appropriate director(s). Please specify to whom your correspondence should be directed. The Corporate Secretary has been instructed by the Board of Directors to review and promptly forward all correspondence (except advertising material and ordinary business matters) to the full Board of Directors, full committee, individual director or committee member, as indicated in the

correspondence.

Certain Transactions

The Company is party to indemnification agreements with each of the members of the Board of Directors pursuant to which the Company has agreed to indemnify and hold harmless each member of the Board of Directors from liabilities incurred as a result of such director’s status as a director of the Company, subject to certain limitations.

Certain Relationships and Related Party Transactions

The Company recognizes that transactions between Ethan Allen and related persons present a potential for actual or perceived conflicts of interest. The Company’s general policies with respect to such transactions are included in its Code of Business Conduct and Ethics (“Code”), the administration of which is overseen by the Nominations/Corporate Governance Committee. The Company defines “related party” transaction as any transaction or series of related transactions in excess of $120,000 in which the Company is a party and in which a “related person” has a material interest. Related persons include directors, director nominees, executive officers, 5%

beneficial owners and members of their immediate families.

The Company collects information about potential related party transactions in its annual questionnaires completed by directors and officers as well as throughout the year at its quarterly Disclosure Control Committee Meetings, comprised of key management responsible for significant business units, departments or divisions. Potential related party transactions are first reviewed and assessed by our General Counsel to consider the materiality of the transactions and then reported to the Nominations/Corporate Governance Committee. The Nominations/Corporate Governance Committee reviews and considers all relevant information available to it about each related party transaction and presents the facts

to the members of the Board of Directors not associated with the potential related party transaction. A related party transaction is approved or ratified only if such members of the Board of Directors determine that it is not inconsistent with the best interests of the Company and its stockholders. The Company did not have any such transactions during fiscal year 2011.

Compensation Committee Interlocks and Insider Participation

No executive officer of the Company, or any of its subsidiaries, served as a director of or on the Compensation Committee (or equivalent) of another entity except as otherwise disclosed herein.

Charters, Code and Guidelines

The Company’s Code, Corporate Governance Guidelines and the charters of its Audit Committee, Compensation Committee and Nominations/Corporate Governance Committee are available on the Company’s website at www.ethanallen.com/governance. Any waiver of the Code for directors or named executive officers may only be made by the Nominations/Corporate Governance Committee, and any waivers or amendments will be disclosed promptly by a posting on our website. Stockholders may request a copy of any of these documents by writing to: Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, CT 06811, Attn: Office of the

Secretary.

Leadership Structure and Board of Directors’ Role in Risk Oversight

The Company’s leadership structure combines the leadership role of the Chairman and CEO coupled with the role of a lead director. The Board of Directors believes that the existence of a lead director supports strong corporate governance principles while deriving the benefit of having the Company’s CEO also serve as Chairman of the Board of Directors. The Board of Directors believes that the Company’s current leadership structure enhances the Chairman/CEO’s ability to provide insight and direction on the Company’s strategic direction to both management and independent directors, and at the same time, with the support and oversight of a lead director, ensures that the

appropriate level of independent oversight is applied to all management decisions. The Board of Directors believes that this structure ensures that the independent directors continue to effectively oversee management and provide effective oversight of key issues relating to strategy, risk and integrity without the need to split the roles of Chairman/CEO.

The Board of Directors believes that splitting the roles, especially in light of Mr. Kathwari’s skill and experience, would potentially have the consequence of making our management and governance process less effective through the undesirable duplication of work, and, in the worst case, the blurring of accountability and responsibility without any clear benefits.

The Board of Directors oversees an enterprise-wide approach to risk management, designed to identify risk areas and provide oversight on the Company’s risk management, and support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and to enhance stockholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks but to also understanding what level of risk is appropriate for the company. The involvement of the entire Board of Directors in reviewing the Company’s business strategy and organizational objectives is an

integral component of its assessment of management’s tolerance for risk and also its determination of what constitutes an appropriate level of risk for the Company. In addition to management’s discussion of risk with the full Board of Directors throughout the year, the independent directors also discuss risk.

Meetings and Committees of the Board of Directors

During fiscal year 2011, there were four (4) regularly scheduled meetings of the Board of Directors and the annual meeting of stockholders. Independent directors ordinarily meet in executive session without management present immediately after regularly scheduled Board of Directors meetings. These sessions are chaired by a non-employee director, which Chair is rotated annually. Clinton Clark currently serves as lead director.

