Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| ETHAN ALLEN INTERIORS INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

October 4, 2016

Dear Fellow Stockholders:

You are cordially invited to attend the Ethan Allen Interiors Inc. 2016 Annual Meeting of Stockholders. This meeting will be held at 10 a.m. on Wednesday, November 16, 2016, at the Ethan Allen International Corporate Headquarters on Ethan Allen Drive in Danbury, Connecticut.

I am pleased to advise you that we continue to review our organizational documents and proactively update them to a current level of governance best practices. In preparation for the meeting, we have prepared a Notice of the Meeting, Proxy Statement, and 2016 Annual Report to Stockholders. These materials provide detailed information relating to our activities and operating performance.

This year, we are once again using the Internet as our primary means of furnishing proxy materials to stockholders. Accordingly, most stockholders will not receive paper copies of our proxy materials. We instead will mail to our stockholders a Notice Regarding the Availability of Proxy Materials. This notice will contain instructions on how to access proxy materials and vote via the Internet. The Notice Regarding the Availability of Proxy Materials also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. Electronic delivery will expedite the receipt of materials while lowering costs and reducing the environmental impact of our annual meeting by reducing printing and mailing costs.

You will find information about the matters to be voted on at the meeting in the formal Notice Regarding the Availability of Proxy Materials and the Proxy Statement.

You may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Your vote is very important to us, and we hope you will be able to attend the meeting. To ensure your representation at the meeting, even if you anticipate attending in person, we urge you to vote by proxy. If you attend, you will, of course, be entitled to vote in person.

Whether or not you plan to attend the Annual Meeting of Stockholders, we encourage you to vote your shares.

Sincerely,

M.

Farooq Kathwari

Chairman of the Board,

President and Chief Executive Officer

ETHAN ALLEN INTERIORS INC.

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

Wednesday, November 16, 2016

10:00 AM EST

Ethan Allen International Corporate Headquarters

Ethan Allen Drive

Danbury, Connecticut 06811

To our Stockholders:

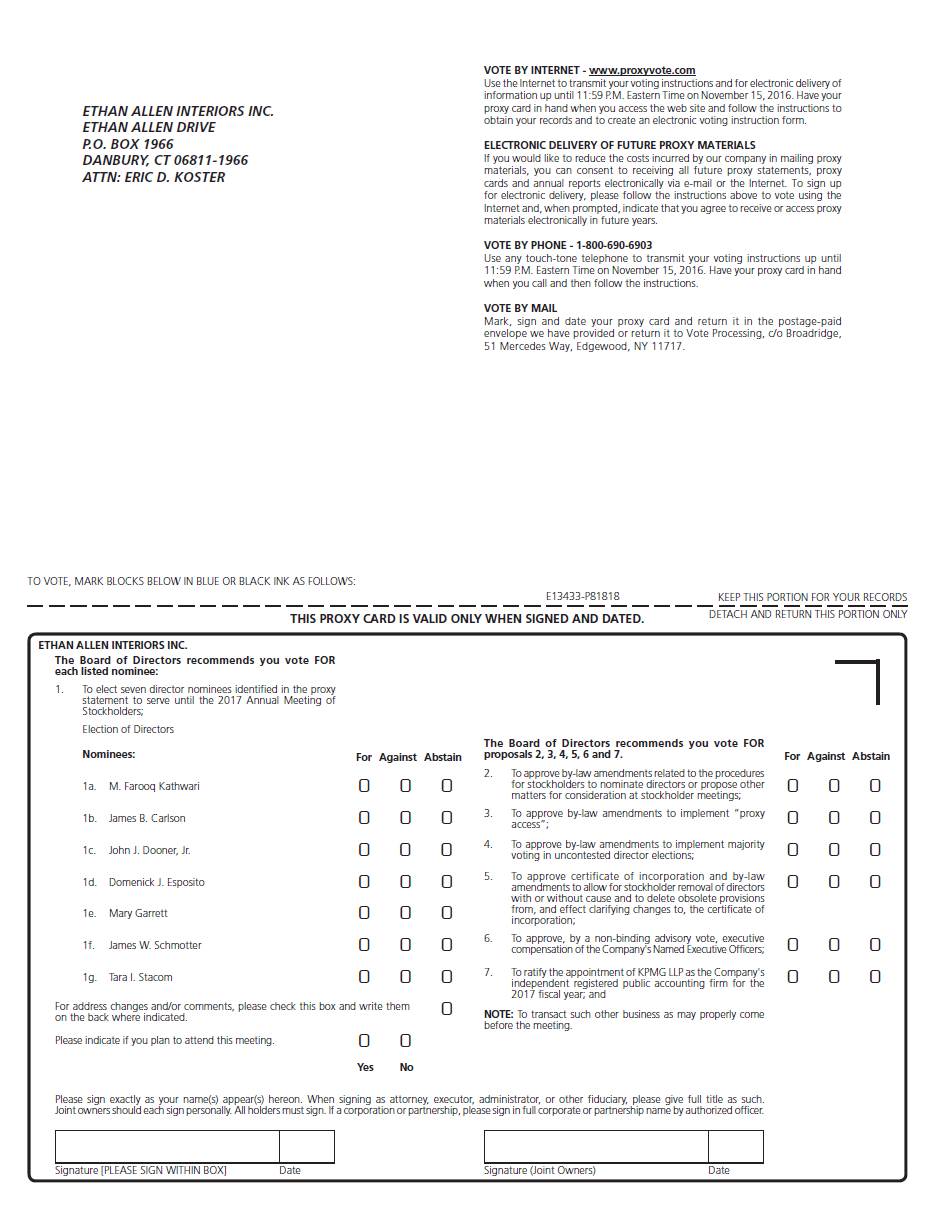

The 2016 Annual Meeting of Stockholders of Ethan Allen Interiors Inc. will be held for the purpose of considering and acting upon the following matters:

| Proposal 1. | to elect seven director nominees identified in the following proxy statement to serve until the 2017 Annual Meeting of Stockholders; | |||

Proposal 2. |

to approve by-law amendments related to the procedures for stockholders to nominate directors or propose other matters for consideration at stockholder meetings; |

|||

Proposal 3. |

to approve by-law amendments to implement "proxy access"; |

|||

Proposal 4. |

to approve by-law amendments to implement majority voting in uncontested director elections; |

|||

Proposal 5. |

to approve certificate of incorporation and by-law amendments to allow for stockholder removal of directors with or without cause and to delete obsolete provisions from, and effect clarifying changes to, the certificate of incorporation; |

|||

Proposal 6. |

to approve by a non-binding advisory vote, executive compensation of the Company's Named Executive Officers; |

|||

Proposal 7. |

to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2017 fiscal year; and |

to transact such other business as may properly come before the meeting.

In accordance with New York Stock Exchange ("NYSE") rules, your broker will not be able to vote your shares with respect to any non-routine matters if you have not given your broker specific instructions to do so. The only routine matter to be voted on at the Annual Meeting is the ratification of the appointment of our independent registered public accounting firm for the current year (Proposal 7). All other matters to be voted upon are considered non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with such proposals.

The Board of Directors has fixed September 21, 2016 as the record date for determining stockholders entitled to notice of, and to vote at, the meeting. It is important that your shares be represented and voted at the meeting. If you received the proxy materials by mail, you can vote your shares by completing, signing, dating, and returning your completed proxy card, or you may vote by telephone or over the Internet. If you received the proxy materials over the Internet, a proxy card was not sent to you, and you may vote your shares by telephone or over the Internet. To vote by telephone or Internet, follow the instructions included in the Notice Regarding the Availability of Proxy Materials, the Proxy Statement or on the Internet. You can revoke a proxy at any time prior to its exercise at the meeting by following the instructions in the Proxy Statement.

