Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| ETHAN ALLEN INTERIORS INC. | ||||

|

(Name of Registrant as Specified in Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a6(i-)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

ETHAN ALLEN INTERIORS INC.

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

Wednesday, November 14, 2018

10:00 AM (ET)

Ethan Allen International Corporate Headquarters

25 Lake Avenue Extension

Danbury, Connecticut 06811-5286

To our Stockholders:

You are cordially invited to attend the Ethan Allen Interiors Inc. 2018 Annual Meeting of Stockholders (the "Annual Meeting"). This meeting will be held at 10:00 a.m. (ET) on Wednesday, November 14, 2018, at the Ethan Allen International Corporate Headquarters, 25 Lake Avenue Extension, Danbury, Connecticut 06811.

The 2018 Annual Meeting of Stockholders of Ethan Allen Interiors Inc. will be held for the purpose of considering and acting upon the following matters:

| Proposal 1. | to elect seven directors to serve until the 2019 Annual Meeting of Stockholders; | |||

Proposal 2. |

to approve by a non-binding advisory vote, named executive officer compensation; |

|||

Proposal 3. |

to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2019 fiscal year; and |

to transact such other business as may properly come before the meeting.

You may vote if you were a shareholder of record at the close of business on September 17, 2018. Whether or not you plan to attend the Annual Meeting, we urge you to read the proxy statement carefully and to vote in accordance with the Board of Directors' recommendations. You should vote by the deadlines specified in the proxy statement, and may do so by telephone or internet, or by signing, dating, and returning the enclosed proxy card in the postage-paid envelope provided. These proxy materials are first being made available on or around October 2, 2018.

Following the formal business of the Annual Meeting, our Chairman & Chief Executive Officer will provide prepared remarks, followed by a question and answer session.

Thank you for your continued support.

BY ORDER OF THE BOARD OF DIRECTORS

Eric

D. Koster

Corporate Secretary

October 2, 2018

Proxy Voting

Even if you plan to attend the Annual Meeting, please vote as soon as possible using one of the following methods:

|

|

Online www.proxyvote.com |

|

By Phone 1-800-690-6903 |

|

By Mail Completing, dating, signing and returning your proxy card |

TABLE OF CONTENTS |

i

ii

ETHAN ALLEN INTERIORS INC.

25 Lake Avenue Ext., Danbury, Connecticut 06811

PROXY STATEMENT

For the 2018 Annual Meeting of Stockholders

October 2, 2018

PROXY STATEMENT |

This proxy statement (this "Proxy Statement") and the accompanying proxy or voting instruction card relate to the 2018 Annual Meeting of Stockholders (the "Annual Meeting") of Ethan Allen Interiors Inc., a Delaware corporation ("Ethan Allen") to be held at the Ethan Allen Corporate Headquarters, 25 Lake Avenue Extension, Danbury, Connecticut 06811 at 10:00 a.m., Eastern Time, on Wednesday, November 14, 2018.

The Board of Directors of the Company (the "Board of Directors" or the "Board") is soliciting proxies from stockholders in order to provide every stockholder an opportunity to vote on all matters submitted to a vote of stockholders at the Annual Meeting, whether or not such stockholder attends in person. A proxy authorizes a person other than a stockholder, called the "proxyholder," who will be present at the Annual Meeting, to cast the votes that the stockholder would be entitled to cast at the Annual Meeting if the stockholder were present in person. It is expected that this Proxy Statement and the accompanying proxy or voting instruction card will be first mailed or delivered to our stockholders beginning on or about October 2, 2018.

When used in this Proxy Statement, "we," "us," "our," "Ethan Allen" or the "Company" refers to Ethan Allen and its subsidiaries collectively or, if the context so requires, Ethan Allen individually.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on November 14, 2018.

The Notice of the 2018 Annual Meeting of Stockholders, the proxy statement and the 2018 Annual Report to Stockholders are available at www.proxyvote.com.

1

PROXY SUMMARY |

Proposals and Voting Recommendations |

Stockholders are being asked to vote on the following matters at the 2018 Annual Stockholder Meeting:

| | Our Board's Recommendation | |||||||

| | ITEM 1. Election of Directors | |||||||

| The Board and the Corporate Governance & Nominations Committee believe that the seven director nominees possess the necessary qualifications and experiences to provide quality advice and counsel to the Company's management and effectively oversee the business and the long-term interests of stockholders. | FOR each Director Nominee |

|||||||

| | ITEM 2. Advisory Vote to Approve Executive Compensation | | ||||||

| The Company seeks a non-binding advisory vote to approve the compensation of its Named Executive Officers as described in the Compensation Discussion and Analysis and the Compensation Tables. The Board values shareowners' opinions, and the Compensation Committee will take into account the outcome of the advisory vote when making future executive compensation decisions. | FOR | |||||||

| | ITEM 3. Ratification of the Appointment of KPMG LLP as Independent Auditors | | ||||||

| The Audit Committee and the Board believe that the retention of KPMG LLP to serve as the Independent Auditors for the fiscal year ending June 30, 2019 is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee's selection of KPMG LLC as our Independent Auditors. | FOR | |||||||

| | | | | | | | | |

The Board of Directors believes that good corporate governance is important to ensure that the Company is managed for the long-term benefit of its stockholders and to enhance the creation of long-term stockholder value. The Board has adopted Corporate Governance Guidelines that support this belief, strengthens Board and management accountability and comply with the corporate governance requirements imposed by the U.S. Securities and Exchange Commission (the "SEC") and the New York Stock Exchange (the "NYSE"), including, among others:

| GOVERNANCE HIGHLIGHTS |

| Board Practices |

| Stockholder Matters |

| Other Best Practices |

2

BOARD OF DIRECTORS |

Ethan Allen Interiors Inc. is a vertically integrated interior design and home furnishings company, serving consumers around the world. To effectively manage our enterprise requires a strong governance foundation, as well as leadership with an understanding of the diverse needs of our consumers and associates. The composition of the Board reflects an appropriate mix of skill sets, experience, and qualifications that are relevant to the business and governance of the Company. Each individual Director epitomizes the Company's Leadership Principles, possesses the highest ethics and integrity, and demonstrates commitment to representing the long-term interests of the Company's stockholders. Each director also has individual experiences that provide practical wisdom and foster mature judgment in the boardroom. Collectively, the directors bring business, international, government, technology, marketing, retail operations, and other experiences that are relevant to the Company's vertical operations. The Board of Directors has general oversight responsibility for the Company's affairs pursuant to the Company's Amended and Restated Articles of Incorporation and By-Laws, and the committee charters, corporate governance guidelines and other policies under which the Company operates. The Board is deeply involved in the Company's strategic planning process, leadership development, succession planning, and oversight of risk management. In exercising its fiduciary duties, the Board represents and acts on behalf of the Company's stockholders and is committed to strong corporate governance, as reflected through its policies and practices.

BOARD INDEPENDENCE |

The Board of Directors has determined that nominees James B. Carlson, John J. Dooner, Jr., Domenick J. Esposito, Mary Garrett, James W. Schmotter and Tara I. Stacom (six nominees for the Board of Directors) are independent directors within the meaning of the listing standards of the NYSE. The Board determined that these directors and nominees not only met all "bright-line" criteria under the NYSE rules, but also that, based on all known relevant facts and circumstances, there did not exist any relationship that would compromise the independence of these directors. In order to be considered "independent" by the Board of Directors, a director must (i) be free of any relationship that, applying the rules of the NYSE, would preclude a finding of independence and must (ii) not have any material relationship (either directly or as a partner, stockholder or officer of an organization) with us or any of our affiliates or any of our executive officers or any of our affiliates' executive officers.