All directors are expected to attend all Board of Directors meetings, independent director meetings, stockholder meetings and committee meetings, as appropriate. The Board of Directors realizes that conflicts may arise from time to time but expects that each director will make every effort to keep such conflicts to a minimum. All directors who then held office attended the November 16, 2010 annual meeting of stockholders except John Birkelund and Edward Meyer who resigned from the Board of Directors effective the date of the annual meeting. In fiscal year 2011, except as otherwise set forth hereinafter, there was 92% attendance at all Board of Directors meetings and committee

meetings.

The Board of Directors has established three standing committees: the Audit Committee; the Compensation Committee; and the Nominations/Corporate Governance Committee. Committee memberships of each nominee and continuing or current director are set forth below:

Audit Committee:

Clinton A. Clark (Chair)

John J. Dooner, Jr.

Kristin Gamble

Don M. Wilson, III

Nominations/Corporate Governance Committee:

Frank G. Wisner (Chair)

Kristin Gamble

James W. Schmotter

Compensation Committee:

Kristin Gamble (Chair)

Clinton A. Clark

Frank G. Wisner

AUDIT COMMITTEE

The Audit Committee is principally responsible for ensuring the accuracy and effectiveness of the annual audit of the financial statements as conducted by the Company’s internal auditors and independent registered public accounting firm. The duties of the Committee include, but are not limited to: (i) appointing and supervising the Company’s independent registered public accounting firm; (ii) assessing the scope and structure of the Company’s internal audit function; (iii) reviewing the scope of audits to be conducted, as well as the results thereof; (iv) approving audit and non-audit services provided to the Company by the independent registered public

accounting firm; and (v) overseeing the Company’s financial reporting activities, including the Company’s system of internal control and the accounting standards and principles applied.

In accordance with SEC regulations, the Audit Committee has approved an Audit Committee Charter, describing the responsibilities of the Audit Committee, (see page ___ for website address). Each member of the Audit Committee is “independent,” as defined in Sections 303A.02 and 303A.07 of the NYSE Listed Company Manual and is an “audit committee financial expert” as defined under Item 407 (d) (5)(ii) of SEC Regulation S-K and as contemplated by Rule 10A-3 of the Exchange Act.

Report of the Audit Committee of the Board of Directors

The Audit Committee, on behalf of the Board of Directors, oversees the Company’s financial reporting process, including the Company’s system of internal control. However, management has the primary responsibility for the financial statements and the reporting process, including the system of internal control. In fulfilling its oversight responsibilities, the Audit Committee reviewed, with management, the audited financial statements contained within the Annual Report on Form 10-K, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures contained in those financial

statements. In addition, in compliance with the Sarbanes-Oxley Act of 2002 (“SOX”), the Audit Committee reviewed with management and KPMG, the Company’s independent registered public accounting firm, the effectiveness of the Company’s system of internal control over financial reporting as of June 30, 2011.

The Audit Committee reviewed with KPMG, who is responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles, their judgment(s) as to the quality, not just the acceptability, of the Company’s accounting principles. The Audit Committee also reviewed such other matters as are required to be discussed under auditing standards of the Public Company Accounting Oversight Board (United States), including Statement on Auditing Standards No. 114. In addition, the Audit Committee has received from KPMG the written disclosures required by Independence Standards Board Standard No. 1 and has discussed with KPMG

the auditors’ independence from management and the Company.

The Audit Committee discussed with the Company’s internal auditors and KPMG the overall scope and plans for their respective audits. The Audit Committee met with the internal auditors and KPMG, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s system of internal control and the overall quality of the Company’s financial reporting practices. The Audit Committee held eight (8) meetings during fiscal year 2011, which included, but were not limited to, the review of the quarterly Form 10-Q filings and annual Form 10-K filing.

In reliance on the reviews and discussions referred to above, the Audit Committee approved the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2011 for filing with the SEC.

| |

CLINTON A. CLARK, CHAIR

JOHN J. DOONER, JR.

KRISTIN GAMBLE

DON M. WILSON, III

|

NOMINATIONS/CORPORATE GOVERNANCE COMMITTEE

The duties of the Nominations/Corporate Governance Committee (“Nominations Committee”) include, but are not limited to, the duty to: (i) develop qualification criteria for Board of Directors members and nominate or recommend to the Board of Directors individuals to serve on the Board of Directors; (ii) review, annually, the qualifications of each member of the Board of Directors; (iii) review and monitor the Company’s corporate governance policies and guidelines, including the Company’s trading policy for its directors and executive officers; and (iv) make an annual assessment of the Board of Directors’ performance and report to the Board of Directors.