These proxy materials are first being made available on the Internet on or around October 4, 2016.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on November 16, 2016. The proxy statement and the annual report are available at http://materials.proxyvote.com/297602

By Order of the Board of Directors,

Eric

D. Koster

Corporate Secretary

October 4, 2016

![]()

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive, Danbury, Connecticut 06811

PROXY STATEMENT

for Annual Meeting of Stockholders 2016

TABLE OF CONTENTS |

i

ii

PROXY STATEMENT |

ABOUT THE ANNUAL MEETING |

This proxy statement (this "Proxy Statement") and the accompanying proxy or voting instruction card relate to the 2016 Annual Meeting of Stockholders (the "Annual Meeting") of Ethan Allen Interiors Inc., a Delaware corporation ("Ethan Allen") to be held at the Ethan Allen Corporate Headquarters, Ethan Allen Drive, Danbury, Connecticut 06811 at 10:00 A.M., Eastern Time, on Wednesday, November 16, 2016. The Board of Directors of the Company (the "Board of Directors" or "Board") is soliciting proxies from stockholders in order to provide every stockholder an opportunity to vote on all matters submitted to a vote of stockholders at the Annual Meeting, whether or not such stockholder attends in person. The proxy authorizes a person other than a stockholder, called the "proxyholder," who will be present at the Annual Meeting, to cast the votes that the stockholder would be entitled to cast at the Annual Meeting if the stockholder were present. It is expected that this Proxy Statement and the accompanying proxy or voting instruction card will be first mailed or delivered to our stockholders beginning on or about October 4, 2016. When used in this Proxy Statement, "we," "us," "our," "Ethan Allen" or the "Company" refers to Ethan Allen and its subsidiaries collectively or, if the context so requires, Ethan Allen individually.

| Proposal 1. | to elect seven director nominees identified in the following proxy statement to serve until the 2017 Annual Meeting of Stockholders; | ||

Proposal 2. |

to approve by-law amendments related to the procedures for stockholders to nominate directors or propose other matters for consideration at stockholder meetings; |

||

Proposal 3. |

to approve by-law amendments to implement "proxy access"; |

||

Proposal 4. |

to approve by-law amendments to implement majority voting in uncontested director elections; |

||

Proposal 5. |

to approve certificate of incorporation and by-law amendments to allow for stockholder removal of directors with or without cause and to delete obsolete provisions from, and effect clarifying changes to, the certificate of incorporation; |

||

Proposal 6. |

to approve, by a non-binding advisory vote, executive compensation of the Company's Named Executive Officers; |

||

Proposal 7. |

to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the 2017 fiscal year; and |

1

2

your shares. If you are a beneficial owner, you must obtain a "legal proxy" from the record holder in order to vote your shares at the Annual Meeting. Your vote at the Annual Meeting will constitute a revocation of your earlier proxy or voting instructions.

| |

|

||

|---|---|---|---|

| Corporate Secretary Eric D. Koster PO BOX 1966 Danbury, CT 06813 (203) 743-8508 |

Proxy Solicitor Georgeson LLC 1290 Avenue of the Americans, 9th Floor New York, NY 10104 (866) 277-0928 |

3

4

Only stockholders and certain other permitted attendees may attend the Annual Meeting. Please note that space limitations make it necessary to limit attendance to stockholders and one guest. Admission to the Annual Meeting will be on a first-come, first-served basis. Proof of Ethan Allen stock ownership as of the record date, along with photo identification, will be required for admission. Stockholders holding stock in an account at a brokerage firm, bank, broker-dealer or other similar organization ("street name" holders) will need to bring a copy of a brokerage statement reflecting their stock ownership as of the record date. No cameras, recording equipment, electronic devices, use of cell phones or other mobile devices, large bags or packages will be permitted at the Annual Meeting.

To reduce the expense of delivering duplicate proxy materials to our stockholders, we are relying on the SEC rules that permit us to deliver only one set of proxy materials to multiple stockholders who share an address unless we receive contrary instructions from any stockholder at that address. This practice, known as "householding," reduces duplicate mailings, thus saving printing and postage costs as well as natural resources. Each stockholder retains a separate right to vote on all matters presented at the Annual Meeting. Once you have received notice from your broker or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you wish to receive a separate copy of the Annual Report or other proxy materials, free of charge, or if you wish to receive separate copies of future annual reports or proxy materials, please mail your request to Ethan Allen Interiors, Inc., PO BOX 1966, Danbury CT 06813-1966, attention: Corporate Secretary, or call us at (203) 743-8000.

BOARD OF DIRECTORS |

Ethan Allen Interiors Inc. is a vertically integrated interior design and home furnishings company, serving consumers around the world. To effectively manage our enterprise requires a strong governance foundation, as well as leadership with an understanding of the diverse needs of our consumers and associates. The composition of the Board reflects an appropriate mix of skill sets, experience, and qualifications that are relevant to the business and governance of the Company. Each individual Director epitomizes the Company's Leadership Principles, possesses the highest ethics and integrity, and demonstrates commitment to representing the long-term interests of the Company's stockholders. Each Director also has individual experiences that provide practical wisdom and foster mature judgment in the boardroom. Collectively, the Directors bring business, international, government, technology, marketing, retail operations, and other experiences that are relevant to the Company's vertical operations. The Board of Directors has general oversight responsibility for the Company's affairs pursuant to the Company's Amended and Restated Articles of Incorporation and By-Laws, and the committee charters, corporate governance guidelines and other policies under which the Company operates. The Board is deeply involved in the Company's strategic planning process, leadership development, succession planning, and oversight of risk management. In exercising its fiduciary duties, the Board represents and acts on behalf of the Company's stockholders and is committed to strong corporate governance, as reflected through its policies and practices.

BOARD OF DIRECTORS – EXPERIENCE AND SKILLS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ethan Allen Board Nominees | |

CEO or Senior Executive Level Experience |

|

Risk Management |

|

International Experience |

|

Operating Experience |

|

Retail and Ecommerce Experience |

|

Finance Experience |

|

Real Estate Experience |

|

Marketing and Brand Building Expertise |

| |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| M. Farooq Kathwari | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | James B Carlson | | ü | | ü | | ü | | | | | | ü | | ü | | | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| John J. Dooner, Jr., | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Domenick J. Esposito | | ü | | ü | | | | ü | | | | ü | | | | ü | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mary Garrett | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | James W. Schmotter | | ü | | ü | | ü | | ü | | | | ü | | | | ü | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tara I. Stacom | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

5

BOARD INDEPENDENCE |

The Board of Directors has determined that nominees James B. Carlson, John J. Dooner, Jr., Domenick J. Esposito, Mary Garrett, James W. Schmotter and Tara I. Stacom (six nominees for the Board of Directors), as well as Clinton A. Clark (the director who has announced that he is retiring from the Board of Directors immediately prior to the Annual Meeting), are independent directors within the meaning of the listing standards of the NYSE. In order for a director to be considered "independent" by the Board of Directors, he or she must (i) be free of any relationship that, applying the rules of the NYSE, would preclude a finding of independence and (ii) not have any material relationship (either directly or as a partner, stockholder or officer of an organization) with us or any of our affiliates of any of our executive officers or any of our affiliates' executive officers. In evaluating the materiality of any such relationship, the Board of Directors takes into consideration whether disclosure of the relationship would be required by the disclosure rules under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended (the "Exchange Act"). If disclosure of the relationship is required, the Board of Directors must make a determination that the relationship is not material as a prerequisite to finding that the director is independent.

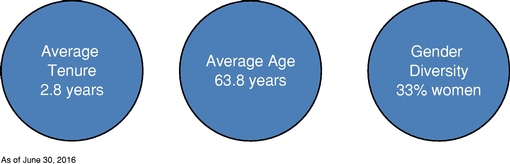

Snapshot of 2016 Independent Director Nominees |

BOARD LEADERSHIP STRUCTURE |

The Board of Directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board believes that, given the dynamic and competitive environment in which we operate, the optimal Board leadership structure may vary as circumstances warrant.