Snapshot of 2018 Independent Director Nominees |

BOARD LEADERSHIP STRUCTURE |

The Board of Directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board believes that, given the dynamic and competitive environment in which we operate, the optimal Board leadership structure may vary as circumstances warrant.

At present, the Board of Directors has chosen to continue combining the two roles of Chairman and Chief Executive Officer. The Board believes that the best interests of the Company are served by Mr. Kathwari serving in both roles taking account of his unique long-standing tenure with, and investment in, the Company and also the Board's utilization of a strong Lead Independent Director. The Board of Directors believes that this governance structure provides the basis for clear, efficient executive authority in the Company, especially taking into account the Company's flat management structure, while balancing appropriate oversight by the Board of Directors.

Lead Independent Director |

Our Corporate Governance Guidelines provide that if the Chairman is not an independent director, the Board shall select a Lead Independent Director from among the members of the Board who are determined by the Board to be independent. The selection of the

3

Lead Independent Director occurs at the annual planning meeting of the Board of Directors. The Lead Independent Director has such clearly delineated duties and responsibilities as set forth in our Corporate Governance Guidelines. While the Board has chosen to continue combining the two roles of Chairman and Chief Executive Officer, it believes that a suitably empowered Lead independent director who is expressly authorized to exert de facto control of the Company by asserting independent leadership of the Board, further promotes the Board's independence from management. The Board formally designated Dr. James W. Schmotter, an independent, non-executive director, as its Lead Independent Director through the Annual Meeting. He organizes and chairs meetings of the independent directors and organizes, facilitates and communicates observations of the independent directors to the Chief Executive Officer, although each director is free to communicate directly with the Chief Executive Officer. The duties and responsibilities of our Lead Independent Director are set forth in our Corporate Governance Guidelines and include, among others:

STOCKHOLDER OUTREACH & COMMUNICATION WITH DIRECTORS |

During fiscal 2018, the Board and management held one investor conference to allow direct interaction and communication amongst the Company and its stockholders and the investment community. Stockholders or interested parties may communicate with the Chairman, the Lead Independent Director, the full Board of Directors, a full committee, individual committee members or individual directors by sending communications to the Office of the Secretary, Ethan Allen Interiors Inc., PO BOX 1966, Danbury, Connecticut 06813-1966 for forwarding to the appropriate director(s). Please specify to whom your correspondence should be directed and the nature of your interest in the Company. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Company's internal audit department and handled in accordance with procedures established by the Audit Committee with respect to such matters.

The Secretary shall review any such correspondence and forward to the Board a summary of all such correspondence and copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or committees thereof or that the Secretary otherwise determines requires their attention. Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the Board and request copies of any such correspondence. Typically, the Secretary would not forward to the Board communications of a personal nature or not related to the duties and responsibilities of the Board, including junk mail, mass mailings, advertisements, magazines, solicitations, job inquiries, opinion surveys or polls.

Additional investor information is available at www.ethanallen.com/investors. Stockholders may also electronically submit their communications to the following e-mail address: ETHBoard@ethanallen.com.

BOARD OF DIRECTORS ROLE IN RISK OVERSIGHT |

While risk management is primarily the responsibility of our management, the Board of Directors provides overall risk oversight focusing on the most significant risks. The Board of Directors oversees an enterprise-wide approach to risk management, designed to identify risk areas and provide oversight of the Company's risk management, to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and to enhance stockholder value. A fundamental part of the Board's risk management is to understand the risks the Company faces and what steps management is taking to mitigate those risks. The Board of Directors participates in discussions with management concerning the Company's overall level of risk, the Company's business strategy and organizational objectives which are all integral components of its assessment of management's tolerance for risk.

The Company has implemented a Company-wide enterprise risk management process to identify and assess the major risks and develop strategies for controlling, mitigating and monitoring risk. As part of this process, information is gathered throughout the Company to identify and prioritize these major risks. The identified risks and risk mitigation strategies are validated with management and discussed with the Audit Committee on an ongoing basis.

The Audit Committee reviews our risk management programs and regularly reports on these items to the full Board. Our Internal Audit group is responsible for monitoring the enterprise risk management process and in that role reports directly to the Audit Committee. Other members of senior management who have responsibility for designing and implementing various aspects of our risk management process also regularly meet with the Audit Committee. The Audit Committee discusses financial and operational risks with our Chief

4

Executive Officer and Chief Financial Officer and receives reports from other members of senior management with regard to our identified risks.

The Compensation Committee is responsible for overseeing any risks relating to our compensation policies and practices. Specifically, the Compensation Committee oversees the design of incentive compensation arrangements of our executive officers to implement our pay-for-performance philosophy without encouraging or rewarding excessive or inappropriate risk-taking by our executive officers.

Finally, cybersecurity is a critical part of risk management for the Company. The Board appreciates the rapidly evolving nature of threats presented by cybersecurity incidents and is committed to the prevention, timely detection, and mitigation of the effects of any such incidents on the Company. With respect to cybersecurity, the Board receives regular reports from management, including updates on the internal and external cybersecurity threat landscape, incident response, assessment and training activities, and relevant legislative, regulatory, and technical developments.

Our management regularly conducts additional reviews of risks, as needed, or as requested by the Board or the Audit Committee.

COMMITTEE CHARTERS, CODE OF CONDUCT AND CORPORATE GOVERNANCE GUIDELINES |

The Company's Code of Business Conduct and Ethics (the "Code of Conduct"), Corporate Governance Guidelines and the charters of its Audit Committee, Compensation Committee and Corporate Governance & Nominations Committee are available on the Company's website at www.ethanallen.com/governance. You may also request printed copies of the Code of Conduct, the Governance Guidelines or the committee charter(s), free of charge, by sending a written request to our Corporate Secretary at Ethan Allen Interiors Inc., PO BOX 1966, Danbury, CT 06813-1966.

The Board has approved a set of corporate governance guidelines in accordance with rules of the NYSE. These guidelines set forth the key policies relating to corporate governance, including director qualification standards, director responsibilities and director compensation. The Corporate Governance Guidelines cover, among other things, the duties and responsibilities of and independence standards applicable to our directors. The Corporate Governance Guidelines also cover the Board's role in overseeing executive compensation, compensation and expenses of non-management directors, communications between stockholders and directors, and Board committee structures and assignments.

Our Code of Conduct requires that each individual deal fairly, honestly and constructively with governmental and regulatory bodies, customers, suppliers and competitors. It prohibits any individual's taking unfair advantage through manipulation, concealment, abuse of privileged information or misrepresentation of material facts. It imposes an express duty to act in the best interests of the Company and to avoid influences, interests or relationships that could give rise to an actual or apparent conflict of interest. Further, it also prohibits directors, officers and employees from competing with us, using Company property or information, or such employee's position, for personal gain, and taking corporate opportunities for personal gain. Waivers of our Code of Conduct must be explicit. Any waiver of the Code of Conduct for directors or executive officers may only be made by the Board or the Corporate Governance & Nominations Committee, and any waivers or amendments will be publicly communicated, as appropriate, including by a posting on our website within four business days. We granted no waivers under our Code of Conduct in fiscal 2018.

Sustainability practices are a fundamental part of our Company's operations. Our Board, along with our customers, investors, employees and other stakeholders, understand that a modern approach to running our Company must be aligned with a commitment to sustainability. We believe that integrating our social and environmental values into our business as part of that commitment generates long-term value for our business, our stockholders and the global community at large. In addition to our overall dedication to ethical and accountable business practices, our corporate social responsibility commitments include the areas of environmental sustainability and community connections. We believe that these commitments create value for our stockholders and help position us to continuously improve business performance. Our strategy focuses our efforts on those areas most significant to our business, including health and safety, environmental stewardship, community and stakeholder engagement, human rights, and transparency. As part of our commitment, the Board and its committees are actively engaged in overseeing our sustainability practices and to ensure focus on these topics starts from the top. The Board oversees policies, positions and systems for environment, health, safety and social responsibility, compliance and risk management. The Company's 2018 Sustainability Report is available at www.ethanallen.com/investors.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS |

During fiscal 2018, there were four regularly scheduled meetings of the Board of Directors including the meeting in connection with the 2017 Annual Meeting of Stockholders. Independent directors also met four times in executive session without management present. The Lead Independent Director, currently Dr. James W. Schmotter, chaired the executive sessions.

5

All directors are expected to attend all regularly scheduled and special Board of Directors meetings, independent director meetings and committee meetings, as appropriate. The Board of Directors realizes that scheduling conflicts may arise from time to time which prevent a director from attending a particular meeting. However, it is the Board's explicit policy that each director shall give priority to his or her obligations to the Company. All directors who then held office attended the 2017 Annual Meeting of Stockholders. In fiscal year 2018, there was 100% attendance by each director at each of the four regularly scheduled Board of Directors meetings, and for directors serving on such committees, there was 100% attendance at the four regularly scheduled Audit Committee meetings, two regularly scheduled Compensation Committee meetings, and two regularly scheduled Corporate Governance & Nominations Committee meetings. As set forth in our Corporate Governance Guidelines, the Company's policy is to expect the resignation of any director who is absent from more than twenty-five percent of regularly scheduled Board meetings or committee meetings in a fiscal year.

The Board of Directors has established three standing committees: the Audit Committee; the Compensation Committee; and the Corporate Governance & Nominations Committee. Committee memberships of each nominee and continuing or current director are set forth below:

| | | | | | | | | | | | | | | | | | | | | |

| Name | |

Audit Committee |

|

Corporate Governance & Nominations Committee |

|

Compensation Committee |

|

Lead Independent Director |

| |||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| James B. Carlson | Member | Chairperson | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | John J. Dooner, Jr | | | | Chairperson | | Member | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Domenick J. Esposito | Chairperson | Member | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Mary Garrett | | Member | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| James W. Schmotter | Member | Member | ü | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Tara I. Stacom | | | | Member | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Additionally, the Board of Directors determined that each of the members of the standing committees is (i) independent within the meaning of the listings standards of the NYSE, including the additional requirements applicable to members of the audit and compensation committees, as applicable, (ii) non-employee directors (within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act")) and (iii) outside directors (within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code")). See "Corporate Governance".

Audit Committee |

The Audit Committee operates under a written charter, which was adopted by the Board. Pursuant to its charter, on behalf of the Board of Directors, the Audit Committee oversees the Company's financial statements, auditors, financial statement audits, financial reporting process, system of internal accounting and financial controls, and internal audit function. In so doing, the Committee seeks to maintain free and open communication between the Committee and the Company's independent registered public accountants, the internal auditors and management. The Audit Committee is also responsible for review and approval of any related party transactions required to be disclosed pursuant to Item 404(a) of Regulation S-K. The responsibilities and activities of the Audit Committee are further described in "Audit Committee Report" and the Audit Committee charter.

Each of the current members of the Audit Committee is an independent director within the meaning of the applicable rules and regulations of the SEC and the NYSE. The Board has determined that each member of the Audit Committee is financially literate within the meaning of the NYSE listing standards. The Audit Committee meets a minimum of four times a year, and holds such additional meetings as it deems necessary to perform its responsibilities. The Audit Committee met five times during 2018. A report of the Audit Committee is set forth elsewhere in this proxy statement.

Compensation Committee |

The Compensation Committee determines our compensation policies and the level and forms of compensation provided to our Board members and executive officers, as discussed more fully under "Compensation Discussion and Analysis". In addition, the Compensation Committee reviews and approves stock-based compensation for our directors, officers and employees, and oversees the administration of our Stock Incentive Plan. Additionally, the Compensation Committee approves the "Compensation Discussion and Analysis" with respect to compensation of the Company's executive officers in accordance with applicable rules of the SEC. The Compensation Committee is authorized to retain and terminate compensation consultants, legal counsel or other advisors to the Committee and to approve the engagement of any such consultant, counsel or advisor, to the extent it deems necessary or appropriate after specifically analyzing the independence of any such consultant retained by the Committee.

6

Each of the current members of the Compensation Committee is an independent director within the meaning of the applicable NYSE rules, including the enhanced independence requirements applicable to members of compensation committees. The Compensation Committee meets a minimum of two times a year, and holds such additional meetings as it deems necessary to perform its responsibilities. The Compensation Committee held four meetings and individual Compensation Committee members communicated, when necessary, by telephone or other means during fiscal 2018. A report of the Compensation Committee is set forth elsewhere in this proxy statement.

Corporate Governance & Nominations Committee |

The duties of the Corporate Governance & Nominations Committee include, but are not limited to, the duty to: (i) develop qualification criteria for the members of the Board of Directors and nominate or recommend to the Board of Directors individuals to serve on the Board of Directors; (ii) review, annually, the qualifications of each member of the Board of Directors; (iii) review and monitor the Company's corporate governance policies and guidelines, including the Company's trading policy for its directors and executive officers; and (iv) make an annual assessment of the Board of Directors' performance and report to the Board of Directors.

The Corporate Governance & Nominations Committee follows the procedure concerning nominations or consideration of director candidates recommended by stockholders set forth in the By-Laws. The By-Laws of the Company permit stockholders, as of the Record Date, to nominate director candidates at the Annual Meeting, subject to certain notification requirements. Additionally, in 2016, the Board adopted a balanced and market-standard proxy access By-law in step with the public companies that have adopted proxy access. Our By-laws permit a stockholder, or group of up to 20 stockholders, owning at least 3% of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials up to the greater of two directors or 20% of our Board. Stockholders and nominees must satisfy the requirements set forth in the by-laws in connection with such nominations. We believe that this by-law provision provides meaningful, effective and accessible proxy access rights to our stockholders, and balances those benefits against the risk of misuse or abuse by stockholders with special interests that are not shared by all or a significant percentage of our stockholders. See "Stockholder Proposals and Nomination of Directors" under "Questions and Answers" for information on how to submit a proposal or nominate a director.

Each of the current members of the Corporate Governance & Nominations Committee is an independent director within the meaning of the listing standards of the NYSE. The Corporate Governance & Nominations Committee meets a minimum of two times a year, and holds such additional meetings as it deems necessary to perform its responsibilities. The Corporate Governance & Nominations Committee held four meetings and individual Corporate Governance & Nominations Committee members communicated, when necessary, by telephone or other means during fiscal 2018.

The Corporate Governance & Nominations Committee seeks candidates who demonstrate a willingness and ability to prepare for, attend and participate in all Board of Directors and committee meetings and whose experience and skill would complement the then existing mix of directors. Among the criteria used to evaluate nominees for the Board is diversity of viewpoints, background and experience, including diversity of race, gender, ethnicity, age and cultural background. The Board believes that such diversity provides varied perspectives which promote active and constructive dialogue among Board members and between the Board and management, resulting in more effective oversight. The Board believes this diversity is amply demonstrated in the varied backgrounds, experience, qualifications and skills of the current and proposed members of the Board. In the Board's executive sessions and in annual performance evaluations conducted by the Board and its committees, the Board from time to time considers whether the members of the Board reflect such diversity and whether such diversity contributes to a constructive and collegial environment.

The Corporate Governance & Nominations Committee gathers suggestions as to individuals who may be available to meet the Board of Directors' future needs from a variety of sources, such as past and present directors, stockholders, colleagues and other parties with which a member of the Corporate Governance & Nominations Committee or the Board of Directors has had business dealings, and undertakes a preliminary review of the individuals suggested. Candidates recommended by stockholders will be considered in the same manner as other candidates. At such times as the Corporate Governance & Nominations Committee determines that a relatively near-term need exists and the Corporate Governance & Nominations Committee believes that an individual's qualities and skills would complement the then existing mix of directors, the Corporate Governance & Nominations Committee or its Chair will contact the individual. The Chair will, after such contact, discuss the individual with the Corporate Governance & Nominations Committee. Based on the Corporate Governance & Nominations Committee's evaluation of potential nominees and the Company's needs, the Corporate Governance & Nominations Committee determines whether to nominate the individual for election as a director. While the Corporate Governance & Nominations Committee has not, in the past, engaged any third-party firm or consultant to identify or evaluate nominees, in accordance with its charter, may do so in the future.

The Corporate Governance & Nominations Committee unanimously recommended the nominees named in this Proxy Statement as the individuals with the experience, industry knowledge, integrity, ability to devote time and energy, and commitment to the interests of all stockholders best qualified to execute our strategic plan and create value for all our stockholders.

7

PROPOSAL 1: ELECTION OF DIRECTORS |

At the Annual Meeting, each of the seven nominees described below will stand for re-election to serve as directors until the 2019 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified. The seven nominees were nominated by the Board of Directors in accordance with recommendations by our Corporate Governance & Nominations Committee. Each nominee has consented to being named in this Proxy Statement as a nominee for election as a director and agreed to serve if elected. All of the seven nominees described below are currently members of the Board of Directors. The information set forth below includes, with respect to each nominee for election as director, his or her age, present principal occupation, specific expertise, qualifications and skills along with other business experience, directorships in other publicly held companies, membership on committees of the Board of Directors and period of service as a director of the Company. Also set forth below is a brief discussion of the specific experience, qualifications, attributes or skills that led to each nominee's nomination as a director, in light of the Company's business.

Each director is elected annually by a majority of the votes cast. This means that the number of votes cast "FOR" a director nominee's election must exceed 50% of the number of votes cast with respect to the election of that nominee in order for the nominee to be elected. Abstentions and broker non-votes are not counted as votes cast. It is the intention of the persons named as proxies in the accompanying proxies submitted by stockholders to vote for the seven nominees described below unless authority to vote for the nominees or any individual nominee is withheld by a stockholder in such stockholder's proxy. If for any reason any nominee becomes unable or unwilling to serve at the time of the Annual Meeting, or for good cause will not serve as a director, the persons named as proxies will have discretionary authority to vote for the remaining nominees and for a substitute nominee(s) to fill the vacancy unless the Board reduces the number of directors to be elected at the Annual Meeting. Alternatively, the Board of Directors may choose to reduce the size of the Board, as permitted by our Amended and Restated By-Laws (the "By-Laws"). It is not anticipated that any nominee will be unavailable or will decline to serve as a director.

The Board of Directors unanimously recommends that you vote FOR each of the seven nominees.

8

BOARD OF DIRECTORS – EXPERIENCE AND SKILLS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ethan Allen Board Nominees | |

CEO or Senior Executive Level Experience |

|

Risk Management |

|

International Experience |

|

Operating Experience |

|

Retail and Ecommerce Experience |

|

Finance Experience |

|

Real Estate Experience |

|

Marketing and Brand Building Expertise |

| |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| M. Farooq Kathwari | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | James B Carlson | | ü | | ü | | ü | | | | | | ü | | ü | | | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John J. Dooner, Jr., | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Domenick J. Esposito | | ü | | ü | | | | ü | | | | ü | | | | ü | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mary Garrett | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | James W. Schmotter | | ü | | ü | | ü | | ü | | | | ü | | | | ü | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tara I. Stacom | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

DIRECTOR NOMINEES FOR ELECTION |

| | | | | | | | | | | |

| | Farooq Kathwari HOME FURNISHINGS INDUSTRY LEADER | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Kathwari is the chairman, president and principal executive officer of Ethan Allen Interiors Inc. He has been president of the Company since 1985 and chairman and principal executive officer since 1988. He holds BAs in English Literature and Political Science from Kashmir University and an MBA in International Marketing from New York University. He is also the recipient of three honorary doctorate degrees. |

Director since 1985 Age: 74 Board Committees: • Chairman of the Board |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

|

Mr. Kathwari serves in numerous capacities at several nonprofit organizations. He is an advisory member of the New York Stock Exchange; former chairman of the National Retail Federation; a member of the Board of Overseers of the International

Rescue Committee; Chairman Emeritus of Refugees International; a member of the International Advisory Council of the United States Institute of Peace; and a member of the advisory board of the Center for Strategic and International Studies. Among his recognitions, Mr. Kathwari is a recipient of the 2018 Ellis Island Medal of Honor and has been inducted into the American Furniture Hall of Fame. He has

been recognized as an Outstanding American by Choice by the U.S. government. He has received the Yale School of Management's Chief Executive Leadership Institute Lifetime of Leadership Award; the National Retail Federation Gold Medal; and

Ernst & Young's Entrepreneur of the Year Award. He has also been recognized by Worth magazine as one of the 50 Best CEOs in the United States. Mr. Kathwari has extensive experience and knowledge of the history of the Company and the furniture industry as well as extensive experience in growing and managing a business. Mr. Kathwari possesses insight into retailing, marketing, manufacturing, finance and strategic planning from experience with the Company as well as his broad experience with both for-profit and not-for-profit organizations which has given him perspectives from other industries valuable to his service to the Company. |

||||||||||

| | | | | | | | | | | |

9

| | | | | | | | | | | |

| | James B. Carlson LEADER IN THE LEGAL AND FINANCIAL INDUSTRIES | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Carlson who has been practicing law since 1981, currently is a member of the law firm Mayer Brown, LLP, where he has been a partner since 1998. From 1997 through 2004, he was the Partner-in-Charge of the firm's New York Office, and also served as the firm's Global Practice Leader from 2004 through 2008. |

Director since 2013 Age: 63 Board Committees: • Compensation - Chair • Audit |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Mr. Carlson, serves as an Adjunct Professor at the New York University School of Law, teaching Securities and Capital Markets Regulation since 1996. From 2009 through 2011, he also taught Derivatives and Changing Regulation at the School of Law, and from 2010 through 2012, he taught Microfinance and Access to Finance for the Global Poor as an Adjunct Professor at the NYU Stern School of Business. Mr. Carlson brings extensive knowledge in corporate and financial strategies, and is a highly regarded member of both the legal and business communities. | ||||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | John J. Dooner, Jr. LEADER IN MARKETING AND STRATEGIC COMMUNICATIONS | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Dooner recently established The Dooner Group, a marketing communication consultancy, and serves as Chairman Emeritus of McCann Worldgroup ("McCann"), a company he formed in 1997 and of which he had been Chief Executive Officer from its founding until 2011. |

Director since 2011 Age: 70 Board Committees: • Nominations - Chair • Compensation |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Under Mr. Dooner's leadership, McCann grew to be one of the world's largest marketing communications organizations, with operations in over 125 countries with a client roster that includes preeminent global marketers and many of the world's most famous brands. Prior to assuming that position, Mr. Dooner was Chief Executive Officer of McCann Erickson Worldwide, a post he assumed in 1992. Mr. Dooner serves on several not for profit organizations including as Chairman of St. Thomas University based in Miami Florida. He is Past Chairman Board of Trustees and Past Brand Platform Chairman of United Way Worldwide based in Washington, DC. Mr. Dooner brings extensive advertising and branding expertise to the Company. | ||||||||||

| | | | | | | | | | | |

10

| | | | | | | | | | | |

| | Domenick J. Esposito LEADER IN THE FINANCIAL SERVICES INDUSTRY | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Esposito has been a practicing CPA since 1974. Currently, he is the Chief Executive Officer of ESPOSITO CEO2CEO and a Board member at three privately held valuation services firms. From 2002 to 2016, Mr. Esposito was a senior partner and member of the Executive Board at CohnReznick LLP. From 2001 through 2002, he was Vice Chairman of BDO, and from 1979 through 2001 he served as a member of Grant Thornton LLP, where he became partner in 1981, and the firm's Chief Executive Officer in 1999. |

Director since 2015 Age: 71 Board Committees: • Audit - Chair • Compensation |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Prior to 1979, Mr. Esposito served as a member of Price Waterhouse. He has been a member of the NASDAQ Listing and Qualifications Committee and recently served on the NASDAQ Listing and Qualifications Panel. He formerly served as the leader of the New York State Society of CPA's Committee for Large and Medium Sized Firms Practice Management, and was also an Adjunct Professor at C.W. Post / Long Island University. Mr. Esposito's extensive public accounting background strengthens the oversight of our financial controls and reporting. | ||||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Mary Garrett LEADER IN TECHNOLOGY AND MARKETING | | ||||||||

| | | | | | | | | | | |

|

|

Ms. Garrett retired from IBM in December 2015 after a distinguished 34-year career with positions in marketing, sales and engineering. In her most recent position at IBM, as CMO of Global Markets, she led the development and execution of unique marketing and communication strategies encompassing cloud computing, cognitive/data analytics and cybersecurity in 170 countries around the world. |

Director since 2016 Age: 59 Board Committees: • Audit |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Previously, Ms. Garrett led global marketing for IBM Global Technology Services and also held P&L responsibility for the $6B enterprise segment for that business. She has earned a patent for her work in speech recognition as an engineer in IBM's research division. Ms. Garrett also serves on the Board at Hill-Rom Corporation (NYSE:HRC), a global medical technology company where she is also a member of the audit committee. Ms. Garrett is the Immediate Past Chairperson of the Board for the American Marketing Association and an active mentor in W.O.M.E.N. in America, a professional development group aimed at advancing promising professional women. Recently, she joined the strategic planning committee and the technology committee of the Western Connecticut Health Network. Ms. Garrett's significant technology and marketing experience is a valuable addition to our Board. | ||||||||||

| | | | | | | | | | | |

11

| | | | | | | | | | | |

| | Dr. James W. Schmotter LEADER IN HIGHER EDUCATION ADMINISTRATION | | ||||||||

| | | | | | | | | | | |

|

|

Dr. Schmotter is President Emeritus of Western Connecticut State University from which he retired in June 2015. He previously served as Western Michigan University's Dean of the Haworth College of Business, the Dean of the College of Business and Economics at Lehigh University in Pennsylvania, as well as Associate Dean and Director of International Studies at the Johnson Graduate School of Management at Cornell University. |

Director since 2010 Age: 71 Board Committees: • Lead Independent

Director • Nominations • Audit |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Dr. Schmotter has served as a managing director of the Southwest Michigan Innovation Center, as chair of the board of directors of the United Way of Western Connecticut and Junior Achievement of Kalamazoo (Michigan), as a corporator of the Savings Bank of Danbury, as a director of Fairfield County's Community Foundation and as a director of the Greater Danbury Chamber of Commerce and the Latino Scholarship Fund (Connecticut). He is currently a consultant with CBT University Consulting, as well as a member of the board of directors of the Dunes of Naples II Condominium Association and the Naples Council on World Affairs (Florida). A recipient of the Walter F. Brady, Jr. Award for the Advancement of Higher Education in Connecticut, he has consulted for various multinational companies and universities on three continents and has, since 2011, chaired accreditation review teams for three New England universities. Dr. Schmotter's strong leadership, educational, and governmental background provides key insight and experience in strategic planning, international/global issues, and communicating with younger customers, which are assets in his service to the Company. | ||||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Tara I. Stacom LEADER IN REAL ESTATE AND FINANCIAL INDUSTRIES | | ||||||||

| | | | | | | | | | | |

|

|

Ms. Stacom is an Executive Vice Chairman of Cushman & Wakefield, a worldwide commercial real estate firm with 43,000 employees. During her 35-year career, Ms. Stacom has been responsible for executing in excess of 40 million square feet and some of the largest and most complex leasing, sales, and corporate finance real estate transactions—including, most recently, acting as exclusive leasing agent for One World Trade Center. |

Director since 2015 Age: 60 Board Committees: • Nominations |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Ms. Stacom has been serving on the Board of Trustees at Lehigh University since 2003 where she earned her Bachelor of Science degree in Finance. She is a founder of ire@l, a real estate minor in the business college at Lehigh University. In recognition of her commitment and many years of service to Lehigh University, as well as Greenwich Academy, Ms. Stacom has received prestigious Alumni Awards from both organizations. Ms. Stacom serves as a Director of the Realty Foundation of New York, and is a Member of the Real Estate Board of New York serving on its Ethics Committee. Ms. Stacom is a "Director's Circle Member" of Girls, Inc. and a Board Member of Right to Dream. She is the recipient of Crain's New York Business 100 Most Influential Women in New York City Business, and is a Realty Foundation of New York honoree. She was awarded "Woman of the Year" of the New York Executives in Real Estate (WX), and Real Estate New York and Real Estate Forum's Women of Influence. She received Northwood University's Distinguished Women's Award in recognition of the enormous contribution she has made to communities, businesses, volunteer agencies, and public and private sector services worldwide. She has also been honored by the Visiting Nurse Service of New York and the New York Police Athletic League. Ms. Stacom was honored with the Real Estate Board of New York's highest achievement, the 2011 Most Ingenious Deal of the Year (First Place Henry Hart Rice Award) for the leasing of One World Trade Center. Ms. Stacom brings extensive knowledge of commercial real estate and finance to the Board. | ||||||||||

| | | | | | | | | | | |

12

DIRECTOR COMPENSATION |

For fiscal 2018, each independent director received $60,000 per annum and an annual stock option award. The number of stock options awarded was determined by dividing the market price of the Company's stock at the grant date into $100,000. Additional quarterly fees are paid to the chairperson of each of the committees as follows: Audit Committee $4,000; Compensation Committee $2,000; and Nominations Committee $2,000. If a committee holds more than four meetings (either in person or telephonically) on days when the full Board does not meet, committee members will be paid an additional $1,000 for each additional meeting beginning with the fifth such meeting. Employee directors do not receive additional compensation for serving on the Board of Directors. Directors serving on committees for part of a year receive a pro rata share of fees.

| | | | | | | | | | | | | | | | | |

|

Name |

|

Fees earned or paid in cash |

|

Option awards (1) |

|

Total |

| |||||||||

| | | | | | | | | | | | | | | | | |

| James B. Carlson (2) | $ 68,000 | $ 22,514 | $ 90,514 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | John J. Dooner, Jr. (3) | | 66,000 | | $ 22,514 | | 88,514 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Domenick J. Esposito (4) | 76,000 | $ 22,514 | 98,514 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Mary Garrett (5) | | 60,000 | | $ 22,514 | | 82,514 | | ||||||||

| | | | | | | | | | | | | | | | | |

| James W. Schmotter (6) | 68,000 | $ 22,514 | 90,514 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Tara I. Stacom (7) | | 60,000 | | $ 22,514 | | 82,514 | | ||||||||

| | | | | | | | | | | | | | | | | |

13

SECURITY OWNERSHIP OF COMMON STOCK OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table sets forth, as of September 17, 2018, except as otherwise noted, information with respect to beneficial ownership of Common Stock in respect of: (i) each director, director nominee and NEO (as defined above) of the Company; (ii) all directors and executive officers of the Company as a group; (iii) based on information available to the Company and a review of statements filed with the SEC pursuant to Section 13(d) and/or 13(g) of the Exchange Act, each person or entity that beneficially owned (directly or together with affiliates) more than 5% of the Common Stock; and (iv) all of our executive officers and directors serving as of September 17, 2018, as a group. The Company believes that each individual or entity named has sole investment and voting power with respect to shares of Common Stock indicated as beneficially owned by them, except as otherwise noted. Unless otherwise noted below, the address for each listed director and NEO is Ethan Allen Interiors Inc., 25 Lake Avenue Ext., Danbury, CT 06811.

| | | | | | | | | | | | | | | | | |

|

Name and Address of Beneficial Owner Directors and Executive Officers |

| |

Shares Beneficially Owned (1) |

|

Common Stock Percentage Ownership (1) |

| ||||||||||

| | | | | | | | | | | | | | | | | |

| M. Farooq Kathwari | (2) | 2,620,839 | 9.8% | |||||||||||||

| | James B. Carlson | | (3) | | 26,225 | | * | | ||||||||

| John J. Dooner, Jr. | (4) | 30,172 | * | |||||||||||||

| | Domenick J. Esposito | | (5) | | 10,162 | | * | | ||||||||

| Mary Garrett | (6) | 3,201 | * | |||||||||||||

| | James W. Schmotter | | (7) | | 21,772 | | * | | ||||||||

| Tara I. Stacom | (8) | 9,301 | * | |||||||||||||

| | Corey Whitely | | (9) | | 23,246 | | * | | ||||||||

| Kathy Bliss | (10) | 7,999 | * | |||||||||||||

| | Daniel Grow | | (11) | | 12,784 | | * | | ||||||||

| Tracy Paccione | (12) | 14,215 | * | |||||||||||||

| | All executive officers and directors as a group (11) persons | | | 2,779,916 | | 10.4% | | |||||||||

| BlackRock, Inc. | (13) | 3,696,274 | 13.8% | |||||||||||||

| | Vanguard Group Inc. | | (14) | | 2,431,304 | | 9.1% | | ||||||||

| Royce & Associates, LLC | (15) | 2,212,862 | 8.3% | |||||||||||||

| | Dimensional Fund Advisors LP | | (16) | | 2,054,604 | | 7.7% | | ||||||||

| | | | | | | | | | | | | | | | | |

14

Policies and Procedures with Respect to Transactions with Related Persons |

The Company recognizes that transactions between the Company and related persons present a potential for actual or perceived conflicts of interest. The Company's general policies with respect to such transactions are included in its Code of Conduct and, the administration of which is overseen by the Corporate Governance & Nominations Committee. The Company defines "related party" transaction as any transaction or series of related transactions in excess of $120,000 in which the Company is a party and in which a "related person" had, has or will have direct or indirect material interest. Related persons include (i) any person who is, or at any time since the beginning of our last fiscal year, was, a director or executive officer of us or a nominee to become a director, (ii) any person who is known to be the beneficial owner of more than 5% of any class of our voting securities, (iii) any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law of the director, executive officer, nominee or more than 5% beneficial owner and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than 5% beneficial owner and (iv) any firm, corporation or other entity in which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 10% or greater beneficial ownership interest.

The Company collects information about potential related party transactions in its annual questionnaires completed by directors and officers as well as throughout the year at its quarterly disclosure control committee meetings, comprised of key management responsible for significant business units, departments or divisions. Potential related party transactions are first reviewed and assessed by our General Counsel to consider the materiality of the transactions and then reported to the Audit Committee. The Audit Committee reviews and considers all relevant information available to it about each related party transaction and upon its approval presents the facts to the members of the Board of Directors not associated with the potential related party transaction. A related party transaction is approved or ratified only if such members of the Board of Directors determine that it is not inconsistent with the best interests of the Company and its stockholders. The Audit Committee then oversees any transaction between the Company and any related person (as defined in Item 404 of Regulation S-K) and any other potential conflict of interest situations on an ongoing basis in accordance with Company policies and procedures.

Related Party Transactions |

The Board, acting through the Corporate Governance & Nominations Committee and the Compensation Committee, believes that the following related person arrangement is reasonable and fair to the Company.

Robin van Puyenbroeck, the son-in-law of Mr. Kathwari, the Company's Chairman, President and Chief Executive Officer, is employed by the Company as Vice President, Business Development. Mr. van Puyenbroeck reports to the Senior Vice President, Business Development. During fiscal year 2018, the Company paid approximately $250,000 in aggregate compensation to Mr. van Puyenbroeck. The compensation was consistent with compensation paid to other employees holding similar positions and was composed of salary. The Compensation Committee and the Board expects periodically and at each fiscal year end to provide an ongoing review of Mr. van Puyenbroeck's employment with the Company, including in relation to his compensation.

Section 16(A) Beneficial Ownership Reporting Compliance |

Section 16(a) of the Exchange Act requires our executive officers, directors and owners of over 10% of our Common Stock to file reports of ownership and changes in ownership with the SEC and the NYSE and furnish us with a copy of each report filed. Based solely on our review of copies of such reports furnished to the Company and written representations that all reports were filed or that no reports were required, we are not aware of any instances of noncompliance with the Section 16(a) filing requirements by any executive officer, director or owner of over 10% of our Common Stock during fiscal year 2018, excepting for a forfeiture of a restricted stock unit grant, which forfeiture was inadvertently not timely reported when effected due to administrative oversight. The restricted stock units were issued during fiscal 2018 pursuant to the Ethan Allen Interiors Inc. (the "Company") Stock Incentive Plan on July 26, 2017 and were forfeited back to the Company during fiscal 2018 prior to vesting, upon approval of such forfeiture by the Compensation Committee.

15

PROPOSAL 2: TO APPROVE, ON AN ADVISORY BASIS, NAMED EXECUTIVE OFFICER COMPENSATION |

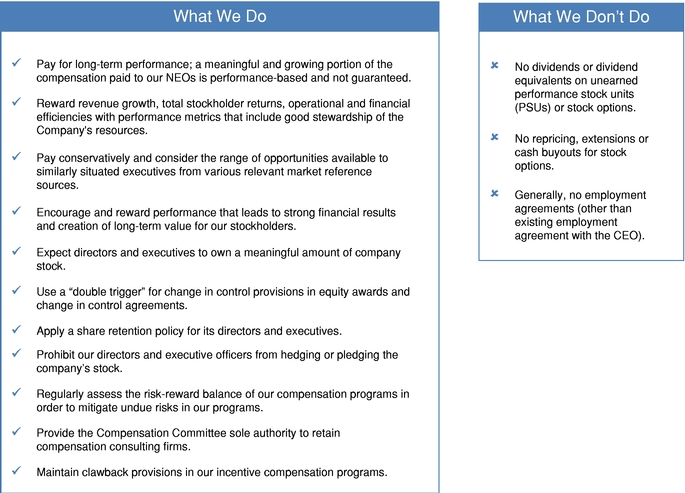

Our executive compensation program is designed to facilitate long-term stockholder value creation. Our focus on pay-for-performance and on corporate governance promotes alignment with the interests of the Company's stockholders.

The Company seeks stockholder approval, on a non-binding basis, of the compensation of our Named Executive Officers, as disclosed in this Proxy Statement pursuant to Section 14A of the Exchange Act, commonly known as a "say-on-pay" vote. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the compensation policies and practices described in this Proxy Statement.

At the Company's 2017 Annual Meeting of Stockholders, our stockholders were asked to approve the Company's executive compensation program. A substantial majority (89%) of the votes cast on the "say-on-pay" proposal at the meeting were voted in favor of the proposal. The Compensation Committee believes that these results reaffirm our stockholders' support of the Company's approach to executive compensation.

The Compensation Committee strives to continue to ensure that the design of the Company's executive compensation program is focused on long-term stockholder value creation (with a meaningful and growing portion of the compensation paid to our Named Executive Officers being at risk, performance-based, tied to performance metrics that include good stewardship of the Company's resources, and not guaranteed) and emphasizes pay for performance and does not encourage the taking of short-term risks at the expense of long-term results.

The Compensation Committee intends to continue to use the "say-on-pay" vote as a guidepost for stockholder sentiment and to consider stockholder feedback in making compensation decisions. See "Compensation Discussion and Analysis—Process for Determining Executive Compensation" for additional discussion of our stockholder outreach efforts during fiscal 2018 and "Annual Incentive Compensation Program Enhancements for Fiscal 2019" for additional discussion about the changes to our executive compensation programs implemented during fiscal 2018.

In deciding how to vote on this proposal, the Board encourages you to read the Compensation Discussion and Analysis and Compensation Table sections. The Compensation Committee in fiscal 2018 engaged in dialogue with many of our significant stockholders about the Company's approach to executive compensation and has made numerous enhancements in recent years to strengthen the link between pay and performance, further link compensation to our business and talent strategies and clearly detail the rationale for pay decisions.

For the reasons outlined above, we believe that our executive compensation program is well designed, appropriately aligns executive pay with Company performance and incentivizes desirable behavior. Accordingly, we are asking our stockholders to endorse our executive compensation program by voting on the following resolution at the Annual Meeting:

"RESOLVED, that the shareowners approve, on an advisory basis, the compensation of the Company's Named Executive Officers, as disclosed in this proxy statement, including the Compensation Discussion and Analysis, the Compensation Tables and the related narrative."

This proposal allows our stockholders to express their opinions regarding the decisions of the Compensation Committee on the annual compensation program for the Named Executive Officers. Because your vote is advisory, it will not be binding upon the Board. However, the Board values shareowners' opinions and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. Further, this advisory vote will serve as an additional tool to guide the Board and the Compensation Committee in continuing to improve the alignment of the Company's executive compensation program with the interests of Ethan Allen and its stockholders, and is consistent with our commitment to high standards of corporate governance and stockholder engagement.

The Board of Directors unanimously recommends a vote FOR the approval, on an advisory basis, of the compensation of the Company's Named Executive Officers.

16

COMPENSATION DISCUSSION AND ANALYSIS |

Overview |

The purpose of this Compensation Discussion and Analysis is to provide material information about the Company's executive compensation objectives and policies for its Named Executive Officers, ("NEOs") and to put into perspective the tabular disclosures and related narratives. The non-binding advisory proposal regarding compensation of the NEOs submitted to stockholders at our 2017 Annual Meeting was approved by over 89% of the votes cast. We regularly engage in outreach efforts with our stockholders relating to a variety of topics and involve our Compensation Committee Chair or one or more independent directors in these conversations as appropriate. We use the information gathered through these outreach efforts to help inform our compensation decisions and look forward to continued dialogue on compensation matters and other issues relevant to our business.

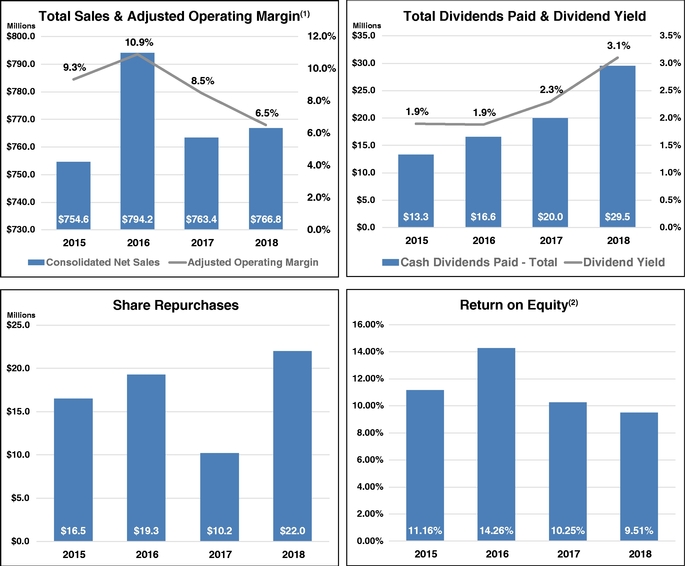

Fiscal Year 2018 Performance at a Glance |

The following highlights show our historical performance on key performance metrics and provides context to our decisions in establishing goal levels under those selected metrics that are utilized by our executive compensation programs to drive our executive compensation outcomes.

17

Compensation Practices |

Process for Determining Executive Compensation |

The Compensation Committee is responsible for determining the composition and value of the compensation programs for all of our NEOs. Our Chief Executive Officer, ("CEO"), and Executive Vice President, Administration, who is responsible for the Company's Human Resources functions, provide input on program design and information on the Company's and the furniture industry's performance. The Compensation Committee also understands and considers stockholder viewpoints on compensation.

The Compensation Committee may not delegate its primary responsibility of overseeing executive officer compensation, but it may delegate to management the administrative aspects of our compensation programs that do not involve the setting of compensation levels for executive officers.

All equity awards to executives, including stock options, PSUs, restricted stock and restricted stock units are approved by the Compensation Committee.

The Compensation Committee maintains sole authority to retain, terminate, approve fees and other terms of engagement of its compensation consultant and to obtain advice and assistance from internal or external legal, accounting or other advisors.

In early fiscal 2018, the Compensation Committee Chair, together with the Executive Vice President, Administration, who is responsible for the Company's Human Resources functions, engaged in dialogue with a number of the Company's larger institutional investors regarding approaches to executive compensation and incentives. The Compensation Committee also reviewed executive compensation and incentive structures used by the peer group companies. In part, this dialogue and review focused on whether the Company's approach to executive compensation should move from a primary focus on Adjusted Operating Income performance to metrics that include Adjusted Operating Income along with revenue growth and total stockholder returns. In the past, the Compensation Committee believed that the Company's executive incentives should be primarily correlated to high margin cash flow generation measured by Adjusted Operating Income in order to bring down debt, especially after the financial crisis and then challenges in the retail industry and to return capital to stockholders through an increase of dividends and share repurchases. Through its 2018 dialogue with investors, the Compensation Committee decided to expand the Company's incentive structure to include revenue growth and total stockholder returns in connection with executive compensation.

18

Benchmarking using Peer Groups |

The Compensation Committee established a peer group which, in its judgment, best represented the unique nature of the Company's vertical business model which integrates manufacturing, merchandising and retailing.

In developing the peer group, the population of U.S. based, publicly traded companies that were considered included:

In addition to industry, branding and supply chain considerations, the Compensation Committee filtered companies by revenues, number of employees and market capitalization. Companies with higher revenues are included in the peer group since the Company competes for executives with such other companies that are in the home furnishings industry. The Compensation Committee established a peer group that reflects 15 companies to enable full comparisons to the Company, as follows (by revenue):

| | | | | | | | | | | | | | | | | | | | | |

|

Company |

|

GICS Sub-Industry |

|

Revenue ($M) |

|

Revenue Multiple |

|

Market Cap ($M) |

| |||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| The Dixie Group Inc. | Home Furnishings | 413 | 0.5 | 36 | ||||||||||||||||

| | Bassett Furniture | | Home Furnishings | | 460 | | 0.6 | | 296 | | ||||||||||

| Flexsteel Industries | Home Furnishings | 489 | 0.6 | 314 | ||||||||||||||||

| | Kirkland's Inc. | | Home Furnishing Retail | | 501 | | 0.7 | | 183 | | ||||||||||

| Kimball International | Office Services & Supplies | 686 | 0.9 | 600 | ||||||||||||||||

| | Ethan Allen | | Home Furnishings | | 767 | | 1.0 | | 650 | | ||||||||||

| Haverty Furniture | Home Furnishing Retail | 821 | 1.1 | 415 | ||||||||||||||||

| | Knoll Inc. | | Office Services & Supplies | | 1,227 | | 1.6 | | 1,028 | | ||||||||||

| Sleep Number Corporation 1 | Home Furnishing Retail | 1,471 | 1.9 | 1,013 | ||||||||||||||||

| | La-Z-Boy Inc. | | Home Furnishings | | 1,612 | | 2.1 | | 1,429 | | ||||||||||

| Pier 1 Imports | Home Furnishing Retail | 1,761 | 2.3 | 196 | ||||||||||||||||

| | HNI Corp | | Office Services & Supplies | | 2,232 | | 2.9 | | 1,627 | | ||||||||||

| Herman Miller | Office Services & Supplies | 2,381 | 3.1 | 2,008 | ||||||||||||||||

| | Restoration Hardware | | Home Furnishing Retail | | 2,461 | | 3.2 | | 3,105 | | ||||||||||

| Tempur Sealy International | Home Furnishings | 2,691 | 3.5 | 2,616 | ||||||||||||||||

| | Steelcase Inc. | | Office Services & Supplies | | 3,074 | | 4.0 | | 1,575 | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

We believe that it is appropriate to offer industry-competitive cash and equity compensation packages to all of our NEOs in order to attract and retain top executive talent. The peer group allows us to monitor the compensation practices of our primary competitors for executive talent. However, we do not target any specific pay percentile of the peer group for our executive officers. Instead, we use this information to provide a general overview of market practices and to ensure that we make informed decisions regarding our executive pay programs. The Compensation Committee removed Tumi Holdings and Kate Spade & Co. from the peer group for fiscal 2018 because they were no longer publicly-traded companies.

19

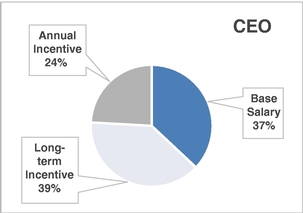

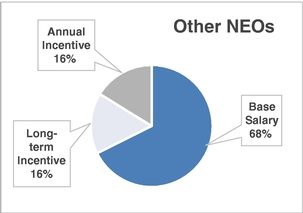

Elements of Fiscal 2018 Executive Compensation

Our compensation programs are structured to align the interests of our executive officers with the interests of our stockholders and include the following elements for fiscal 2018:

| Element | Key characteristics | Link to shareholder value | How we determine amount | Key decisions | ||||||||||||

| | | | | | | | | | | | | | | | | |

| | Fixed | | Base Salary | Fixed compensation component payable in cash. Reviewed annually and adjusted when appropriate. | A means to attract and retain talented executives capable of driving superior performance. | Consider individual contributions to business outcomes, the scope and complexity of each role, future potential, market data, and internal pay equity. | During fiscal 2018, the Compensation Committee approved a base salary increase for Ms. Bliss, but no other NEO. | |||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | Annual Incentive Program | Variable compensation component payable in cash based on performance against annually established financial goals. | Incentive targets are tied to achievement of key annual financial measures. Financial metric for the fiscal 2018 award was based on Adjusted Operating Income. | Incentive award levels based on individual contributions to business outcomes, potential future contributions, historical incentive amounts, retention considerations and market data. | For fiscal 2018, the Adjusted Operating Income financial metric did not attain the incentive award threshold level; therefore no incentive awards were earned for any NEO. Moreover, no discretionary bonus was awarded to any NEO. | |||||||||

| | | | | | | | | | | | | | | | | |

| | Performance-Based | | Performance-Based Restricted Stock Unit Awards | PSUs cliff vest over a two or three-year performance period and payouts are based on Company performance against pre-established financial goals. | PSUs recognize our executive officers for achieving superior long-term relative performance. Financial metric for the fiscal 2018 award based on Adjusted Operating Income per Share. | Grant award levels based on individual contributions to business outcomes, potential future contributions, historical grant amounts, retention considerations and market data. Actual award payout is based on performance against pre-established goals over a two or three-year performance period. | During fiscal 2018, the Board approved a shift in the timing of the total compensation decisions for NEOs, other than the CEO, from the last quarter of fiscal 2018 to July 2018 in order to align with market practices. See the below section, "Long-term Incentives for Fiscal 2018", for more information. | |||||||||

| | | | | | | | | | | | | | | | | |

Base Salary |

We set base salaries for our NEOs based on individual contributions to business outcomes, the scope and complexity of each role, competencies, experience, leadership, performance, future potential, market data, and internal pay equity.

20

Salary Changes in Fiscal Year 2018 |

In July 2017, the Compensation Committee completed the annual review of the salary levels for each of the NEOs. As part of the salary review process, the Compensation Committee reviewed and considered the performance of each NEO, relevant market data, the comparison of compensation among various levels of management, and the Company's overall performance. As a result of this review, the Compensation Committee determined the base salaries were appropriate and no annual increases were made for fiscal 2018. In October 2017, when Ms. Bliss assumed additional responsibilities, the Compensation Committee increased her base salary to $325,000, but made no changes to the base salaries of any of the other NEOs.

Salary Changes for Fiscal Year 2019 |

In July 2018, the Compensation Committee completed the annual review of the salary levels for each of the NEOs. As part of the salary review process, the Compensation Committee reviewed and considered the performance of each NEO, relevant market data, the comparison of compensation among various levels of management, and the Company's overall performance. As a result of this review, the Compensation Committee determined the base salaries were appropriate and no annual increases were made for fiscal 2019.

The NEOs' fiscal year 2018 and 2019 salaries are presented in the following table. |

| | | | | | | | | | | | | | | | | |

| Executive | |

Fiscal 2018 Salary $ |

|

Fiscal 2019 Salary $ |

|

% Chg |

| |||||||||

| | | | | | | | | | | | | | | | | |

| M. Farooq Kathwari | 1,150,000 | 1,150,000 | 0% | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Corey Whitely | | 500,000 | | 500,000 | | 0% | | ||||||||

| | | | | | | | | | | | | | | | | |

| Kathy Bliss (1) | 325,000 | 325,000 | 0% | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Daniel M. Grow | | 350,000 | | 350,000 | | 0% | | ||||||||

| | | | | | | | | | | | | | | | | |

| Tracy Paccione | 340,000 | 340,000 | 0% | |||||||||||||

| | | | | | | | | | | | | | | | | |

Director Compensation Changes for Fiscal 2019 |