The Nominations Committee follows the procedure concerning nominations or consideration of director candidates recommended by stockholders set forth in the By-laws. The By-laws of the Company permit stockholders, as of the Record Date, to nominate director candidates at the annual meeting, subject to certain notification requirements. (See “Stockholder Proposals and Nomination of Directors” under Other Matters, beginning on page ___ herein, for information on how to submit a proposal or nominate a director.) The Nominations Committee believes that as a result of the provisions in the By-laws, any separate policy relating to stockholder proposals or nominations would be duplicative. Each member of the Nominations Committee is “independent” as defined in Section 303A.02 of the NYSE Listed Company Manual. The Nominations Committee met formally one

(1) time and individual committee members conducted interviews/meetings with potential candidates and communicated, when necessary, by telephone or other means during fiscal year 2011.

The Nominations Committee seeks candidates who demonstrate a willingness and ability to prepare for, attend and participate in all Board of Directors and committee meetings and whose experience and skill would complement the then existing mix of directors. The Nominations Committee may consider the diversity of a candidate’s background and experience when evaluating a nominee, as well as the diversity of a candidate’s perspectives, which may result from diversity in age, gender, ethnicity or national origin. While the Nominations Committee may consider diversity in its evaluation process, the Nominations Committee does not have a formal policy with regard to the consideration of

diversity in identifying director nominees. The Nominations Committee gathers suggestions as to individuals who may be available to meet the Board of Directors’ future needs from a variety of sources, such as past and present directors, stockholders, colleagues and other parties with which a member of the Nominations Committee or the Board of Directors has had business dealings, and undertakes a preliminary review of the individuals suggested. At such times as the Nominations Committee determines that a relatively near term need exists and the Nominations Committee believes that an individual’s qualities and skills would complement the then existing mix of directors, the Nominations Committee or its Chair will contact the individual. The Chair will, after such contact, discuss the individual with the Nominations Committee. Based on the Nominations Committee’s

evaluation of potential nominees and the Company’s needs, the Nominations Committee determines whether to nominate the individual for election as a director. While the Nominations Committee has not, in the past, engaged any third party firm or consultant to identify or evaluate nominees, the Nominations Committee, in accordance with its charter, may do so in the future. The Nominations Committee would evaluate nominees for director, recommended by a stockholder, in the same manner it undertakes the Nominations Committee’s evaluation.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, owners of over 10% of our Common Stock, and some persons who formerly were directors or executive officers, to file reports of ownership and changes in ownership with the SEC and the NYSE and furnish us with a copy of each report filed. Based solely on our review of copies of the reports by some of those persons and written representations from others that all reports were filed or that no reports were required, we believe that during fiscal year 2011 all Section 16(a) filing requirements were complied with in a timely fashion.

Security Ownership of Common Stock of Certain Owners and Management

The following table sets forth, as of September 20, 2011, except as otherwise noted, information with respect to beneficial ownership of the Common Stock in respect of: (i) each director and Named Executive Officer (as defined herein) of the Company; (ii) all directors and Named Executive Officers of the Company as a group; and (iii) based on information available to the Company and a review of statements filed with the SEC pursuant to Section 13(d) and/or 13(g) of the Exchange Act, each person or entity that beneficially owned (directly or together with affiliates) more than 5% of the Common Stock. The Company believes that each individual or entity named has sole

investment and voting power with respect to shares of Common Stock indicated as beneficially owned by them, except as otherwise noted. Unless otherwise noted below, the address for each listed director and Named Executive Officer is Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, CT 06810.

Name and Address of Beneficial Owner

|

|

Shares

Beneficially

Owned(1)

|

|

|

Common Stock

Percentage

Ownership(1)

|

|

|

Directors and Executive Officers:

|

|

|

|

|

|

|

|

M. Farooq Kathwari(2)

|

|

|

4,400,820 |

|

|

|

15.30 |

% |

|

Kristin Gamble(3)

|

|

|

37,500 |

|

|

|

* |

|

|

Corey Whitely (4)

|

|

|

27,692 |

|

|

|

* |

|

|

Clinton A. Clark(5)

|

|

|

27,500 |

|

|

|

* |

|

|

Frank G. Wisner(6)

|

|

|

23,100 |

|

|

|

* |

|

|

Don M. Wilson, III(7)

|

|

|

11,000 |

|

|

|

* |

|

|

Lynda W. Stout (8)

|

|

|

9,585 |

|

|

|

* |

|

|

Tracy Paccione(9)

|

|

|

8,630 |

|

|

|

* |

|

|

David R. Callen(10)

|

|

|

5,893 |

|

|

|

* |

|

|

James W. Schmotter(11)

|

|

|

2,700 |

|

|

|

* |

|

|

John J. Dooner, Jr. (12)