At present, the Board of Directors has chosen to continue combining the two roles of Chairman and Chief Executive Officer. The Board believes that the best interests of the Company are served by Mr. Kathwari serving in both roles taking account of his unique long standing tenure with, and investment in, the Company and also the Board's utilization of a strong Lead Independent Director. The Board of Directors believes that this governance structure provides the basis for clear, efficient executive authority in the Company, especially taking into account the Company's flat management structure, while balancing appropriate oversight by the Board of Directors.

The Company defined the role of the Lead Independent Director, a position which rotates annually. The Board expresses its intent that one person serving as both Chief Executive Officer and Chairman evidences sound management as it allows the assertion of unambiguous authority over the operations of the Company. There is no need to separate the roles of Chief Executive Officer and Chairman since the Company has a suitably empowered independent director who is expressly authorized to exert de facto control of the Company by asserting independent leadership of the Board, increasing the Board's independence over management. The Board formally designated John J. Dooner Jr., an independent, non-executive director, as its Lead Independent Director through the Annual Meeting. He organizes and chairs meetings of the independent directors and organizes, facilitates and communicates observations of the independent directors to the Chief Executive Officer, although each director is free to communicate directly with the Chief Executive Officer.

BOARD OF DIRECTORS ROLE IN RISK OVERSIGHT |

While risk management is primarily the responsibility of our management, the Board of Directors provides overall risk oversight focusing on the most significant risks. The Board of Directors oversees an enterprise-wide approach to risk management, designed to identify risk areas and provide oversight of the Company's risk management, to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and to enhance stockholder value. A fundamental part of the Board's risk management is to understand the risks the Company faces and what steps management is taking to mitigate those risks.

6

The Board of Directors participates in discussions with management concerning the Company's overall level of risk, the Company's business strategy and organizational objectives which are all integral components of its assessment of management's tolerance for risk.

The Company has implemented a Company-wide enterprise risk management process to identify and assess the major risks and develop strategies for controlling, mitigating and monitoring risk. As part of this process, information is gathered throughout the Company to identify and prioritize these major risks. The identified risks and risk mitigation strategies are validated with management and discussed with the Audit Committee on an ongoing basis.

The Audit Committee reviews our risk management programs and reports on these items to the full Board. Our Internal Audit group is responsible for monitoring the enterprise risk management process and in that role reports directly to the Audit Committee. Other members of senior management who have responsibility for designing and implementing various aspects of our risk management process also regularly meet with the Audit Committee. The Audit Committee discusses our identified financial and operational risks with our Chief Executive Officer and Chief Financial Officer and receives reports from other members of senior management with regard to our identified risks.

The Compensation Committee is responsible for overseeing any risks relating to our compensation policies and practices. Specifically, the Compensation Committee oversees the design of incentive compensation arrangements of our executive officers to implement our pay-for-performance philosophy without encouraging or rewarding excessive risk-taking by our executive officers.

Our management regularly conducts additional reviews of risks, as needed, or as requested by the Board or Audit Committee.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS |

During fiscal year 2016, there were four regularly scheduled meetings of the Board of Directors in addition to the 2015 Annual Meeting of Stockholders. Independent directors also met four times in executive session without management present. The Lead Independent Director, currently John J. Dooner Jr., chaired the executive sessions.

All directors are expected to attend all regularly scheduled and special Board of Directors meetings, independent director meetings and committee meetings, as appropriate. The Board of Directors realizes that scheduling conflicts may arise from time to time which prevent a director from attending a particular meeting. However, it is the Board's explicit policy that each director shall give priority to his or her obligations to the Company. All directors who then held office attended the 2015 Annual Meeting of Stockholders. In fiscal year 2016, there was 100% attendance by each director at each of the four regularly scheduled Board of Directors meetings, six regularly scheduled Audit Committee meetings, two regularly scheduled Compensation Committee meetings, and two regularly scheduled Nominations Committee meetings. Our policy is to expect resignation of any director who is absent from more than twenty-five percent of regularly scheduled Board meetings or committee meetings in a fiscal year. In addition to the regularly scheduled meetings, there were five special Board of Directors meetings, one special Compensation Committee meeting and one special Nominations Committee meeting. There was 100% attendance at each of the special meetings.

The Board of Directors has established three standing committees: the Audit Committee; the Compensation Committee; and the Nominations/Corporate Governance Committee. Committee memberships of each nominee and continuing or current director are set forth below:

| | | | | | | | | | | | | | | | | | | | | |

| Name | |

Audit Committee |

|

Nominations/ Corporate Governance |

|

Compensation Committee |

|

Lead Independent Director |

| |||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Clinton A. Clark (1) | Chairperson | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | James B. Carlson | | Member | | | | Chairperson | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| John J. Dooner, Jr | Member | Member | ü | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | Domenick J. Esposito | | Member | | | | Member | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Mary Garrett | Member | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| | James W. Schmotter | | Member | | Chairperson | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| Tara I. Stacom | Member | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Additionally, the Board of Directors determined that all of the members of the standing committees are (i) independent within the meaning of the listings standards of the NYSE, (ii) non-employee directors (within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 (the "Exchange Act")) and (iii) outside directors (within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code")). See "Corporate Governance".

7

NOMINATIONS/CORPORATE GOVERNANCE COMMITTEE |

The duties of the Nominations/Corporate Governance Committee include, but are not limited to, the duty to: (i) develop qualification criteria for the members of the Board of Directors and nominate or recommend to the Board of Directors individuals to serve on the Board of Directors; (ii) review, annually, the qualifications of each member of the Board of Directors; (iii) review and monitor the Company's corporate governance policies and guidelines, including the Company's trading policy for its directors and executive officers; and (iv) make an annual assessment of the Board of Directors' performance and report to the Board of Directors. The Nominations/Corporate Governance Committee follows the procedure concerning nominations or consideration of director candidates recommended by stockholders set forth in the By-Laws. The By-Laws of the Company permit stockholders, as of the Record Date, to nominate director candidates at the Annual Meeting, subject to certain notification requirements. (See "Stockholder Proposals and Nomination of Directors" under "Other Matters" for information on how to submit a proposal or nominate a director.) Each member of the Committee is independent within the meaning of the listing standards of the NYSE. The Committee held two meetings and individual Committee members communicated, when necessary, by telephone or other means during fiscal year 2016.

The Nominations/Corporate Governance Committee seeks candidates who demonstrate a willingness and ability to prepare for, attend and participate in all Board of Directors and committee meetings and whose experience and skill would complement the then existing mix of directors. While the Board has no specific policy on diversity, the Committee considers the diversity of a candidate's background and experience when evaluating a nominee, as well as the diversity of a candidate's perspectives, which may result from diversity in age, gender, ethnicity or national origin. The Committee gathers suggestions as to individuals who may be available to meet the Board of Directors' future needs from a variety of sources, such as past and present directors, stockholders, colleagues and other parties with which a member of the Nominations/Corporate Governance Committee or the Board of Directors has had business dealings, and undertakes a preliminary review of the individuals suggested. Candidates recommended by stockholders will be considered in the same manner as other candidates. At such times as the Committee determines that a relatively near term need exists and the Committee believes that an individual's qualities and skills would complement the then existing mix of directors, the Committee or its Chair will contact the individual. The Chair will, after such contact, discuss the individual with the Committee. Based on the Committee's evaluation of potential nominees and the Company's needs, the Committee determines whether to nominate the individual for election as a director. While the Nominations/Corporate Governance Committee has not, in the past, engaged any third party firm or consultant to identify or evaluate nominees, in accordance with its charter, may do so in the future. The Nominations/Corporate Governance Committee unanimously recommended the nominees named in this Proxy Statement as the individuals with the experience, industry knowledge, integrity, ability to devote time and energy, and commitment to the interests of all stockholders best qualified to execute our strategic plan and create value for all our stockholders.

8

PROPOSAL 1: ELECTION OF DIRECTORS |

At the Annual Meeting, each of the seven nominees described below will stand for election to serve as directors until the 2017 Annual Meeting of Stockholders and until their successors are duly elected and qualified. The seven nominees were nominated by the Board of Directors in accordance with recommendations by our Nominations/Corporate Governance Committee. Each nominee has consented to being named in this Proxy Statement as a nominee for election as a director and agreed to serve if elected. All of the seven nominees described below are currently members of the Board of Directors. The information set forth below includes, with respect to each nominee for election as director, his or her age, present principal occupation, specific expertise, qualifications and skills along with other business experience, directorships in other publicly held companies, membership on committees of the Board of Directors and period of service as a director of the Company. Also set forth below is a brief discussion of the specific experience, qualifications, attributes or skills that led to his or her nomination as a director, in light of the Company's business.

Under a majority voting standard, each nominee for election to the Board who receives the vote of a majority of the shares present, in person or by proxy and entitled to vote at the Annual Meeting, will be elected as a director. It is the intention of the persons named as proxies in the accompanying proxies submitted by stockholders to vote for the seven nominees described below unless authority to vote for the nominees or any individual nominee is withheld by a stockholder in such stockholder's proxy. If for any reason any nominee becomes unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies will have discretionary authority to vote for a substitute nominee(s). Alternatively, the Board of Directors may choose to reduce the size of the Board, as permitted by our Amended and Restated By-Laws (the "By-Laws"). It is not anticipated that any nominee will be unavailable or will decline to serve as a director. As a result of Mr. Clark's resignation, the Board has determined to reduce the size of the Board to seven members effective immediately upon Mr. Clark's resignation.

The Board of Directors unanimously recommends to vote FOR each of the Board of Director's seven nominees for director.

DIRECTOR NOMINEES FOR ELECTION |

| | | | | | | | | | | |

| | Farooq Kathwari HOME FURNISHINGS INDUSTRY LEADER | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Kathwari is the Chairman, President and Principal Executive Officer of Ethan Allen Interiors Inc. He has been President of the Company since 1985 and Chairman and Principal Executive Officer since 1988. He received his B.A. degree from Kashmir University in English Literature and Political Science and an M.B.A. in International Marketing from New York University. |

Director since 1985 Age: 72 Board Committees: • Chairman of the Board |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

|

From 2010 to 2014, Mr. Kathwari served on the President's Advisory Commission on Asian Americans and Pacific Islanders and is currently affiliated with several not-for-profit organizations, including: as Chairman Emeritus and director of

Refugees International, director and former Chairman of American Home Furnishings Alliance, director and former Chairman of National Retail Federation (NRF) and on the Board of Overseers of International Rescue Committee. In addition, Mr. Kathwari currently serves on the Advisory Board of the New York Stock Exchange. Mr. Kathwari has received numerous recognitions, including

Honorary Doctor of Public Service awarded by Tufts University President on May 20, 2012, the NRF's highest honor Gold Medal Award, a recognition by the U.S. Government as an Outstanding American by Choice and was an inductee into the Furniture

Hall of Fame. Mr. Kathwari has extensive experience and knowledge of the history of the Company and the furniture industry as well as extensive experience in growing and managing a business. Mr. Kathwari possesses insight into retailing, marketing, manufacturing, finance and strategic planning from experience with the Company as well as his broad experience with both for-profit and not-for-profit organizations which has given him perspectives from other industries valuable to his service to the Company. |

||||||||||

| | | | | | | | | | | |

9

| | | | | | | | | | | |

| | James B. Carlson LEADER IN THE LEGAL AND FINANCIAL INDUSTRIES | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Carlson serves as an Adjunct Professor at the New York University School of Law, teaching Securities and Capital Markets Regulation since 1996. From 2009 through 2011, he also taught Derivatives and Changing Regulation at the School of Law, and from 2010 through 2012, he taught Microfinance and Access to Finance for the Global Poor as an Adjunct Professor at the NYU Stern School of Business. |

Director since 2013 Age: 61 Board Committees: • Compensation - Chair • Audit |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Mr. Carlson, who has been practicing law since 1981, currently is a member of the law firm Mayer Brown, LLP, where he has been a partner since 1998. From 1997 through 2004, he was the Partner-in-Charge of the firm's New York Office, and also served as the firm's Global Practice Leader from 2004 through 2008. Mr. Carlson brings extensive knowledge in corporate and financial strategies, and is a highly regarded member of both the legal and business communities. | ||||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | John J. Dooner, Jr. LEADER IN MARKETING AND STRATEGIC COMMUNICATIONS | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Dooner recently established The Dooner Group, a marketing communication consultancy, and serves as Chairman Emeritus of McCann Worldgroup ("McCann"), a company he formed in 1997 and of which he had been Chief Executive Officer from its founding until 2010. |

Director since 2011 Age: 68 Board Committees: • Lead Independent Director • Nominations • Compensation |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Under Mr. Dooner's leadership, McCann grew to be one of the world's largest marketing communications organizations, with operations in over 125 countries with a client roster that includes preeminent global marketers and many of the world's most famous brands. Prior to assuming that position, Mr. Dooner was Chief Executive Officer of McCann Erickson Worldwide, a post he assumed in 1992. Mr. Dooner also serves on several not-for-profit organizations; including Chairman of St. Thomas University based in Miami Florida, Immediate past Chairman of Board of Trustees United Way Worldwide, and remains Trustee and Chairman Brand Platform United Way Worldwide based in Washington, DC. Mr. Dooner brings extensive advertising and branding expertise to the Company. | ||||||||||

| | | | | | | | | | | |

10

| | | | | | | | | | | |

| | Domenick J. Esposito LEADER IN THE FINANCIAL SERVICES INDUSTRY | | ||||||||

| | | | | | | | | | | |

|

|

Mr. Esposito has been a practicing CPA since 1974, currently is the Chief Executive Officer of ESPOSITO CEO2CEO and a Board member at a privately held valuation services firm. From 2002 to 2016, Mr. Esposito was a senior partner and member of the Executive Board at CohnReznick LLP. From 2001 through 2002, he was Vice Chairman of BDO, and from 1979 through 2001 he served as a member of Grant Thornton, where he became partner in 1981, and the firm's Chief Executive Officer in 1999. |

Director since 2015 Age: 69 Board Committees: • Audit • Compensation |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Prior to 1979, Mr. Esposito served as a member of Price Waterhouse. He has been a member of the NASDAQ Listing and Qualifications Committee and recently served on the NASDAQ Listing and Qualifications Panel. He formerly served as the leader of the New York State Society of CPA's Committee for Large and Medium Sized Firms Practice Management, and was also an Adjunct Professor at C.W. Post / Long Island University. Mr. Esposito's extensive public accounting background strengthens the oversight of our financial controls and reporting. | ||||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Mary Garrett LEADER IN TECHNOLOGY AND MARKETING | | ||||||||

| | | | | | | | | | | |

|

|

Ms. Garrett retired from IBM in December 2015 after a distinguished 34-year career where she led the development and execution of unique marketing and communication strategies encompassing the Smarter Planet agenda, Big Data, cloud computing, social business and other growth plays in support of IBM clients across both mature and emerging markets. |