|

|

|

1,000 |

|

|

|

* |

|

|

Named executive officers and directors as a group(2) - (12)

|

|

|

4,555,420 |

|

|

|

15.84 |

|

|

Other Principal Stockholders:

|

|

|

|

|

|

|

|

|

|

FMR LLC(13)

|

|

|

4,306,414 |

|

|

|

14.98 |

% |

|

Royce & Associates, LLC(14)

|

|

|

3,419,560 |

|

|

|

11.90 |

% |

|

Invesco Ltd. (15)

|

|

|

2,611,043 |

|

|

|

9.08 |

% |

|

BlackRock, Inc.(16)

|

|

|

2,177,147 |

|

|

|

7.57 |

% |

|

WS Management, LLLP(17)

|

|

|

1,982,310 |

|

|

|

6.90 |

% |

|

*

|

Indicates beneficial ownership of less than 1% of shares of Common Stock.

|

|

(1)

|

Information presented herein for each director and Named Executive Officer reflects beneficial share ownership and includes stock-based compensation awards and outstanding options granted under the 1992 Stock Option Plan (“Option Plan”) (the “Stock Options”) which, as of September 20, 2011, are currently exercisable or will become exercisable within sixty (60) days by such director or Named Executive Officer, as applicable. The information provided for other principal stockholders is based solely on the most recently filed statements filed with the SEC pursuant to Section 13(d) and/or 13(g). We have not made any individual determination as to beneficial ownership of any such other principal stockholders.

|

|

(2)

|

Includes (a) 2,203,002 shares owned directly by Mr. Kathwari, (b) 440,368 shares owned indirectly by Mr. Kathwari, (c) 74,000 shares of restricted Common Stock, (d) options to purchase 1,550,000 shares of Common Stock, (e) 7,450 shares held indirectly by Mr. Kathwari in the Ethan Allen Retirement Savings Plan, and (f) 126,000 stock units as noted on page __ under Employment Agreement.

|

|

(3)

|

Includes (a) 10,000 shares owned directly by Ms. Gamble, and (b) options to purchase 27,500 shares of Common Stock.

|

|

(4)

|

Includes (a) 1,667 shares owned directly by Mr. Whitely, (b) 3,333 shares of restricted Common Stock, (c) options to purchase 21,250 shares of Common Stock, and (c) 1,442 shares of Common Stock held indirectly by Mr. Whitely in the Ethan Allen Retirement Savings Plan.

|

|

(5)

|

Includes (a) 14,000 shares owned directly by Mr. Clark, and (b) options to purchase 13,500 shares of Common Stock.

|

|

(6)

|

Includes (a) 3,600 shares owned directly by Mr. Wisner, (b) 2,500 shares of restricted Common Stock, and (c) options to purchase 17,000 shares of Common Stock.

|

|

(7)

|

Includes (a) 10,000 shares of Common Stock owned directly by Mr. Wilson, and (b) 1,000 shares of restricted Common Stock.

|

|

(8)

|

Includes (a) 1,667 shares of restricted Common Stock, (b) options to purchase 7,800 shares of Common Stock, and (c) 118 shares of Common Stock held indirectly by Ms. Stout in the Ethan Allen Retirement Savings Plan.

|

|

(9)

|

Includes (a) 1,334 shares of restricted Common Stock, (b) options to purchase 7,200 shares of Common Stock, and (c) 96 shares of Common Stock held indirectly by Ms. Paccione in the Ethan Allen Retirement Savings Plan.

|

|

(10)

|

Includes (a) 1,500 shares of Common Stock owned directly by Mr. Callen, (b) 1,000 shares of restricted Common Stock, (c) options to purchase 3,275 shares of Common Stock, and (d) 118 shares of Common Stock held indirectly by Mr. Callen in the Ethan Allen Retirement Savings Plan ..

|

|

(11)

|

Includes (a) 700 shares of Common Stock owned directly by Mr. Schmotter, and (b) 2,000 shares of restricted Common Stock.

|

|

(12)

|

Includes 1,000 shares of restricted Common Stock.

|

|

(13)

|

FMR LLC (“FMR”), a parent holding company of certain institutional investment managers registered under the Exchange Act and certain other entities, beneficially owned 4,306,414 shares of Common Stock as per their Schedule 13G filing with the SEC on February 14, 2011. FMR’s filing indicates that it held sole voting power with respect to 250 of such shares and sole investment power with respect to all of such shares. The address of FMR is 82 Devonshire Street, Boston, MA 02109.

|

|

(14)

|

Royce & Associates, LLC (“Royce”), an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, beneficially owned 3,419,560 shares of Common Stock as per their Schedule 13G filing with the SEC on January 12, 2011. The address of Royce is 745 Fifth Avenue, New York, New York 10151.