Director since 2016 Age: 58 Board Committees: • Nominations |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

|

During Ms. Garrett's career, she most recently served as Vice President, Marketing and Communications for IBM Global Sales and Distribution responsible for leading geography marketing teams as well as global marketing for Industries, Enterprise

and Midmarket business, Digital Sales and field enablement. In addition, she was secretary for the IBM Board of Advisors, where she drove ongoing dialog with IBM's largest global CIOs, and the CMO Council, where she facilitated best practice

exchanges with the world's leading marketers. Previously, Ms. Garrett led worldwide marketing for IBM Global Technology Services. Ms. Garrett serves on the Board of Directors of the American Marketing Association, a global professional association with more than 30,000 members, where she also serves as Vice President Finance and Secretary, and also is an active mentor in W.O.M.E.N. in America, a professional development group aimed at advancing promising professional women. Her significant technology and marketing experience is a valuable addition to our Board. |

||||||||||

| | | | | | | | | | | |

11

| | | | | | | | | | | |

| | Dr. James W. Schmotter LEADER IN HIGHER EDUCATION ADMINISTRATION | | ||||||||

| | | | | | | | | | | |

|

|

Dr. Schmotter is President Emeritus of Western Connecticut State University from which he retired on June 30, 2015. He previously served as Western Michigan University's Dean of the Haworth College of Business, the Dean of the College of Business and Economics at Lehigh University in Pennsylvania, as well as Associate Dean and Director of International Studies at the Johnson Graduate School of Management at Cornell University. |

Director since 2010 Age: 69 Board Committees: • Nominations - Chair • Audit |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

|

Dr. Schmotter has consulted for a variety of organizations including IBM, TRW, the Institute for International Education, the Cleveland Foundation, the Graduate Management Admission Council, the Educational Testing Service, United States Agency

for International Development, and a number of universities in the U.S., Asia and Europe. He has served as Chairman of the Board of Trustees of the Graduate Management Admission Council, was the founding Vice Chair of the Board of the MBA Enterprise

Corps, has been a member of many committees of the Association to Advance Collegiate Schools of Business and has served as a member of the Executive Committee of the NCAA. Since 2011, he has chaired accreditation review teams for three New England universities. Dr. Schmotter served as chair of the board of directors of the United Way of Western Connecticut, as a corporator of the Savings Bank of Danbury, as a director of Fairfield County's Community Foundation and as a director of the Greater Danbury Chamber of Commerce. He is currently a member of the board of directors of the Dunes of Naples II Condominium Association and a member of the Schools Outreach Committee of the Naples Council on World Affairs (both Naples, Florida). Dr. Schmotter's strong leadership, educational and governmental background provides key insight and experience in strategic planning, international/global issues as well as communicating with younger customers which is valuable in his service to the Company. |

||||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Tara I. Stacom LEADER IN REAL ESTATE AND FINANCIAL INDUSTRIES | | ||||||||

| | | | | | | | | | | |

|

|

Ms. Stacom is an Executive Vice Chairman of Cushman & Wakefield, a worldwide commercial real estate firm with 43,000 employees. During her 35-year career, Ms. Stacom has been responsible for executing in excess of 40 million square feet and some of the largest and most complex leasing, sales, and corporate finance real estate transactions – including, most recently, acting as exclusive leasing agent for One World Trade Center. |

Director since 2015 Age: 58 Board Committees: • Nominations |

|||||||

| | | | | | | | | | | |

| Specific Qualifications, Attributes, Skills and Experience: | ||||||||||

| | | | | | | | | | | |

| Ms. Stacom has been serving on the Board of Trustees at Lehigh University where she earned her Bachelor of Science degree in Finance. She is a founder of ire@l, a real estate minor in the business college at Lehigh University. In recognition of her commitment and many years of service to Lehigh University, as well as Greenwich Academy, Ms. Stacom has received prestigious Alumni Awards from both organizations. Ms. Stacom serves as a Director of the Realty Foundation of New York, and is a Member of the Real Estate Board of New York serving on its Ethics Committee. Ms. Stacom is a "Director's Circle Member" of Girls, Inc. and a Board Member of Right to Dream. She is the recipient of Crain's New York Business 100 Most Influential Women in New York City Business, and is a Realty Foundation of New York honoree. She was awarded "Woman of the Year" of the New York Executives in Real Estate (WX), and Real Estate New York and Real Estate Forum's Women of Influence. She received Northwood University's Distinguished Women's Award in recognition of the enormous contribution she has made to communities, businesses, volunteer agencies, and public and private sector services worldwide. She has also been honored by the Visiting Nurse Service of New York and the New York Police Athletic League. Ms. Stacom was honored with the Real Estate Board of New York's highest achievement....the 2011 Most Ingenious Deal of the Year (First Place Henry Hart Rice Award) for the leasing of One World Trade Center. Ms. Stacom brings extensive knowledge of commercial real estate and finance to the Board. | ||||||||||

| | | | | | | | | | | |

12

CORPORATE GOVERNANCE |

The Board of Directors believes that good corporate governance is important to ensure that the Company is managed for the long-term benefit of its stockholders and to enhance the creation of long-term stockholder value. The Board has adopted corporate governance guidelines (the "Governance Guidelines") that support this belief and comply with the corporate governance requirements imposed by the SEC and the NYSE. At the 2015 Annual Meeting of Stockholders, stockholders approved the Company's proposals to enhance our governance policies as follows:

Amended and Restated the Stock Incentive Plan. The Company amended and restated the Company's 1992 Stock Option Plan, and renamed it the Ethan Allen Interiors Inc. Stock Incentive Plan. The plan was modified to remain compliant with the requirements of section 162(m) of the Internal Revenue Code relating to deductibility of performance-based compensation and was updated to reflect changes in corporate governance best-practices since it was last submitted for stockholder approval.

Updated By-Laws. Stockholders approved the Company's amendment to its Amended and Restated Certificate of Incorporation to delete Article Fifth and eliminate the requirement that Business Combinations be approved by a majority of the Continuing Directors.

Over the past several years, the Company has updated and clarified its corporate governance policies and procedures to conform to emerging trends and best practices. Some of our key policies and practices include the following:

13

14

The Board of Directors periodically reviews the Company's governance polices and as such these policies may be waived, updated or modified by any of the Nominations Committee, Compensation Committee or the Board of Directors, upon notice to the Company and the Board of Directors, as applicable. They are accessible under "Corporate Governance Charters and Policies" on our website at www.ethanallen.com/governance. The charter of each of the committees of the Board is also available on our website at www.ethanallen.com/governance. You may also request printed copies of the charter(s) by sending a written request to our Corporate Secretary at Ethan Allen Interiors, Inc., PO BOX 1966, Danbury, CT 06813.

ADDITIONAL STOCKHOLDER OUTREACH |

During fiscal years 2015 and 2016, the Board and management made additional outreach to stockholders, investors and stockholder advisory firms and held two investor conferences. This outreach included conversations with stockholders representing 90% of outstanding shares as of June 30, 2016. Based on this outreach and on recent trends and best practices related to good corporate governance, we are proposing further changes to our Certificate of Incorporation and By-Laws at the 2016 Annual Meeting of Stockholders as follows:

PROPOSAL 2: TO APPROVE BY-LAW AMENDMENTS RELATED TO THE PROCEDURES FOR STOCKHOLDERS TO NOMINATE DIRECTORS OR PROPOSE OTHER MATTERS FOR CONSIDERATION AT STOCKHOLDER MEETINGS |

Our by-laws contain provisions governing the ability of stockholders to bring business before any meeting of stockholders of the Company. As part of the Board's ongoing review of corporate governance practices, the Board has adopted, and is recommending that stockholders vote to approve, amendments to Sections 9.1, 9.2, 10 and 13 of Article II of the by-laws relating to the procedures that stockholders must comply with in order to nominate directors and properly bring any business before stockholder meetings, as well as certain related matters. The Board believes that the proposed amendments conform the by-laws, as they have been amended from time to time, to customary standards.

The proposed amendments, among other things, include the following requirements:

15

The amendments to Sections 9.1, 9.2, 10 and 13 of Article II of the by-laws pertaining to the procedures for stockholders to nominate directors, propose other matters for consideration at a stockholder meeting and certain related matters will automatically become effective if this Proposal 2 is approved by our stockholders. If, however, our stockholders do not approve this Proposal 2, then the by-law amendment to implement proxy access as set forth in Proposal 3 will not take effect even if Proposal 3 is approved by our stockholders.

The discussion above is qualified in its entirety by reference to the full text of the Amended and Restated By-laws marked to show all proposed changes (additions are underlined and deletions are struck through), which is attached hereto as Appendix B - AMENDED & RESTATED BY-LAWS.

The Board of Directors unanimously recommends that you vote

FOR the

proposal to amend and restate the Company's by-laws to revise procedures for stockholders to nominate directors or propose other matters for consideration at stockholder meetings.

PROPOSAL 3: TO APPROVE BY-LAW AMENDMENTS TO IMPLEMENT "PROXY ACCESS" |

Our Board recognizes that properly structured "proxy access" tailored to our stockholder makeup and crafted to include appropriate safeguards against potential abuse and opportunism would give our stockholders the ability to include their director nominees in our proxy materials for our annual meetings of stockholders, thereby promoting stockholder ability to participate in director elections while potentially increasing the Board's accountability and responsiveness to stockholders.

Therefore, after careful consideration, the Board has adopted, and is recommending that stockholders vote to approve, amendments to Article II of the by-laws to adopt new Section 9.3 to implement proxy access.

If approved, these provisions would vest eligible stockholders (or a group of up to 20 eligible stockholders) who meet certain conditions, including holding at least 3% of the Company's outstanding capital stock continuously for at least three years, with the right to use the Company's proxy statement to nominate, at each annual meeting, director candidates comprising up to 20% of the Board, but not less than two candidates. The Board believes that this "3/3/20/20" approach is consistent with emerging prevailing market practices regarding proxy access implementation and embodies the most appropriate of proxy access for the Company. For example, the Board believes that a group limitation of up to 20 stockholders will provide reasonable access while limiting the possibility that small stockholders with narrowly defined special interests could become over-represented on the Board. A limitation of 20 stockholders will also prevent the administrative burden and expense that could be incurred in managing and vetting nominations from groups of potentially dozens or hundreds of small stockholders.

In crafting the particulars of the proxy access approach, the Board sought to balance potential benefits of proxy access with appropriate limitations to avoid abuse by investors who wish to promote special interests that may not be aligned with the interests of our other stockholders, or who lack a meaningful long-term interest in the Company. In designing the provisions of this proposal, the Board has been mindful not to impose any undue impediments that may tend to render our proxy access approach impractical or overly burdensome. The Board believes the amendments set out herein are in the best interests of the Company.

Implementation of this Proposal 3 is contingent upon the approval of the amendments to Sections 9.1, 9.2, 10 and 13 of Article II of our by-laws related to the procedures for stockholders to nominate directors or propose other matters for consideration at stockholder meetings set forth in Proposal 2. If approved, this Proposal 3 will become effective only if Proposal 2 is approved by our stockholders.

The discussion above is qualified in its entirety by reference to the full text of the Amended and Restated By-laws marked to show all proposed changes (additions are underlined and deletions are struck through), which is attached hereto as Appendix B - AMENDED & RESTATED BY-LAWS.

16

The Board of Directors unanimously recommends that you vote

FOR the

proposal to amend and restate the Company's by-laws to implement "proxy access."

PROPOSAL 4: TO APPROVE BY-LAW AMENDMENT TO IMPLEMENT MAJORITY VOTING IN UNCONTESTED DIRECTOR ELECTIONS |

Our Board recognizes that many stockholders believe that a majority voting standard increases a board's accountability to stockholders and that many public companies recently have adopted a majority voting standard in uncontested director elections. A majority voting standard requires that the number of votes cast "FOR" a director nominee's election exceed the number of votes cast "against" that nominee in order for the nominee to be elected. Abstentions and broker non-votes have no effect in determining whether the required majority vote had been obtained. By contrast, under a plurality voting standard, a director nominee who receives the highest number of affirmative votes cast is elected, whether or not such "FOR" votes constitute a majority of all votes (including those withheld).

The Company currently has a majority voting standard; however, the provision was adopted in 1995 and lacks important features necessary for its smooth functioning. In particular, the majority voting standard should not apply in the case of a contested election in which case a plurality standard is more customary and practice. In addition, the provision currently fails to include a provision requiring a "holdover" candidate, who would otherwise remain in office until his or her successor is elected and qualified, to tender his or her resignation. Accordingly, after careful consideration, the Board has determined the retention of majority voting standard continues to be in the best interests of the Company and its stockholders, but that it should be limited to uncontested director elections. Therefore, the Board has adopted, and is recommending that stockholders vote to approve, amendments to our by-laws to adopt new Section 2 of Article III to implement majority voting in uncontested director elections.

The majority voting standard would only apply in uncontested elections. Uncontested elections are elections where the number of director nominees does not exceed the number of directors to be elected at the meeting. In a contested election, director nominees would continue to be elected by a plurality vote standard. A contested election is an election where the number of director nominees exceeds the number of directors to be elected at the annual meeting, as determined by the secretary of the company.

Further, the Board shall not nominate for election as director any nominee who has not agreed to offer, promptly following the annual meeting at which he or she is elected as director, an irrevocable resignation that will be effective upon (a) the failure to receive the required number of votes for reelection at the next annual meeting of stockholders at which he or she faces reelection, and (b) acceptance of such offer to resign by the Board. If a director nominee fails to receive the required number of votes for reelection, the Board (excluding the director in question) shall, within 90 days after certification of the election results, decide whether to accept such incumbent director's offer to resign through a process overseen by the Nominations/Corporate Governance Committee (and excluding the director in question from all Board and committee deliberations). In making its determination, the Board may consider any factor it deems relevant.

The amendments to Section 2 Article III of the by-laws to implement majority voting in uncontested director elections will automatically become effective if this Proposal 4 is approved by our stockholders.

The discussion above is qualified in its entirety by reference to the full text of the Amended and Restated By-laws marked to show all proposed changes (additions are underlined and deletions are struck through), which is attached hereto as Appendix B - AMENDED & RESTATED BY-LAWS.

The Board of Directors unanimously recommends that you vote

FOR

proposal to amend and restate the Company's by-laws to implement majority voting in uncontested director elections.

17

Article Sixth of the Company's Amended and Restated Certificate of Incorporation and Section 13 of Article III of the Company's Amended and Restated By-laws each currently provides that the Company's stockholders may remove directors from office at any time for cause by the affirmative vote of the holders of not less than a majority of the outstanding shares of stock generally entitled to vote. In a recent bench ruling on a summary judgment motion, the Delaware Court of Chancery held in December 2015 that a provision of a Delaware Corporation's charter or by-laws could not override the default rule under Delaware law that directors serving on a non-classified board and who are not elected pursuant to cumulative voting may be removed with or without cause by vote of holders of a majority of the outstanding shares entitled to vote in director elections. In light of these developments under Delaware corporate law, in January 2016, the Board adopted an amendment to the Company's Certificate of Incorporation, subject to stockholder approval, and believes it is in the best interests of the Company and its stockholders to approve amendments to the Company's certificate of incorporation and by-laws so that they state that directors can be removed by stockholders with or without cause. Further, the Company's certificate of incorporation currently includes a number of obsolete provisions relating to Class B Common Stock. The proposed amendments are intended to remove such obsolete provisions and to make minor clarifying changes, enhance readability and eliminate redundancies. Accordingly, the Board has adopted, subject to stockholder approval, amendments to the Company's certificate of incorporation and the by-laws to permit the removal of directors by stockholders with or without cause, and, with respect to the certificate of incorporation, to remove certain obsolete provisions and to renumber the remaining provisions.