|

|

(15)

|

Invesco Ltd. (“Invesco”), a U.K. entity and an investment advisor registered under Section 203 of the Investment Advisors Act, and a holding company, beneficially owned 2,611,043 shares of Common Stock per their Schedule 13G filing with the SEC on February 13, 2006. The address of Invesco is 1555 Peachtree Street, NE, Suite 1000, Atlanta, Georgia 30309.

|

|

(16)

|

BlackRock, Inc. (“BlackRock”), a parent holding company of certain institutional investment managers registered under the Exchange Act and certain other entities, beneficially owned 2,177,147 shares of Common Stock as per their Schedule 13G filing with the SEC on February 4, 2011. The address of BlackRock is 40 East 52nd Street, New York, NY 10022.

|

|

(17)

|

WS Management, LLLP (“WS”), a partnership, beneficially owned 1,982,310 shares of Common Stock per their Schedule 13G filing with the SEC on February 7, 2011. The address of WS is 4306 Pablo Oaks Court, Jacksonville, FL 32224.

|

COMPENSATION COMMITTEE

Compensation Discussion and Analysis

The purpose of this Compensation Discussion and Analysis is to provide material information about the Company’s compensation objectives and policies for its Named Executive Officers and to put into perspective the tabular disclosures and related narratives.

Compensation Philosophy and Objectives

The Company’s executive compensation philosophy is focused on attracting, retaining and motivating a qualified management team and aligning their interests with the long-term interests of stockholders. This is accomplished by offering compensation packages which are (i) competitive within the industries in which the Company operates, (ii) fair and equitable among the executives and (iii) which provide incentives for the long-term success and performance of the Company. Compensation is allocated among base salary, annual discretionary cash incentive compensation and long-term equity incentives. Incentive compensation for Named Executive Officers and managerial employees,, other than Mr.

Kathwari, is discretionary and designed to (i) reward achievement within areas under the control of the relevant employee, although Company-wide performance is also a significant factor and (ii) to retain management for the long-term success and performance of the Company. The Principal Executive Officer exercises discretion in assessing an executive’s, including Named Executive Officers, other than his own, personal performance and the extent, if any, of incentive compensation. We consider the cost to the Company when we make decisions on and consider total compensation. As the level of responsibility increases, the portion of an executive’s compensation tied to the Company’s and the executive’s personal performance will be proportionately greater. Finally, we endeavor to ensure that the Company’s compensation program is perceived as fundamentally fair to

all stakeholders.

The duties of the Compensation Committee include, but are not limited to: (i) reviewing and making determinations with regard to the employment arrangements and compensation for the Principal Executive Officer, President and Principal Financial Officer or Treasurer; and (ii) considering and either accepting, modifying or rejecting the Principal Executive Officer’s recommendations as to incentive compensation for other executives, including Named Executive Officers. No member of the Compensation Committee was an officer or employee of the Company or any of its subsidiaries during fiscal year 2011. The Compensation Committee, in accordance with its charter, may engage any third party

firm or consultant in fulfilling its responsibilities. The Compensation Committee held one (1) meeting during fiscal year 2011.

General Policies Regarding Compensation of Named Executive Officers

The Compensation Committee’s goal is to establish compensation levels and administer executive compensation which serves to: (1) attract and retain high quality managerial and executive talent; (2) reward executives for superior performance; and (3) structure appropriate incentives for executives to produce sustained superior performance in the future. Generally, in assessing the compensation arrangements for Named Executive Officers, other than the Principal Executive Officer, the Compensation Committee solicits recommendations from the Principal Executive Officer relating to annual discretionary cash incentive compensation and long-term equity incentives such as stock option

grants or restricted stock awards, which it considers, and either accepts, modifies or rejects.

Overview of Process and Compensation Components

The compensation for our executives, including our President and Principal Executive Officer, is comprised of three primary elements: base salary, cash incentive compensation and long-term equity incentives. We also provide or have provided perquisites, a retirement savings plan and, for select executives, employment and post-employment agreements. The Company does not maintain a stock ownership policy.

During fiscal year 2011, the Company maintained a cash incentive compensation program (“Bonus Program”). Under the Bonus Program (See “Incentive Bonus” under Executive Compensation on page __), the President and Principal Executive Officer made recommendations to the Compensation Committee with respect to select executives and managerial employees, other than himself. The other executives are not present at the time of deliberations, although the President and Principal Executive Officer is or may be present. The Compensation Committee considers such recommendations and consistent with the overall compensation philosophy, the duties of the Committee, and

general policies regarding compensation, may accept or adjust such recommendations. In fiscal year 2011 the Principal Executive Officer presented his recommendations as to incentive compensation, including annual discretionary cash bonus and equity incentives for other Named Executive Officers, taking into account each Named Executive Officers’ total compensation resulting from base salary, discretionary cash and long-term incentives. After considering such recommendations and discussions with the Principal Executive Officer, the Compensation Committee agreed with the Principal Executive Officer’s recommendations for fiscal year 2011. Because no targets are set in advance of a fiscal year, the Compensation Committee considers the Incentive Bonus to be a discretionary bonus. The Principal Executive Officer along with the Compensation Committee, conduct, as needed, an informal

review of market data, with the assistance of the Company’s Human Resource Department which periodically performs benchmarking studies.

The Compensation Committee reviews, annually, the performance and compensation of the President and Principal Executive Officer. For a detailed description of the terms of the Employment Agreement that governed Mr. Kathwari’s compensation for 2011, see “Employment Agreement” beginning on Page __. In consideration of the severe economic impact of the credit crisis and the Company’s superior industry results during and throughout this period, the Compensation Committee believed that the Employment Agreement did not reward Mr. Kathwari for his superior achievement during this time

and provided for additional incentive compensation and long term equity incentives. For details of the additional compensation granted Mr. Kathwari outside of his Employment Agreement, see “ ” beginning on page __.

The Company entered into an employment agreement with Mr. Kathwari to assure the continued availability of his services to the Company (“Employment Agreement”) dated October, 2007. The Employment Agreement governed Mr. Kathwari’s compensation for fiscal year 2011.

When developing an employment agreement for the President and Principal Executive Officer we engage the services of an independent third party consultant to assist in gathering relevant market information which we analyze and consider in developing the compensation package to be included in the employment agreement. We also receive input from legal counsel, as appropriate.

To assist in developing the terms of the Employment Agreement for Mr. Kathwari, the Compensation Committee engaged Sibson Consulting. Members of the Compensation Committee met and/or had discussions and communications with representatives of the consultant including five (5) teleconferences over several months. Key considerations for the Compensation Committee in developing the compensation package to be included in the Employment Agreement were: (i) identification of a peer group, which included both known competitors of the Company and companies in related industries and/or with companies of similar revenue and employee size; (ii) ensuring that the overall level of compensation

was competitive and appropriate with the market; (iii) ensuring that a substantial portion of the total compensation package was tied to long-term incentives; and (iv) creation of parameters that provide for increased compensation based upon performance of the Company. The companies that Sibson Consulting reviewed included, but were not limited to Haverty Furniture Companies, Inc., Herman Miller, Inc., Pier I Imports, Inc., Polo Ralph Lauren and Williams Sonoma. Sibson Consulting analyzed data contained in proxy filings of the peer group. In addition, they analyzed published compensation data for a broader group of retail and similarly sized companies.

The Compensation Committee and Mr. Kathwari agreed to include a substantial incentive component in the Employment Agreement. As a result, a large part of Mr. Kathwari’s potential compensation under the Employment Agreement was in the form of stock options, restricted stock awards, and a bonus based upon the Company’s operating income.

Whether an equity incentive grant will be made to a Named Executive Officer, and if so in what amount, is based upon: (i) the subjective evaluation, by the President and Principal Executive Officer of the Named Executive Officer’s contribution to the Company’s future success; (ii) the level of incentive compensation previously provided by the number and term of the Named Executive Officer’s existing stock option and restricted stock holdings; and (iii) the market price of the Common Stock on the date of grant. Generally it is our practice to allocate to the President and Principal Executive Officer a block of equity incentives (stock options and/or restricted

stock) to be granted throughout the fiscal year to recruit executives, and reward and retain management, including the Named Executive Officers other than himself. Equity incentives are granted to directly align the interest of employees, including the Named Executive Officers, to the appreciation on the Common Stock. Options typically vest twenty-five (25%) percent per year beginning one year after the grant date, with full vesting over a four (4) year period. The term of such options is ten (10) years, after which the options expire, unless the employee separates from the Company earlier, at which point the options expire 90 days after such separation. The exercise price is established using the closing price of our Common Stock on the date of grant. Restricted stock awards typically vest one-third per year beginning one year after the grant date,

with full vesting over a three (3) year period. Any stock not fully vested on the date the employee separates are forfeited.

In determining the size of individual option grants, stock unit awards and restricted stock awards, the Compensation Committee considers the aggregate number of shares available, which is, in turn, a function of: (i) the level of stockholders’ dilution; (ii) the number of shares previously authorized by stockholders and remaining available; and (iii) the number of individuals to whom the Company wishes to grant stock options, stock unit awards and/or restricted stock awards. The Compensation Committee also considers the range of potential compensation levels that may be yielded by the option grants or restricted stock awards. The Compensation Committee reserves the discretion

to consider any factors it considers relevant, and to give all factors considered the relative weight it considers appropriate under the circumstances, then prevailing, in reaching its determination regarding the size and timing of option grants, stock unit awards and restricted stock awards. The timing of option grants is neither date nor event specific. Grants of stock options to the Company’s executives under the Option Plan provide an incentive to executives and managerial staff to achieve the Company’s long-term performance objectives and to retain managerial staff.

2011 Compensation

In light of the continued uncertainty of the economy, consumer confidence and business results, during fiscal year 2011, no salary increases were made for Named Executive Officers. In fiscal year 2011, no grants or awards of equity incentives were made to Names Executive Officers, executives or employees, other than Mr. Kathwari who was awarded 11,000 shares of restricted stock on July 20, 2010.

At the end of fiscal year 2011, in reviewing total compensation for 2011, the Compensation Committee received the total compensation of the Named Executive Officers throughout the year and determined that the payment of discretionary incentive bonus awards for each Named Executive Officer was appropriate. The Compensation Committee determined that the grant of a cash award was appropriate and the amount of each award was considered in light of the overall compensation philosophy, policies and objections of the Committee, the value of total compensation paid or awarded to each Named Executive Officer and the total value of the Named Executive Officer brought to the Company

considering the following:

|

|

1.

|

The extent that the Named Executive Officer took initiatives to position the Company well for the future;

|

|

|

2.

|

The extent that the Named Executive Officer contributed to the reduction and minimization in the overall overhead cost of the Company;

|

|

|

3.

|

The extent that the Named Executive Officer was successful in maintaining the morale of his or her department(s)/division(s);

|

|

|

4.

|

The extent that the Named Executive Officer contributed to the Company’s strategic objective to conserve cash; and

|

|

|

5.

|

The more efficient operation of the Company and sensible maximizing of Company revenues.

|

Although the Compensation Committee will continue to consider deductibility under Section 162(m) with respect to future compensation arrangements with Named Executive Officers, deductibility will not be the sole factor used in determining appropriate levels or methods of compensation. Since Company objectives may not always be consistent with the requirements for full deductibility, the Company may enter into compensation arrangements under which payments are not deductible under Section 162(m).

Conclusion

The Compensation Committee believes that long-term stockholder value is enhanced by corporate and individual performance achievements. Through the plans and practices described above, a meaningful portion of the Company’s executive compensation is based on competitive pay practices, as well as corporate and individual performance. The Compensation Committee believes equity compensation, in the form of stock options, restricted stock, and stock units is vital to the long-term success of the Company. The Compensation Committee remains committed to this policy, recognizing that the competitive market for talented executives and the cyclical nature of the Company’s business may result in

highly variable compensation for a particular time period.

Report of the Compensation Committee of the Board of Directors

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis set forth above. Based upon the review and discussion, the Compensation Committee has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s proxy statement.

| |

KRISTIN GAMBLE, CHAIR

CLINTON A. CLARK

FRANK G. WISNER

|

Executive Compensation

Set forth below is a description of the business experience of each Named Executive Officer, other than Mr. Kathwari, whose experience is set forth on page __

David R. Callen, 44, has served as Vice President, Finance and Treasurer since joining the Company in October 2007. Mr. Callen serves as both the Principal Financial Officer and Principal Accounting Officer, responsible for all aspects of treasury, finance and accounting of the Company. From 2003 through 2007, Mr. Callen served as Vice President of Global Finance for Photronics, Inc., an industry leader in reticles and photomasks for semiconductor applications, in Brookfield, Connecticut after being the Corporate Controller of Johnson Outdoors, Inc., a global outdoor recreation products company, in Racine, Wisconsin.

Mr. Callen holds a B.A. in Accounting from Michigan State University and is a licensed Certified Public Accountant in the state of Connecticut.

Tracy Paccione, 45, has served as Vice President of Merchandising since June 2009. She is responsible for overseeing the Company’s merchandising, resourcing, and product development. Ms. Paccione began working for Ethan Allen as a Merchandise Manager in 1997. Prior to her current role, she served as Director of Accents Merchandising and then Vice President of Upholstery and Accents Merchandising. Ms. Paccione has more than 20 years experience in the home furnishings industry. Before joining Ethan Allen, she was a Home Furnishings Buyer for Bloomingdales in New York City. She holds a B.A. in Art History from Hamilton College in Clinton,

NY.

Lynda W. Stout, 47 has served as Vice President, Retail Division since October 2007. Ms. Stout is responsible for the oversight of the Company’s retail division and its employees. She joined Ethan Allen Retail Inc. in 2002 and has since held positions of increasing responsibility in the Company’s retail division. Ms. Stout has over 24 years experience in the areas of Interior Design, management, and sales. She is a graduate of West Virginia University where she studied Interior Design and Business.

Corey Whitely, 51, has served as Executive Vice President, Operations since October 2007 and Executive Vice President of our subsidiary, Ethan Allen Operations, Inc., since 2005. He is responsible for overseeing the Company’s manufacturing, logistics processes and information systems. Mr. Whitely served as Vice President Operations from 2003 until October 2007. He joined the Company in 1988 in the retail division and has held positions of increasing responsibilities including the areas of information technology, logistics and manufacturing. Mr. Whitely also serves on the Board of Directors of the Connecticut Retail

Merchants Association, a statewide group representing retailers in Connecticut, and is a member of the National Retail Federation’s CIO Council which is the industry’s committee of IT leaders.

Summary Compensation Table

The following table sets forth, as to the Principal Executive Officer, Principal Financial Officer and the three next most highly compensated officers (the “Named Executive Officers”), information concerning all compensation paid or accrued for services rendered in all capacities to the Company during the fiscal years indicated.

|

Name and Principal Position

|

|

Year

|

|

Salary (6)

|

|

|

Bonus

|

|

|

Stock award (1)

|

|

|

Option awards (1)

|

|

|

All other compensation (3)

|

|

|

Total

|

|

|

M. Farooq Kathwari,

|

|

2011

|

|

$ |

1,138,511 |

|

|

$ |

600,000 |

|

|

$ |

152,130 |

|

|

|

|

|

— |

|

|

$ |

77,051 |

|

(4 |

) |

|

$ |

1,967,692 |

|

|

Chairman of the Board,

|

|

2010

|

|

$ |

1,050,050 |

|

|

$ |

150,000 |

|

|

$ |

318,053 |

|

(2 |

) |

|

$ |

630,800 |

|

|

$ |

83,337 |

|

(4 |

) |

|

$ |

2,232,240 |

|

|

President and Principal

|

|

2009

|

|

$ |

1,118,847 |

|

|

|

— |

|

|

$ |

772,721 |

|

(2 |

) |

|

$ |

887,900 |

|

|

$ |

213,767 |

|

(4 |

) |

|

$ |

2,993,235 |

|

|

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David R. Callen,

|

|

2011

|

|

$ |

228,125 |

|

|

$ |

35,000 |

|

|

|

— |

|

|

|

|

|

— |

|

|

$ |

1,000 |

|

|

|

|

$ |

264,125 |

|

|

Principal Financial

|

|

2010

|

|

$ |

213,750 |

|

|

$ |

25,000 |

|

|

$ |

21,675 |

|

|

|

|

$ |

11,200 |

|

|

$ |

750 |

|

|

|

|

$ |

272,375 |

|

|

Officer

|

|

2009

|

|

$ |

221,539 |

|

|

|

— |

|

|

|

— |

|

|

|

|

$ |

4,305 |

|

|

$ |

500 |

|

|

|

|

$ |

226,344 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corey Whitely,

|

|

2011

|

|

$ |

298,269 |

|

|

$ |

70,000 |

|

|

|

— |

|

|

|

|

|

— |

|

|

$ |

1,000 |

|

|

|

|

$ |

369,269 |

|

|

Executive Vice President,

|

|

2010

|

|

$ |

285,000 |

|

|

$ |

45,000 |

|

|

$ |

72,250 |

|

|

|

|

$ |

44,800 |

|

|

$ |

750 |

|

|

|

|

$ |

447,800 |

|

|

Operations

|

|

2009

|

|

$ |

295,385 |

|

|

|

— |

|

|

|

— |

|

|

|

|

$ |

8,610 |

|

|

$ |

500 |

|

|

|

|

$ |

304,495 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lynda W. Stout,

|

|

2011

|

|

$ |

228,673 |

|

|

$ |

40,000 |

|

|

|

— |

|

|

|

|

|

— |

|

|

$ |

1,000 |

|

|

|

|

$ |

269,673 |

|

|

Vice President,

|

|

2010

|

|

$ |

218,500 |

|

|

$ |

25,000 |

|

|

$ |

36,125 |

|

|

|

|

$ |

22,400 |

|

|

$ |

27,747 |

|

(5 |

) |

|

$ |

329,772 |

|

|

Retail Division

|

|