The amendments to the certificate of incorporation, if adopted, would become effective upon the filing of a certificate of amendment with the Secretary of State of the State of Delaware incorporating the amendments, which we would expect to do as soon as practicable after the amendments are adopted. The amendments to Section 13 of Article III of the by-laws related removal of directors by stockholders will automatically become effective if this Proposal 5 is approved by our stockholders. The effectiveness of these amendments will not impact the rights of stockholders since the amendments reflect rights already granted to stockholders under Delaware law.

The discussion above is qualified in its entirety by reference to the full text of the Amended and Restated Certificate of Incorporation and the Amended and Restated By-laws marked to show all proposed changes (additions are underlined and deletions are struck through), which are attached hereto as Appendix A - AMENDED & RESTATED CERTIFICATE OF INCORPORATION and Appendix B - AMENDED & RESTATED BY-LAWS.

The Board of Directors unanimously recommends that you vote

FOR the

proposal to approve amendments to the Company's certificate of incorporation and by-laws to allow for stockholder removal of directors with or without cause and to implement certain clarifying

amendments to, and to delete obsolete provisions from, the certificate of incorporation.

CHARTERS, CODE AND GUIDELINES |

The Company's Business Code, Corporate Governance Guidelines and the charters of its Audit Committee, Compensation Committee and Nominations Committee are available on the Company's website at www.ethanallen.com/governance. Our Business Code requires that each individual deal fairly, honestly and constructively with governmental and regulatory bodies, customers, suppliers and competitors. It prohibits any individual's taking unfair advantage through manipulation, concealment, abuse of privileged information or misrepresentation of material facts. It imposes an express duty to act in the best interests of the Company and to avoid influences, interests or relationships that could give rise to an actual or apparent conflict of interest. Further, it also prohibits directors, officers and employees from competing with us, using Company property or information, or such employee's position, for personal gain, and taking corporate opportunities for personal gain. Waivers of our Business Code must be explicit. Any waiver of the Business Code for directors or executive

18

officers may only be made by the Nominations Committee, and any waivers or amendments will be disclosed promptly by a posting on our website. We granted no waivers under our Code of Business Conduct and Ethics in fiscal 2016. Stockholders may request a copy of any of these documents by writing to: Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, CT 06811, Attention: Office of the Secretary.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

Section 16(a) of the Exchange Act requires our executive officers, directors and owners of over 10% of our Common Stock to file reports of ownership and changes in ownership with the SEC and the NYSE and furnish us with a copy of each report filed. Based solely on our review of copies of such reports furnished to the Company and written representations that all reports were filed or that no reports were required, we are not aware of any instances of noncompliance with the Section 16(a) filing requirements by any executive officer, director or owner of over 10% of our Common Stock during fiscal year 2016.

DIRECTOR COMPENSATION |

For fiscal year 2016, each independent director received $60,000 per annum and an annual stock option award in whole shares determined by dividing the market price of the Company's stock at the grant date into $100,000. Additional fees are paid quarterly to the chairperson of each of the committees as follows: Audit Committee $4,000; Compensation Committee $2,000; and Nominations Committee $2,000. If a committee holds more than four meetings (either in person or telephonically) on days when the full Board does not meet, committee members will be paid an additional $1,000 for each additional meeting beginning with the fifth such meeting. Employee directors do not receive additional compensation for serving on the Board of Directors. Directors serving on committees for part of a year receive a pro-rata share of fees.

| | | | | | | | | | | | | | | | | |

|

Name |

|

Fees Earned or Paid in Cash |

|

Option Awards (1) |

|

Total |

| |||||||||

| | | | | | | | | | | | | | | | | |

| James B. Carlson (2) | $ 68,000 | $ 40,128 | $ 108,128 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Clinton A. Clark (3) | | 76,000 | | 40,128 | | 116,128 | | ||||||||

| | | | | | | | | | | | | | | | | |

| John J. Dooner, Jr. (4) | 60,000 | 40,128 | 100,128 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Domenick J. Esposito (5) | | 56,739 | | 40,128 | | 96,867 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Kristin Gamble (6) | 23,901 | 40,128 | 64,029 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Mary Garrett (7) | | 30,000 | | - | | 30,000 | | ||||||||

| | | | | | | | | | | | | | | | | |

| James W. Schmotter (8) | 68,000 | 40,128 | 108,128 | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Tara I. Stacom (9) | | 45,326 | | - | | 45,326 | | ||||||||

| | | | | | | | | | | | | | | | | |

| Frank G. Wisner (10) | 23,901 | 40,128 | 64,029 | |||||||||||||

| | | | | | | | | | | | | | | | | |

19

Stockholders or interested parties may communicate with the full Board of Directors, a full committee, individual committee members or individual directors by sending communications to the Office of the Secretary, Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, Connecticut 06811 for forwarding to the appropriate director(s). Please specify to whom your correspondence should be directed. The Corporate Secretary has been instructed by the Board of Directors to review and promptly forward all correspondence (except advertising material and ordinary business matters) to the full Board of Directors, full committee, individual director or committee member, as indicated in the correspondence.

The Company recognizes that transactions between the Company and related persons present a potential for actual or perceived conflicts of interest. The Company's general policies with respect to such transactions are included in its Code of Business Conduct and Ethics ("Business Code"), the administration of which is overseen by the Nominations Committee. The Company defines "related party" transaction as any transaction or series of related transactions in excess of $120,000 in which the Company is a party and in which a "related person" had, has or will have direct or indirect material interest. Related persons include (i) any person who is, or at any time since the beginning of our last fiscal year, was, a director or executive officer of us or a nominee to become a director, (ii) any person who is known to be the beneficial owner of more than 5% of any class of our voting securities, (iii) any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law of the director, executive officer, nominee or more than 5% beneficial owner and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than 5% beneficial owner and (iv) any firm, corporation or other entity in which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 10% or greater beneficial ownership interest.

The Company collects information about potential related party transactions in its annual questionnaires completed by directors and officers as well as throughout the year at its quarterly Disclosure Control Committee Meetings, comprised of key management responsible for significant business units, departments or divisions. Potential related party transactions are first reviewed and assessed by our General Counsel to consider the materiality of the transactions and then reported to the Nominations/Corporate Governance Committee. The Nominations/Corporate Governance Committee reviews and considers all relevant information available to it about each related party transaction and presents the facts to the members of the Board of Directors not associated with the potential related party transaction. A related party transaction is approved or ratified only if such members of the Board of Directors determine that it is not inconsistent with the best interests of the Company and its stockholders.

The Board, acting through the Nominations and the Compensation Committees, believes that the following related person transactions are reasonable and fair to the Company.

Robin van Puyenbroeck, the son in law of Mr. Kathwari, the Company's Chairman, President and Chief Executive Officer is employed by the Company as the Company's Vice President, Business Development. Mr. van Puyenbroeck reports to the Senior Vice President, Business Development. During fiscal year 2016, the Company paid approximately $260,000 in aggregate compensation to Mr. van Puyenbroeck. The compensation was consistent with compensation paid to other employees holding similar positions and was composed of salary and annual bonus. The Compensation Committee and the Board expects periodically and at each fiscal year end to provide an ongoing review of Mr. van Puyenbroeck's employment with the Company, including in relation to his compensation.

The Company is party to indemnification agreements with each of the members of the Board of Directors pursuant to which the Company has agreed to indemnify and hold harmless each member of the Board of Directors from liabilities incurred as a result of such director's status as a director of the Company, subject to certain limitations.

No member of the Compensation Committee is, or has ever been, an officer or employee of the Company or any of its subsidiaries. In addition, during the last fiscal year, no executive officer of the Company served as a director or member of the compensation or similar committee of another entity whose executive officer(s) serve as a member of the Board or the Compensation Committee.

20

The following table sets forth, as of September 21, 2016, except as otherwise noted, information with respect to beneficial ownership of Common Stock in respect of: (i) each director, director nominee and NEO (as defined above) of the Company; (ii) all directors and executive officers of the Company as a group; and (iii) based on information available to the Company and a review of statements filed with the SEC pursuant to Section 13(d) and/or 13(g) of the Exchange Act, each person or entity that beneficially owned (directly or together with affiliates) more than 5% of the Common Stock. The Company believes that each individual or entity named has sole investment and voting power with respect to shares of Common Stock indicated as beneficially owned by them, except as otherwise noted. Unless otherwise noted below, the address for each listed director and NEO is Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, CT 06810.

| | | | | | | | | | | | | | | | | |

|

Name and Address of Beneficial Owner Directors and Executive Officers |

| |

Shares Beneficially Owned (1) |

|

Common Stock Percentage Ownership (1) |

| ||||||||||

| | | | | | | | | | | | | | | | | |

| M. Farooq Kathwari | (2) | 2,970,882 | 10.5% | |||||||||||||

| | James B. Carlson | | (3) | | 19,441 | | * | | ||||||||

| Clinton A. Clark | (4) | 2,757 | * | |||||||||||||

| | John J. Dooner, Jr. | | (5) | | 23,388 | | * | | ||||||||

| Domenick J. Esposito | (6) | 3,160 | * | |||||||||||||

| | James W. Schmotter | | (7) | | 14,988 | | * | | ||||||||

| Tara I. Stacom | (8) | 3,300 | * | |||||||||||||

| | Corey Whitely | | (9) | | 34,478 | | * | | ||||||||

| Daniel Grow | (10) | 8,409 | * | |||||||||||||

| | Tracy Paccione | | (11) | | 11,771 | | * | | ||||||||

| Clifford Thorn | (12) | 8,367 | * | |||||||||||||

| | | | | | | | | | | | | | | | | |

| | Named executive officers and directors as a group | | | 3,100,941 | | 11.0% | | |||||||||

| | | | | | | | | | | | | | | | | |

| BlackRock, Inc. | (13) | 2,973,816 | 10.5% | |||||||||||||

| | FMR, LLC | | (14) | | 2,209,599 | | 7.8% | | ||||||||

| Royce & Associates, LLC | (15) | 2,791,617 | 9.9% | |||||||||||||

| | T. Rowe Price Associates, Inc. | | (16) | | 1,519,710 | | 5.4% | | ||||||||

| The Vanguard Group | (17) | 1,934,759 | 6.9% | |||||||||||||

| | | | | | | | | | | | | | | | | |

21

PROPOSAL 6: TO APPROVE, ON AN ADVISORY BASIS, NAMED EXECUTIVE OFFICER COMPENSATION |

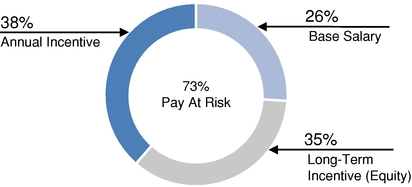

Our executive compensation program is designed to facilitate long-term stockholder value creation. Our focus on pay-for-performance and on corporate governance promotes alignment with the interests of the Company's stockholders.

The Company seeks stockholder approval, on a non-binding basis, of the compensation of our Named Executive Officers, or "NEOs", as disclosed in this Proxy Statement pursuant to Section 14A of the Exchange Act, commonly known as a "Say-on-Pay" vote. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the compensation policies and practices described in this Proxy Statement.

At the Company's 2015 Annual Meeting of Stockholders, our stockholders were asked to approve the Company's fiscal 2014 executive compensation programs. A substantial majority (80%) of the votes cast on the "Say-on-Pay" proposal at that meeting were voted in favor of the proposal. The Compensation Committee believes that these results reaffirm our stockholders' support of the Company's approach to executive compensation.

In deciding how to vote on this proposal, the Board encourages you to read the Compensation Discussion and Analysis and Compensation Table sections. The Compensation Committee has made numerous enhancements in recent years to strengthen the link between pay and performance, further link compensation to our business and talent strategies and clearly detail the rationale for pay decisions.

For the reasons outlined above, we believe that our executive compensation program is well designed, appropriately aligns executive pay with Company performance and incentivizes desirable behavior. Accordingly, we are asking our stockholders to endorse our executive compensation program by voting on the following resolution at the Annual Meeting:

"RESOLVED, that the shareowners approve, on an advisory basis, the compensation of the Company's Named Executive Officers, as disclosed in this proxy statement, including the Compensation Discussion and Analysis, the Compensation Tables and the related narrative."

This proposal allows our stockholders to express their opinions regarding the decisions of the Compensation Committee on the prior year's annual compensation to the NEOs. Because your vote is advisory, it will not be binding upon the Board. However, the Board values shareowners' opinions and the Compensation Committee will take into account the outcome of the advisory vote when considering future executive compensation decisions. Further, this advisory vote will serve as an additional tool to guide the Board and the Compensation Committee in continuing to improve the alignment of the Company's executive compensation programs with the interests of Ethan Allen and its stockholders, and is consistent with our commitment to high standards of corporate governance.

The Board of Directors unanimously recommends a vote FOR the approval of the compensation of the Company's Named Executive Officers.

COMPENSATION COMMITTEE REPORT |

The Compensation Committee oversees our compensation program for our Named Executive Officers ("NEOs") on behalf of the Board of Directors. In fulfilling its oversight responsibilities, the Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis and recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement and the Company's Annual Report.

| JAMES B. CARLSON, CHAIR JOHN J. DOONER, JR. DOMENICK J. ESPOSITO |

22

COMPENSATION DISCUSSION AND ANALYSIS |

Overview |

The purpose of this Compensation Discussion and Analysis is to provide material information about the Company's executive compensation objectives and policies for its NEOs and to put into perspective the tabular disclosures and related narratives. The non-binding advisory proposal regarding compensation of the NEOs submitted to stockholders at our 2015 Annual Meeting was approved by over 80% of the votes cast. The Committee believes this favorable outcome conveyed our stockholders' support of our executive compensation programs and the Committee's decisions. After considering the stockholder vote and other factors in its annual review of our total executive compensation programs, the Committee made further refinements in the structure of our compensation programs. The Committee will continue to consider the outcome of the Company's say-on-pay votes when conducting its regular evaluations of the program and making future compensation decisions for the NEOs.

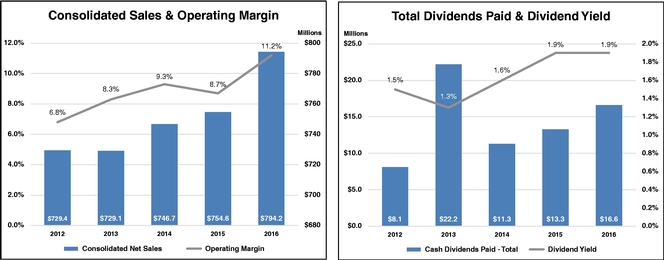

We continue to have strong alignment between our executive compensation and the interests of our stockholders. Fiscal 2016 was a strong year for the Company.

In 2016, the Compensation Committee continued to focus on the alignment of the interests of the NEOs with those of our Company and stockholders, and the Compensation Committee took the following steps for fiscal 2016:

23

As part of its ongoing review of the Company's compensation programs and consistent with its commitment to reflect best practices in corporate governance standards and compensation practices, the Company's Stock Incentive Plan was amended and restated following the approval of our stockholders at the 2015 Annual Meeting of Stockholders. The Compensation Committee and the Company improved, clarified and updated the Stock Incentive Plan as follows: