QuickLinks

-- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ý

|

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to Rule 14a-12 |

o |

|

Confidential, for Use of Commission Only (as permitted by Rule 14a-6(e)(2)) |

ETHAN ALLEN INTERIORS INC.

|

| (Name of Registrant as Specified in its Charter) |

ETHAN ALLEN INTERIORS INC.

|

(Name of Person(s) Filing Proxy Statement)

|

Payment of Filing Fee (Check the appropriate box):

ý |

|

No fee required. |

| o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

5) |

|

Total fee paid:

|

o |

|

Fee paid previously with preliminary materials: |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or

schedule and the date of its filing. |

|

|

1) |

|

Amount Previously Paid:

|

| |

|

2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

3) |

|

Filing Party:

|

| |

|

4) |

|

Date Filed:

|

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

October 1, 2003

Dear

Shareholder:

You are cordially invited to attend the 2003 Annual Meeting of Shareholders of Ethan Allen Interiors Inc. This meeting will be held at the Ethan Allen International Corporate Headquarters,

Ethan Allen Drive, Danbury, Connecticut 06811 at 9:00 A.M. local time, on Monday, November 17, 2003.

You will find information about the meeting in the enclosed Notice and Proxy Statement.

Your vote is very important and we hope you will be able to attend the meeting. To ensure your representation at the meeting, even if you anticipate attending in person, we urge you to mark, sign,

date and return the enclosed proxy card. If you attend, you will, of course, be entitled to vote in person.

Sincerely,

M.

Farooq Kathwari

Chairman of the Board,

Chief Executive Officer and

President

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

NOTICE OF 2003 ANNUAL MEETING OF SHAREHOLDERS

TO

THE SHAREHOLDERS OF

ETHAN ALLEN INTERIORS INC.

The Annual Meeting of Shareholders of Ethan Allen Interiors Inc. will be held at the Ethan Allen International Corporate Headquarters on Monday, November 17, 2003 at 9:00 A.M.,

local time, for the purpose of considering and acting upon the following:

- 1.

- The

election of directors;

- 2.

- Ratification

of the appointment of KPMG LLP as independent auditors for the 2004 fiscal year; and

- 3.

- Such

other business as may properly come before the meeting.

The

Board of Directors has fixed September 26, 2003 as the record date for determining shareholders entitled to notice of and to vote at the meeting. Shareholders are requested to mark, sign,

date and return the enclosed proxy card. An envelope is provided requiring no postage for mailing in the United States. Your prompt response will be appreciated.

October 1,

2003

Ethan Allen Interiors Inc.

Ethan Allen Drive

Danbury, Connecticut 06811

ETHAN ALLEN INTERIORS INC.

Ethan Allen Drive

Danbury, Connecticut 06811

PROXY STATEMENT

The Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board of Directors") of Ethan Allen Interiors Inc., a

Delaware corporation (the "Company"), of proxies for use at the 2003 Annual Meeting of Shareholders of the Company to be held on November 17, 2003 and any adjournment thereof (the "Annual

Meeting"). The Proxy Statement and accompanying form of proxy are first being mailed to shareholders on or about October 1, 2003.

VOTING SECURITIES; PROXIES; REQUIRED VOTE

Voting Securities

The Board of Directors has fixed the close of business on September 26, 2003 as the record date (the "Record Date") for the determination of shareholders

entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, the Company had outstanding 37,250,844 shares of common stock, par value $.01 per share (the "Common Stock"). The

holders of Common Stock are entitled to notice of and to vote at the Annual Meeting. Holders of Common Stock are entitled to one vote per share.

Proxies

M. Farooq Kathwari, Horace G. McDonell and Edward H. Meyer, the persons named as proxies on the proxy card accompanying this Proxy Statement, were selected by the

Board of Directors of the Company to serve in such capacity. Each properly executed and returned proxy will be voted in accordance with the directions indicated thereon, or if no direction is

indicated, such proxy will be voted in accordance with the recommendations of the Board of Directors contained in this Proxy Statement. Each shareholder giving a proxy has the power to revoke it at

any time before the shares it represents are voted. Revocation of a proxy is effective upon receipt by the Secretary of the Company of either (i) an instrument revoking the proxy or

(ii) a duly executed proxy bearing a later date.

Additionally, a shareholder may change or revoke a previously executed proxy by voting in person at the Annual Meeting.

Required Vote

The holders of at least one third of the outstanding shares of Common Stock represented in person or by proxy will constitute a quorum at the Annual Meeting. At

the Annual Meeting, the vote of a majority in interest of the shareholders present in person or by proxy and entitled to vote thereon is required to elect directors and ratify the appointment of KPMG

LLP as the independent auditor of the Company's consolidated financial statements for the fiscal year ending June 30, 2004.

The

election inspectors appointed for the meeting will tabulate the votes cast in person or by proxy at the Annual Meeting and will determine whether or not a quorum is present. The

election inspectors will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum but as unvoted for purposes of determining the approval

of any matter submitted to the shareholders for a vote. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those

shares will not be considered as present and entitled to vote with respect to that matter.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors is presently composed of seven members. The Restated Certificate of Incorporation of the Company divides the Board of Directors into three

classes, with one class of directors elected each year for a three-year term. The term of the directors in one class, which was composed of two directors, expires as of the Annual Meeting.

Frank

G. Wisner is nominated for election at the Annual Meeting, to serve as a director for a three year term. If for any reason Mr. Wisner becomes unable or unwilling to serve at

the time of the meeting, the persons named in the enclosed proxy card will have discretionary authority to vote for a substitute nominee. It is not anticipated that Mr. Wisner will be

unavailable for election.

The

following sets forth information as to Mr. Wisner and each director continuing in office, including his or her age, present principal occupation, other business experience

during the last five years, directorships in other publicly held companies, membership on committees of the Board of Directors and period of service as a director of the Company. William W. Sprague,

whose term expires as of the Annual Meeting is not seeking re-election. The Board of Directors anticipates being able to identify a suitable director shortly.

Nominee for Election at this Meeting to a Term Expiring in 2006

Frank G. Wisner, 65, was elected as a director of the Company on July 23, 2001. He is Vice Chairman,

External Affairs, of American International Group ("AIG"), the leading United States-based international insurance organization. Mr. Wisner is also on the board of directors of EDG Resources.

Prior to joining AIG, he was the United States Ambassador to India from July 1994 through July 1997. He retired from the United States Government with the rank of Career Ambassador, the

highest grade in the Foreign Service. Mr. Wisner joined the State Department as a Foreign Service Officer in 1961 and served in a variety of overseas and Washington positions during his

36-year career. Among his other positions, Mr. Wisner served successively as United States Ambassador to Zambia, Egypt and the Philippines. Before being named United States

Ambassador to India, his most recent assignment was as Under Secretary of Defense for Policy. Prior to that he was Under Secretary of State for International Security Affairs. He is the Chairman of

the Nominations/Corporate Governance Committee.

Directors Whose Present Term will Continue Until 2004

Clinton A. Clark, 61, was elected as a director of the Company on June 30, 1989. He is the President and

sole shareholder of CAC Investments, Inc. ("CAC"), a private investment company he founded in January 1986. Prior to founding CAC, Mr. Clark was Chairman, President and Chief

Executive Officer of Long John Silver's Restaurants, Inc. from 1990 through September 1993 and President and Chief Executive Officer of The Children's Place, a retail children's apparel

chain he founded in 1968. Mr. Clark is also an investor and director of several private companies. He is a member of the Audit Committee, Compensation Committee and Nominations/Corporate

Governance Committee.

Kristin Gamble, 58, was elected as a director of the Company on July 28, 1992. Since 1984, she has been President of Flood, Gamble

Associates, Inc., an investment counseling firm. Ms. Gamble was Senior Vice President responsible for equity strategy and economic research with Manufacturers Hanover Trust Company from

1981 to 1984. Prior to that, she held various management positions with Manufacturers Hanover (1977-1981), Foley, Warendorf & Co., a brokerage firm (1976-1977),

Rothschild, Inc. (1971-1976) and Merrill, Lynch, Pierce, Fenner & Smith (1968-1971). Since May 1995, she has served as a member of the Board of Trustees of

Federal Realty Investment Trust. She is a member of the Audit Committee and the Compensation Committee.

Edward H. Meyer, 76, was elected as a director of the Company on May 30, 1991. He is President, Chairman of the Board, and Chief

Executive Officer of Grey Global Group Inc. ("Grey Global"). Mr. Meyer joined Grey Global in 1956 and in 1964 was appointed Executive Vice President for Account Services. He was

thereafter elected President in 1968 and Chief Executive Officer and Chairman in 1970. Grey Global performs advertising services for Ethan Allen. See "Certain Transactions". Mr. Meyer is a

Director of a number of outside business and financial organizations, including Harman International Industries, Inc. He is Chairman of the Compensation Committee and a member of the

Nominations/Corporate Governance Committee.

2

Directors Whose Present Term Will Continue Until 2005

M. Farooq Kathwari, 59, was elected as a director of Ethan Allen in 1981, was appointed President and Chief

Operating Officer in 1985 and was appointed to the additional position of Chairman and Chief Executive Officer of the Company and Ethan Allen in September 1988. In 1973, Mr. Kathwari

formed a joint venture company called KEA International Inc. ("KEA") with Ethan Allen to develop home furnishings product programs such as lighting, floor coverings, decorative accessories and

other related programs. In 1980, KEA merged with Ethan Allen and Mr. Kathwari joined Ethan Allen as a Vice President responsible for merchandising and international operations. He was promoted

to Senior Vice President in 1981, to Executive Vice President in 1983, and to President in 1985. From 1968 to 1973 he was Vice President of Rothschild, Inc. Mr. Kathwari is a director of

several non-profit organizations, including the American Furniture Manufacturer's Association and the National Retail Federation.

Horace G. McDonell, 74, was elected as a director of the Company on May 30, 1991. He retired as Chairman and Chief Executive

Officer of the Perkin-Elmer Corporation in November 1990. Mr. McDonell served in a number of marketing and executive positions in that company. He was elected President in 1980, Chief

Executive Officer in 1984, and Chairman in 1985. He is a past Chairman of the American Electronics Association and a past director of Danbury Health Systems, Hubbell Incorporated, Uniroyal

Incorporated, Silicon Valley Group Incorporated and ETEC Incorporated. He is Chairman of the Audit Committee and a member of the Nominations/Corporate Governance Committee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEE FOR DIRECTOR NAMED ABOVE, WHICH IS DESIGNATED AS PROPOSAL NO. 1 ON THE ENCLOSED PROXY

CARD.

Meetings and Committees of the Board of Directors

During fiscal year 2003, there were four regularly scheduled meetings of the Board of Directors and three additional meetings where the independent directors met

without management. Average attendance at the aggregate number of Board of Directors and committee meetings was 100% in fiscal year 2003 and no director attended fewer than 100% of the aggregate

number of meetings of the Board of Directors and committees on which he or she served.

The

Board of Directors has established three standing committees, the Audit Committee, the Compensation Committee, and the Nominations/Corporate Governance Committee. Committee

memberships of each nominee and continuing director are set forth in their biographical information above.

Audit Committee

The Audit Committee, among other matters, is responsible for the annual appointment and supervision of the independent public accountants, and reviews the

arrangements for and the results of the auditor's examination of the Company's books and records and auditors' compensation. The Audit Committee also reviews the scope and findings of the Company's

internal auditors. In accordance with Securities and Exchange Commission ("SEC") regulations, the Audit Committee has approved an Audit Committee Charter, describing the responsibilities of the Audit

Committee, a copy of which is attached as an exhibit to this Proxy Statement. Each member of the Audit Committee is independent, as defined in Sections 303.01(B)(2)(a) and (3) of the listing

standards of the New York Stock Exchange (the "NYSE Listing Standards").

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the

financial statements and the reporting

3

process

including the system of internal control. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report with management

including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial

statements.

The

Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on conformity of those audited financial statements with accounting principles

generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of the Company's accounting principles. The Audit Committee also reviewed such other

matters as are required to be discussed under auditing standards generally accepted in the United States of America and the Codification of Statements on Auditing Standards AU 380. In addition, the

Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 and has discussed with the independent

auditors the auditors' independence from management and the Company.

The

Audit Committee discussed with the Company's internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the internal and

independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's system of internal control and the overall quality of the

Company's financial reporting. The Audit Committee held eight meetings during fiscal year 2003, which included, but were not limited to, the review of the quarterly 10-Q filings and annual

10-K filing.

In

reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board of Directors has approved) that the audited

financial statements be included in the Company's Annual Report on Form 10-K for the year ended June 30, 2003 for filing with the SEC. The Audit Committee has also

recommended, to the Board of Directors (and the Board of Directors has approved) subject to shareholder approval, the selection of the Company's independent auditors.

HORACE

G. McDONELL, CHAIRMAN

CLINTON A. CLARK

KRISTIN GAMBLE

WILLIAM W. SPRAGUE

Compensation Committee

The duties of the Compensation Committee are to (i) review and make determinations with regard to the employment arrangements, and compensation for the

Chief Executive Officer, President and Chief Financial Officer or Treasurer and (ii) consider and accept, modify or reject the Chief Executive Officer's recommendations as to incentive

compensation for executives and employees. No member of the Compensation Committee may be an employee of the Company or of Ethan Allen Inc. The Compensation Committee held two meetings in

fiscal year 2003.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Compensation Committee of the Board of Directors is responsible for (i) reviewing and making determinations with regard to the employment arrangements,

and compensation for the Chief Executive Officer, President and Chief Financial Officer or Treasurer and (ii) considering and accepting, modifying or rejecting the Chief Executive Officer's

recommendations as to incentive compensation for executives and employees. The Compensation Committee held two meetings in fiscal year 2003. The Compensation Committee reviews and approves the

remuneration arrangements for the officers and directors of the Company, and reviews and recommends new executive compensation or stock plans in which the officers and/or directors are eligible to

participate, including the granting of stock options and restricted stock awards.

4

General Policies Regarding Compensation of Executive Officers

The Compensation Committee's goals in establishing compensation levels and administering executive compensation plans are (1) to attract and retain high

quality managerial and executive talent, (2) to reward executives for superior performance and (3) to structure appropriate incentives for executives to produce sustained superior

performance in the future. The Company's compensation structure consists of base salary, annual cash bonuses, stock options and restricted stock awards. Generally, in formulating the compensation

arrangements for executives other than the Chief Executive Officer, the Compensation Committee solicits recommendations from its Chief Executive Officer, which it considers, modifies and/or approves.

Salary

The Compensation Committee assesses base salaries of the Chief Executive Officer and Chief Financial Officer or Treasurer at levels that reflect the Compensation

Committee's subjective assessment of prevailing salary levels among the companies with which it believes the Company competes for executive talent, as well as companies in the Company's industry

generally.

Bonuses

For fiscal year 2003, the Company's Compensation Committee maintained a cash bonus program (the "Bonus Program") for managerial employees of the Company. The

Bonus Program had two components: (i) an aggregate of $2,218,500 in cash to be distributed to managerial employees, other than Mr. Kathwari, in amounts recommended by

Mr. Kathwari, and (ii) as to Mr. Kathwari, an amount determined in accordance with the Employment Agreement (defined below). In light of the Company's performance for fiscal year

2003 and in accordance with the bonus formula in the Employment Agreement, the Committee approved a bonus of $1,100,000 for Mr. Kathwari.

Stock Options and Restricted Stock Awards

Stock options granted at 100% of the stock's market value on the date of grant are currently the Company's primary long term compensation vehicle. The

Compensation Committee believes that stock options align the interest of management with those of the Company's shareholders and provide appropriate incentives to motivate executives to provide

increased returns for shareholders.

In

determining the size of individual option grants, and restricted stock awards, the Compensation Committee considers the aggregate number of shares available, which is in turn a

function of the level of shareholders' dilution, the number of shares previously authorized by shareholders remaining available for grants of options and awards and the number of individuals to whom

it wishes to award stock options and restricted stock awards. The Compensation Committee also considers the range of potential compensation levels that may be yielded by the options. Furthermore, the

Compensation Committee considers the size of option grants awarded by those companies with which it believes the Company competes for executives, especially within the home furnishings industry. The

Compensation Committee reserves the discretion to consider any factors it considers relevant, and to give all factors considered the relative weight it considers appropriate under the circumstances

then prevailing, in reaching its determination regarding the size and timing of option grants and restricted stock awards.

Compensation for the Chief Executive Officer

As of July 1, 2002, Mr. Kathwari and the Company entered into a new employment agreement (the "Employment Agreement"). Pursuant to the Employment

Agreement, the Company has agreed to continue to employ Mr. Kathwari as Chairman, Chief Executive Officer and President of the Company and Ethan Allen Inc. for a period of five years

commencing July 1, 2002, with two automatic one-year extensions commencing on each of July 1, 2007, and July 1, 2008 (each, an "Anniversary Date"), unless

5

notice

is given by either Mr. Kathwari or the Company not later than 12 months prior to an Anniversary Date. Pursuant to the terms of the Employment Agreement, Mr. Kathwari will

receive a base salary of $850,000 per year, subject to increase annually upon the review and recommendation of the Compensation Committee, with automatic annual cost-of-living

increases.

Pursuant

to the terms of the Employment Agreement, Mr. Kathwari is entitled to an annual incentive bonus based upon the Company's Operating Income (as described in the Employment

Agreement). If the Company's Operating Income for the fiscal year ending June 30, 2003, is $80 million (the "Threshold") or less, he will receive no incentive bonus. If the Company's

Operating Income for the fiscal year ending June 30, 2003, exceeds the Threshold, his incentive bonus will be equal to 2% of the amount by which Operating Income exceeds the Threshold. The

Threshold will be increased by 10% each year. In addition, in the event the Company consummates a major acquisition, the Company and Mr. Kathwari have agreed that they will negotiate in good

faith for an appropriate revision to the Threshold in order to properly implement its purposes.

Pursuant

to the Employment Agreement, Mr. Kathwari was granted (i) as of August 1, 2002, ten-year stock options to purchase 600,000 shares of Common

Stock, at an exercise price of $31.02 per share (the price of a share of Common Stock on the New York Stock Exchange as of such date), which vest at a rate of 200,000 each year following the date of

grant, up to and including August 1, 2005, (ii) as of August 1, 2003, ten-year stock options to purchase 400,000 shares of Common Stock, at an exercise price of $35.52

per share (the price of a share of Common Stock on the New York Stock Exchange as of such date), which vest at a rate of 200,000 each year following the date of grant, up to and including

August 1, 2005, and (iii) as of August 1, 2004, ten-year stock options to purchase 200,000 shares of Common Stock, at an exercise price per share equal to the price of

a share of Common Stock on the New York Stock Exchange as of such date, which vest on August 1, 2005. All options were granted pursuant to the 1992 Stock Option Plan. All options will become

fully vested upon the occurrence of a Change in Control of the Company (as defined in the Employment Agreement) or in the event that Mr. Kathwari's employment is terminated by the Company

without "cause" or by Mr. Kathwari "for good reason."

Pursuant

to the Employment Agreement, Mr. Kathwari received on July 1, 2002 and July 1, 2003 and will receive on July 1, 2004, 10,500 shares of restricted

stock. The shares of restricted stock vest on the third anniversary of the grant date in accordance with a tiered vesting schedule tied to the Company's total

return to its shareholders as compared to the total return to holders of common stock of the companies which comprise the Standard & Poor's 500. Any shares which do not vest will be forfeited.

As of each dividend record date for the Common Stock occurring on or after the date of any grant of shares of restricted stock, but prior to the date such shares become vested or are forfeited, an

account established by the Company for the benefit of Mr. Kathwari shall be credited with the amount of dividends which would otherwise have been paid with respect to such shares. Amounts

credited to the account shall be credited with interest at the rate of 5% per year until distribution. Mr. Kathwari shall be fully vested in all amounts credited to the account, regardless of

the subsequent vesting or forfeiture of the shares. The balance credited to Mr. Kathwari's account shall be distributed to him in cash as soon as practicable after the termination of his

employment. All shares of restricted stock will become fully vested upon the occurrence of a Change in Control of the Company or in the event that Mr. Kathwari's employment is terminated by the

Company without "cause" or by Mr. Kathwari "for good reason."

Under

his prior employment agreement, the Company established a book account for Mr. Kathwari, which has been credited with 126,000 Stock Units (the "Stock Units"). Following the

termination of Mr. Kathwari's employment, Mr. Kathwari will receive shares of Common Stock equal to the number of Stock Units credited to the account. During the period in which Stock

Units were credited to the account, Mr. Kathwari received dividend equivalent payments in cash equal to the dividends payable on the shares of Common Stock represented by the Stock Units.

6

In

the event Mr. Kathwari's employment with the Company is terminated by reason of death or disability, he (or his estate) will receive his base salary plus his bonus through the

end of the year, along with any deferred compensation, unreimbursed expenses, insurance proceeds and other payments in accordance with Company practices. If Mr. Kathwari's employment is

terminated by the Company without "cause" or by Mr. Kathwari "for good reason", he will receive his base salary through the end of the term of the Employment Agreement and a payment equal to

the lesser of $1 million or the bonus payments for two years calculated by reference to the highest bonus previously paid to him, and he will be entitled to settlement of the stock options,

which are exercisable within three years after termination. If Mr. Kathwari's employment is terminated by the Company for "cause" or voluntarily by Mr. Kathwari, he will receive his base

salary and bonus prorated through the date of termination, along with any deferred compensation, unreimbursed expenses or any other payment in accordance with the practices of the Company. In

connection with each of the foregoing termination payments, Mr. Kathwari will be reimbursed for certain excise and other taxes he is required to pay in respect of such payments.

In

fiscal year 2003, Mr. Kathwari received $850,000 in base salary, which represented a $79,441 increase from the prior fiscal year and was consistent with the terms of the

Employment Agreement. Mr. Kathwari also received an annual incentive bonus in fiscal year 2003 of $1,100,000 and dividend income of $31,500 from the Stock Units. The payment of the incentive

bonus and the dividend income were in accordance with the recommendation and action of the Compensation Committee and the terms of the Employment Agreement. In fiscal year 2002, Mr. Kathwari

received $770,559 in base salary, which represented a $22,779 increase from the prior fiscal year. Mr. Kathwari also received an annual incentive bonus in fiscal year 2002 of $1,575,000 and

dividend income of $18,900 from the Stock Units.

The payment of the incentive bonus and the dividend income were in accordance with the recommendation and action of the Compensation Committee and the terms of the prior employment agreement. In

fiscal year 2001, Mr. Kathwari received $747,780 in base salary, which represented a $20,957 increase from the prior fiscal year. Mr. Kathwari also received an annual incentive bonus in

fiscal year 2001 of $1,642,000, dividend income of $13,440 from the Stock Units and was deemed to have received $390,000 from the vesting of restricted stock. The payment of the incentive bonus and

the dividend income, and the deemed vesting of restricted stock, were in accordance with the recommendation and action of the Compensation Committee and the terms of the prior employment agreement.

The

Employment Agreement is effective through June 30, 2007, although it may be extended for two automatic one-year extensions commencing on each Anniversary Date,

unless notice is given by either Mr. Kathwari or the Company not later than 12 months prior to an Anniversary Date. To assist in developing the terms of the Employment Agreement, the

Compensation Committee retained an independent compensation consultant, and met with such consultant over a period of six months. In determining the level of compensation appropriate for

Mr. Kathwari, the Compensation Committee reviewed employment contracts of chief executive officers in companies in the home furnishings industry of a size and complexity comparable to the

Company. In addition, the Compensation Committee and Mr. Kathwari agreed to include a substantial incentive component in the Employment Agreement. As a result, the large part of

Mr. Kathwari's potential compensation is in the form of stock options, restricted stock awards, and a bonus based on the Company's performance.

Tax Policy

Section 162(m) of the Code limits deductibility of annual compensation in excess of $1 million paid to the Company's Chief Executive Officer and any

of the four other highest paid officers. However, compensation is exempt from this limit if it qualifies as "performance based compensation." In 2001, the Company submitted an amendment to the 1992

Stock Option Plan to shareholders, to allow awards thereunder to qualify under the "performance-based compensation" requirements. The Company has also submitted the incentive performance bonus

provisions of the Employment Agreement to its shareholders

7

to

allow the bonus to comply with the "performance-based compensation" requirements, which was approved and ratified by the shareholders.

Although

the Compensation Committee will continue to consider deductibility under Section 162(m) with respect to future compensation arrangements with executive officers,

deductibility will not be the sole factor used in determining appropriate levels or methods of compensation. Since Company objectives may not always be consistent with the requirements for full

deductibility, the Company may enter into compensation arrangements under which payments are not deductible under Section 162(m).

Conclusion

The Compensation Committee believes that long-term shareholder value is enhanced by corporate and individual performance achievements. Through the

plans described above, a significant portion of the Company's executive compensation is based on corporate and individual performance, as well as competitive pay practices. The Compensation Committee

believes equity compensation, in the form of stock options, restricted stock, and stock units is vital to the long-term success of the Company. The Compensation Committee remains committed

to this policy, recognizing that the competitive market for talented executives and the cyclical nature of the Company's business may result in highly variable compensation for a particular time

period.

EDWARD

H. MEYER, CHAIRMAN

CLINTON A. CLARK

KRISTIN GAMBLE

Nominations/Corporate Governance Committee

The duties of the Nominations/Corporate Governance Committee include but are not limited to the duty to (i) develop qualification criteria for board

members and nominate or recommend to the Board of Directors individuals to serve on the Board of Directors; (ii) review and monitor the Company's corporate governance policies and guidelines,

including the Company's trading policy for its directors and executive officers; and (iii) make an annual assessment of the Board's performance and report to the Board of Directors. No member

of the Nominations/Corporate Governance Committee may be an employee of the Company or of Ethan Allen Inc. The Nominations/Corporate Governance Committee held four meetings in fiscal year 2003.

Director Compensation

For fiscal year 2003, all independent directors (defined in NYSE Listing Standards) received $16,000 per annum and $2,500 per meeting of the Board of Directors

attended in person ($500 per meeting attended by telephone). Each Chairman of a committee who is an independent director received an additional $6,000 per annum. Each independent director received

$1,000 for each committee meeting of the Board of Directors attended in person ($500 per meeting attended by telephone) held on a date on which a meeting of the Board of Directors was not held. In

addition, independent directors are eligible for awards of options and stock appreciation rights under the Company's 1992 Stock Option Plan. Pursuant to the 1992 Stock Option Plan, 3,000 options were

awarded in fiscal 2003 to each independent director. Employee directors do not receive additional compensation for serving on the Board of Directors.

8

Certain Transactions

Clinton A. Clark, Kristin Gamble and Edward H. Meyer served as members of the Compensation Committee of the Board of Directors of the Company for fiscal year

2003. Clinton A. Clark, Kristin Gamble, Horace G. McDonell and William W. Sprague served as members of the Audit Committee of the Board of Directors of the Company for fiscal year 2003. Horace G.

McDonell, Edward H. Meyer and Frank G. Wisner served as members of the Nominations/Corporate Governance Committee of the Board of Directors of the Company for fiscal year 2003. Mr. Meyer is

Chairman and President of Grey Global, which received a fee of approximately $1,361,842 for the performance of advertising services for Ethan Allen in fiscal year 2003.

The

Company is party to indemnification agreements with each of the members of the Board of Directors pursuant to which the Company has agreed to indemnify and hold harmless each

director from liabilities incurred as a result of such director's status as a director of the Company, subject to certain limitations.

Executive Officers

Set forth below is a description of the business experience of each executive officer, other than Mr. Kathwari, of the Company;

Edward Teplitz, 42, has served as General Manager and Vice President, Retail Division since May 2003. He is responsible for

oversight and operation of the Company's retail division. Mr. Teplitz joined the Company in 2001 as Vice President, Finance, later becoming Chief Financial Officer. Prior to joining the Company

he was an Ethan Allen licensee in Pittsburgh, Pennsylvania and Cleveland, Ohio. Prior to that, Mr. Teplitz worked in the corporate finance department of E.F. Hutton & Company and FLIC

(USA), Inc. Mr. Teplitz holds an MBA in Finance from Columbia Business School and a B.S. in Accounting from Wharton School of Finance.

Sandra Lamenza, 55, has served as Vice President Marketing, Retail Division since May 2003. She is responsible for the marketing

programs of the retail stores operated by the Company. Ms. Lamenza started in the training department of Ethan Allen in 1988 and has held various marketing positions.

Craig W. Stout, 53, has served as Vice President, Design and Product Development since August 1995. He is responsible for the

design and development of products sold by the Company. Mr. Stout joined Ethan Allen in 1972 and has held various marketing, merchandising and product development positions.

Nora Murphy, 44, has served as Vice President, Style, since October 2001 and is responsible for coordinating the style,

presentation and design of products sold by the Company. Prior to joining the Company Ms. Murphy owned an interior design firm which performed consulting services on behalf of the Company.

Security Ownership of Common Stock of Certain Owners and Management

The following table sets forth, as of June 30, 2003, except as otherwise noted, information with respect to beneficial ownership of the Common Stock on a

fully-diluted basis in respect of (i) each director and executive officer of the Company named in the table below under "Executive Compensation—Summary Compensation Table",

(ii) all directors and executive officers of the Company as a group and (iii) based on information available to the Company and a review of statements filed with the SEC pursuant to

Section 13(d) and 13(g) of the Securities Act of 1934, as amended (the "Exchange Act"), each person or entity that beneficially owned (directly or together with affiliates) more than 5% of the

Common Stock.

9

The

Company believes that each individual or entity named has sole investment and voting power with respect to shares of Common Stock indicated as beneficially owned by them, except as otherwise

noted.

Name and Address of

Beneficial Owner

|

|

Shares

Beneficially Owned(1)

|

|

Common Stock

Percentage Ownership(1)

|

|

| Directors and Executive Officers: |

|

|

|

|

|

| M. Farooq Kathwari(2) |

|

4,346,494 |

|

10.96 |

% |

| Edward H. Meyer(3) |

|

78,860 |

|

* |

|

| Horace G. McDonell(4) |

|

58,000 |

|

* |

|

| Kristin Gamble(5) |

|

41,800 |

|

* |

|

| Sandra Lamenza(6) |

|

27,497 |

|

* |

|

| Craig W. Stout(7) |

|

22,085 |

|

* |

|

| Clinton A. Clark(8) |

|

19,500 |

|

* |

|

| William W. Sprague (9) |

|

19,000 |

|

* |

|

| Edward Teplitz(10) |

|

14,000 |

|

* |

|

| Nora Murphy(11) |

|

5,500 |

|

* |

|

| Frank G. Wisner(12) |

|

5,000 |

|

* |

|

All executive officers and directors as a group(2)(3)(4)(5)(6)(7)(8) (9)(10)(11)(12) |

|

4,637,736 |

|

11.64 |

% |

Other Principal Shareholders: |

|

|

|

|

|

| Ruane, Cunniff & Co., Inc.(13) |

|

5,757,486 |

|

15.46 |

% |

| Baron Capital Group, Inc.(14) |

|

2,999,400 |

|

8.05 |

% |

- *

- Indicates

beneficial ownership of less than 1% of shares of Common Stock.

- (1)

- Information

presented herein reflects share ownership on a fully-diluted basis and assumes outstanding options and other stock based compensation awards granted under the 1992 Stock

Option Plan (the "Stock Options") and under the Incentive Stock Option Plan (the "Incentive Options") are exercised, whether or not currently vested, earned or exercisable.

- (2)

- Includes

(a) 1,705,928 shares owned directly by Mr. Kathwari (including 21,000 restricted shares); (b) options to purchase 2,400,050 shares of Common Stock;

(c) 235,954 shares issued upon the exercise of stock options, which are included in Mr. Kathwari's direct holdings, but as to which delivery of the shares has been deferred;

(d) 4,562 shares held directly by Mr. Kathwari in the Ethan Allen Retirement Savings Plan. Mr. Kathwari's address is Ethan Allen Drive, Danbury, Connecticut 06811.

- (3)

- Includes

(a) 47,360 shares owned directly by Mr. Meyer and (b) options to purchase 31,500 shares of Common Stock. Mr. Meyer's address is Ethan Allen Drive,

Danbury, Connecticut 06811.

- (4)

- Includes

(a) 26,500 shares owned directly by Mr. McDonell and (b) options to purchase 31,500 shares of Common Stock. Mr. McDonell's address is Ethan Allen

Drive, Danbury, Connecticut 06811.

- (5)

- Includes

(a) 10,300 shares owned directly by Ms. Gamble and (b) options to purchase 31,500 shares of Common Stock. Ms. Gamble's address is Ethan Allen

Drive, Danbury, Connecticut 06811.

- (6)

- Includes

(a) 583 shares owned directly owned by Ms. Lamenza; (b) options to purchase 26,800 shares of Common Stock; and (c) 114 shares held directly by

Ms. Lamenza in the Ethan Allen Retirement Savings Plan. Ms. Lamenza's address is Ethan Allen Drive, Danbury, Connecticut 06811.

- (7)

- Includes

(a) options to purchase 21,550 shares of Common Stock and (b) 535 shares held directly by Mr. Stout in the Ethan Allen Retirement Savings Plan.

Mr. Stout's address is Ethan Allen Drive, Danbury Connecticut 06811.

10

- (8)

- Includes

options to purchase 19,500 shares of Common Stock. Mr. Clark's address is Ethan Allen Drive, Danbury, Connecticut 06811.

- (9)

- Includes

(a) 13,000 shares owned directly by Mr. Sprague and (b) options to purchase 6,000 shares of Common Stock. Mr. Sprague's address is Ethan Allen

Drive, Danbury, Connecticut 06811.

- (10)

- Includes

options to purchase 14,000 shares of Common Stock. Mr. Teplitz's address is Ethan Allen Drive, Danbury, Connecticut 06811

- (11)

- Includes

options to purchase 5,500 shares of Common Stock. Ms. Murphy's address is Ethan Allen Drive, Danbury, Connecticut 06811.

- (12)

- Includes

options to purchase 5,000 shares of Common Stock. Mr. Wisner's address is Ethan Allen Drive, Danbury, Connecticut 06811.

- (13)

- As

of February 14, 2003, Ruane, Cunniff & Co., Inc. ("RCC"), a broker/dealer registered under the Exchange Act and an investment advisor registered under the

Investment Advisors Act of 1940, beneficially owned 5,757,486 shares of Common Stock. RCC has (i) sole voting power with respect to 3,489,542 shares of Common Stock, (ii) sole

dispositive power with respect to 5,757,486 shares of Common Stock and (iii) shared dispositive power with respect to none of the shares of Common Stock. The address of RCC is 767 Fifth Avenue,

New York, New York 10153.

- (14)

- As

of February 14, 2003, Baron Capital Group, Inc. ("BCG") and Ronald Baron ("RB"), each a parent holding company, in accordance with

Section 13d-1(b)(ii)(G) of the Exchange Act, beneficially owned 2,999,400 shares of Common Stock. Such shares are held by their controlled entities or the investment advisory

clients thereof. BCG and RB have (i) sole voting power with respect to 240,000 shares of Common Stock, (ii) shared voting power with respect to 2,759,400 shares of Common Stock,

(iii) sole dispositive power with respect to 240,000 shares of Common Stock and (iv) shared dispositive power with respect to 2,759,400 shares of Common Stock. The address of BCG and RB

is 767 Fifth Avenue, New York, New York 10153.

11

PROPOSAL 2

RATIFICATION OF THE APPOINTMENT OF AUDITOR

Subject to shareholder ratification, the Board of Directors has appointed KPMG LLP as the independent auditors of the Company for the fiscal year ending

June 30, 2004. KPMG LLP was the independent auditor for the Company for the fiscal year ended June 30, 2003. Representatives of KPMG LLP will be present at the Annual Meeting and will be

given the opportunity to make a statement if they so desire. They will also be available to respond to appropriate questions.

The

following table represents a summary of professional fees billed by KPMG LLP for services rendered in connection with (i) the audit for the Company's annual financial

statements for the fiscal years ended June 30, 2003 and 2002, and (ii) other matters.

|

|

2003

|

|

2002

|

| Audit fees |

|

$ |

411,400 |

|

$ |

379,250 |

| Audit-related fees(1) |

|

|

20,000 |

|

|

20,000 |

| Tax fees(2) |

|

|

46,757 |

|

|

29,400 |

| All other fees |

|

|

— |

|

|

— |

| |

|

|

|

|

| Total fees |

|

$ |

478,157 |

|

$ |

428,650 |

| |

|

|

|

|

- (1)

- Audit-related

fees consist of fees incurred in connection with the annual audit of the Ethan Allen Retirement Savings Plan.

- (2)

- Tax

fees consist of fees incurred in connection with tax compliance and tax planning services.

There

were no fees incurred related to financial information design and implementation. The Audit Committee has determined that the provision of tax and other services by the independent

auditors is compatible with maintaining their independence.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS INDEPENDENT AUDITOR FOR THE COMPANY FOR THE FISCAL YEAR ENDING

JUNE 30, 2004, WHICH IS DESIGNATED AS PROPOSAL NO. 2 ON THE ENCLOSED PROXY CARD.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth, as to the Chief Executive Officer and the four most highly compensated officers other than the Chief Executive Officer,

information concerning all cash compensation paid or accrued for services rendered in all capacities to the Company during the fiscal years ended June 30, 2003,

12

2002

and 2001. For a description of the terms of employment agreements, option and restricted stock grants for the listed officers, see pages 4 through 13.

|

|

|

|

|

|

|

|

Long Term

Compensation Awards

|

|

|

|

|

Annual Compensation

|

|

|

|

Securities

Underlying

Options/Warrants

Granted

|

|

|

Name and Principal Position

|

|

Restricted

Stock

Awards

|

|

All other

Compensation(1)

|

| |

Year

|

|

Salary

|

|

Bonus

|

M. Farooq Kathwari

Chairman of the Board of Directors, President and Chief Executive Officer |

|

2003

2002

2001 |

|

$

|

850,000

770,559

747,780 |

|

$

|

1,100,000

1,575,000

1,642,000 |

|

10,500

—

12,000 |

|

600,000

—

— |

|

$

|

32,500

19,900

404,440 |

Sandra Lamenza

Vice President Marketing, Retail Division |

|

2003

2002

2001 |

|

|

204,230

190,769

180,673 |

|

|

35,000

105,000

70,000 |

|

—

—

— |

|

7,000

3,000

— |

|

|

1,000

1,000

1,000 |

Edward Teplitz(2)

General Manager and Vice President, Retail Division |

|

2003

2002

2001 |

|

|

197,116

144,711

— |

|

|

125,000

100,000

— |

|

—

—

— |

|

7,000

7,000

— |

|

|

1,000

—

— |

Craig W. Stout

Vice President, Design and Product Development |

|

2003

2002

2001 |

|

|

185,000

185,000

180,673 |

|

|

80,000

85,000

70,000 |

|

—

—

— |

|

1,500

1,500

— |

|

|

1,000

1,000

1,000 |

Nora Murphy(2)

Vice President, Style |

|

2003

2002

2001 |

|

|

157,308

112,500

— |

|

|

70,000

60,000

— |

|

—

—

— |

|

2,000

3,500

— |

|

|

—

—

— |

- (1)

- Includes

contributions by Ethan Allen of $1,000 each pursuant to the Ethan Allen Retirement Savings Plan for fiscal years 2003, 2002, and 2001. In addition, Mr. Kathwari's

compensation for fiscal year 2003 includes $31,500 from dividends on Stock Units.

- (2)

- Mr. Teplitz

and Ms. Murphy joined the Company during fiscal year 2002 and thus no information is available for fiscal year 2001.

Incentive Stock Option Grants During Fiscal Year 2003

The following table sets forth information concerning grants of options to the named executive officers during the fiscal year ended June 30, 2003.

|

|

Individuals Grants (1)

|

|

|

|

|

|

|

Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term

|

|

|

Number

of Shares

Underlying

Options

Awarded

|

|

% of Total

Options

Awarded to

Employees in

Fiscal Year

|

|

|

|

|

Securities Awarded to

|

|

Exercise or

Base Price

Per share

|

|

Expiration

Date(2)

|

| |

5%

|

|

10%

|

| M. Farooq Kathwari |

|

600,000 |

|

86.4 |

% |

31.02 |

|

8/1/12 |

|

$ |

10,261,321 |

|

$ |

25,274,122 |

| Sandra Lamenza |

|

7,000 |

|

1.0 |

% |

29.55 |

|

4/14/13 |

|

|

114,042 |

|

|

280,891 |

| Edward Teplitz |

|

7,000 |

|

1.0 |

% |

29.55 |

|

4/14/13 |

|

|

114,042 |

|

|

280,891 |

| Craig W. Stout |

|

1,500 |

|

0.2 |

% |

29.55 |

|

4/14/13 |

|

|

24,438 |

|

|

60,191 |

| Nora Murphy |

|

2,000 |

|

0.3 |

% |

29.55 |

|

4/14/13 |

|

|

32,583 |

|

|

80,255 |

- (1)

- All

Stock options reported in this table were granted pursuant to the 1992 Stock Option Plan—see "Employee Stock Plans".

- (2)

- Expires

the earlier of the date indicated or 90 days after the participants' employment with the Company is terminated for any reason.

13

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Options/Warrants Values

The following table sets forth information concerning the number of unexpired Incentive Options and Stock Options outstanding as of the end of fiscal year 2003,

and the value of any unexercised in-the-money Incentive Options and Stock Options outstanding at such time (assuming a stock price of $35.16 per share at June 30, 2003),

held by the named executive officers.

|

|

Shares Acquired

on Exercise

|

|

Value

Realized

|

|

Number of Securities

Underlying Unexercised

Incentive Options

and 1992 Stock Options at June 30, 2003

Exercisable/Unexercisable

|

|

Value of

Unexercised In-the-Money

Incentive Options

and 1992 Stock Options at June 30, 2003

Exercisable/Unexercisable

|

| M. Farooq Kathwari |

|

|

|

|

|

|

|

|

|

| |

Exercisable |

|

75,000 |

|

2,313,375 |

|

2,400,037 |

|

$ |

42,144,226 |

| |

Unexercisable |

|

— |

|

— |

|

600,013 |

|

|

2,484,132 |

| Sandra Lamenza |

|

|

|

|

|

|

|

|

|

| |

Exercisable |

|

— |

|

— |

|

16,912 |

|

|

303,269 |

| |

Unexercisable |

|

— |

|

— |

|

9,888 |

|

|

45,752 |

| Edward Teplitz |

|

|

|

|

|

|

|

|

|

| |

Exercisable |

|

— |

|

— |

|

1,750 |

|

|

10,378 |

| |

Unexercisable |

|

— |

|

— |

|

12,250 |

|

|

70,403 |

| Craig W. Stout |

|

|

|

|

|

|

|

|

|

| |

Exercisable |

|

3,000 |

|

91,275 |

|

18,412 |

|

|

332,068 |

| |

Unexercisable |

|

— |

|

— |

|

3,138 |

|

|

13,627 |

| Nora Murphy |

|

|

|

|

|

|

|

|

|

| |

Exercisable |

|

— |

|

— |

|

875 |

|

|

0 |

| |

Unexercisable |

|

— |

|

— |

|

4,625 |

|

|

11,220 |

14

Employee Stock Plans

The Company has issued options to purchase shares of Common Stock pursuant to the 1992 Stock Option Plan and the Incentive Stock Option Plan. See Note 11

to "Notes to Consolidated Financial Statements" in the Company's Annual Report as of June 30, 2003 filed on Form 10-K. The Company has registered shares of Common Stock

issuable upon exercise of such options in the near future.

The Ethan Allen Retirement Savings Plan

Ethan Allen established the Ethan Allen Profit Sharing and 401(k) Retirement Plan (the "Plan"), now known as the Ethan Allen Retirement Savings Plan, effective

July 1, 1994 as a result of the merger of the Profit Sharing and 401(k) Plans. The Plan covers all employees who have completed at least three months of service.

The

401(k) aspect of the Plan allows participants to defer up to 100% of their compensation, subject to certain statutory limitations. The Company may, at its discretion, fully match the

first $500 of a participant's before tax contribution and one-half of the next $1,000 of a participant's before tax contribution, up to a maximum of $1,000 each year. Except as otherwise

noted in the Summary Compensation Table, during each of the fiscal years 2003, 2002, and 2001, the Company made a contribution of $1,000 to the 401(k) aspect of the Plan for each of the above named

executive officers. Participant contributions and employer 401(k) contributions are immediately and fully vested.

The

Profit Sharing portion of the Plan is a defined contribution plan. Contributions to the Plan can only be made by the Company and are at the discretion of the Company. Contributions

are allocated among, all members in the same ratio as their covered remuneration bears to that of all members.

The

Plan is the primary vehicle for providing retirement income to Ethan Allen employees.

The

Plan is administered by Ethan Allen Inc. with J.P. Morgan as Investment Manager and Recordkeeper. Investments offered include a stable asset fund, seven mutual funds, three

strategic

allocation funds, employer common stock, a bond fund and a personal choice option. The investments are employee directed and qualify under Section 404c of the Internal Revenue Code (the

"Code").

As

of June 30, 2003, the estimated net present aggregate value of Company contributions to the retirement programs for the above named executive officers were: M. Farooq Kathwari

$14,184.17, Sandra Lamenza $6,117.46, Craig W. Stout $12,897.30, Edward Teplitz $1,152.65.00 and Nora Murphy $0.00.

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors; some over 10% owners of our common shares, and some

persons who formerly were directors, executive officers, or over 10% owners, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and the New York Stock

Exchange and furnish us with a copy of each report filed. Based solely on our review of copies of the reports by some of those persons and written representation from others that no reports were

required, we believe that during fiscal 2003 all Section 16(a) filing requirements were complied with in a timely fashion except that all officers required to fill Form 5s filed late due

to the blackout of August 14 and 15, 2003.

15

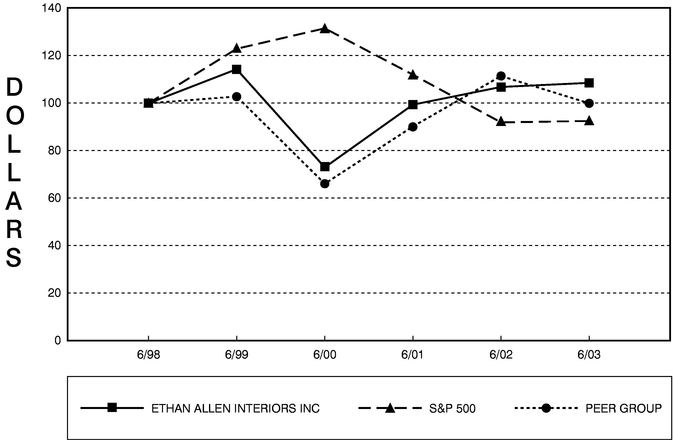

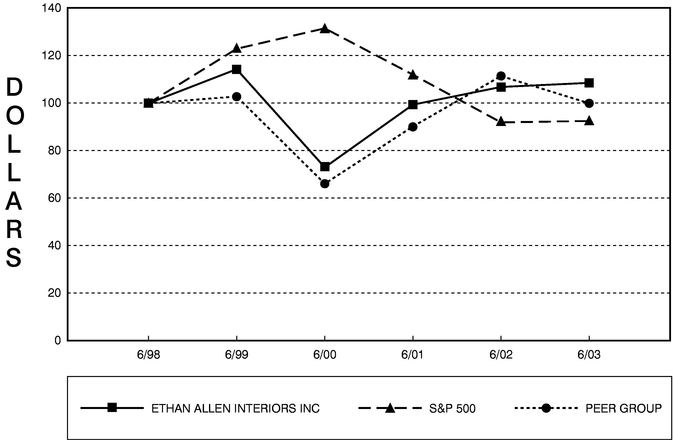

Comparative Company Performance

The following line graph compares cumulative total shareholder return for the Company with a performance indicator of the overall stock market, the

Standard & Poor's 500 Index, and an industry index, the Peer Issuer Group Index, assuming $100 was invested on June 30, 1998.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG ETHAN ALLEN INTERIORS INC., THE S&P 500 INDEX

AND A PEER GROUP

|

|

6/98

|

|

6/99

|

|

6/00

|

|

6/01

|

|

6/02

|

|

6/03

|

| Ethan Allen Interiors Inc. |

|

100.00 |

|

114.02 |

|

72.90 |

|

99.26 |

|

106.91 |

|

108.66 |

| S & P 500 |

|

100.00 |

|

122.76 |

|

131.66 |

|

112.13 |

|

91.96 |

|

92.19 |

| Peer Issuer Group |

|

100.00 |

|

102.95 |

|

66.00 |

|

89.82 |

|

111.08 |

|

99.97 |

- *

- $100

INVESTED ON 6/30/98 IN STOCK OR INDEX—INCLUDING REINVESTMENT OF DIVIDENDS. FISCAL YEAR ENDING JUNE 30, 1998.

- (1)

- Standard &

Poor's 500 Index

- (2)

- Peer

Issuer Group which includes Bassett Furniture Industries, Inc., Bush Industries, Inc., Chromcraft Revington, Inc., DMI Furniture, Inc., Flexsteel

Industries, Inc., Furniture Brands International, Inc., Haverty Furniture Companies, Inc., La-Z Boy Inc., Legett & Platt, Inc., and Pier 1

Imports Inc.

The

returns of each company have been weighted according to each Company's market capitalization.

16

OTHER MATTERS

Proxy Solicitation Expense

The expense of the proxy solicitation will be paid by the Company. In addition to the solicitation of proxies by use of the mails, solicitation also may be made

by telephone, telegraph or personal interview by directors, officers and regular employees of the Company, none of whom will receive additional compensation for any such solicitation. The Company has

engaged Morrow & Company, a professional proxy solicitation firm, to provide customary solicitation services for a fee $4,000 plus expenses. The Company does not anticipate that the costs and

expenses incurred in connection with this proxy solicitation will exceed those normally expended for a proxy solicitation for those matters to be voted on in the Annual Meeting. The Company will, upon

request, reimburse brokers, banks and similar

organizations for out-of-pocket and reasonable clerical expenses incurred in forwarding proxy material to their principals.

Shareholder Proposals

Proposals of shareholders must be received in writing by the Secretary of the Company no later than 120 days in advance of the first anniversary of the

date of the mailing of this proxy statement in order to be considered for inclusion in the Company's proxy statement and form of proxy relating to the 2004 Annual Meeting of Shareholders.

If

a shareholder desires to submit a proposal for consideration at the 2004 Annual Meeting of Shareholders, written notice of such shareholder's intent to make such a proposal must be

given and received by the Secretary of the Company at the principal executive offices of the Company either by personal delivery or by United States mail not later than June 1, 2004. Each

notice must describe the proposal in sufficient detail for the proposal to be summarized on the agenda for the 2004 Annual Meeting of Shareholders and must set forth: (i) the name and address,

as it appears on the books of the Company, of the shareholder who intends to make the proposal; (ii) a representation that the shareholder is a holder of record of stock of the Company entitled

to vote at such meeting and intends to appear in person or by proxy at such meeting to present such proposal; and (iii) the class and number of shares of the Company which are beneficially

owned by the shareholder. In addition the notice must set forth the reasons for conducting such proposed business at the 2004 Annual Meeting of Shareholders and any material interest of the

shareholder in such business. The presiding officer of the 2004 Annual Meeting of Shareholders will, if the facts warrant, refuse to acknowledge a proposal not made in compliance with the foregoing

procedure, and any such proposal not properly brought before the 2004 Annual Meeting of Shareholders will not be considered.

Any

proposals to be submitted that do not comply with Rule 14a-8 promulgated under the Exchange Act may be omitted. Any Shareholder proposal for the 2004 Annual

Meeting of Shareholders submitted outside the submission date will be deemed untimely for purposes of Rule 14a-4(c)(i). Proxies for that meeting may confer discretionary authority

to vote on untimely proposals without express direction from the shareholders giving the proxies.

We will send you a copy of our Annual Report on Form 10-K for the fiscal year ended June 30, 2003 without charge if you send a written

request to Office of the Secretary, Ethan Allen Interiors Inc., Ethan Allen Drive, Danbury, CT 06811. You can also obtain copies of our Form 10-K and any other reports we

file with the SEC, or any of our committee charters, on our website at www.ethanallen.com or through the SEC's website at www.sec.gov.

Other Business

The Board of Directors is not aware of any matters to be presented at the Annual Meeting other than those enumerated in the Company's Notice enclosed herewith. If

any other matters do come before the meeting, it is intended that the holders of the proxies will vote thereon in their discretion. Any such other

17

matters

will require for its approval the affirmative vote of the majority in interest of the shareholders present in person or by proxy at the Annual Meeting where a quorum is present, or such

greater vote as may be required by the Company's Restated Certificate of Incorporation, the Company's Amended and Restated By-laws or the General Corporation Law of the State of Delaware.

Ethan

Allen Interiors Inc.

Ethan Allen Drive

Danbury, Connecticut 06811

October 1, 2003

Each

shareholder, whether or not he or she expects to be present in person at the Annual Meeting, is requested to MARK, SIGN, DATE and RETURN THE ENCLOSED PROXY CARD in the accompanying envelope as promptly as possible. A shareholder may revoke his or her proxy at any time prior to

voting.

18

Ethan Allen Interiors Inc.

Board of Directors

AUDIT COMMITTEE CHARTER

Purpose

The Audit Committee, which shall consist of no fewer than three members appointed by the Board to monitor (1) the integrity of the Company's financial

statements, (2) the compliance by the Company with legal and regulatory requirements, (3) the qualifications, independence and performance of the independent auditors, and (4) the

performance of the Company's internal audit function.

Statement of Policy

The Audit Committee shall provide assistance to the Board of Directors in fulfilling their oversight responsibility relating to the Company's financial statements

and the financial reporting process, the system of internal accounting and financial controls, the internal audit function and the annual independent audit of the Company's financial statements. In so

doing, it is the responsibility of the Committee to maintain free and open communication between the Committee, independent auditors, the internal auditors and management of the Company. In

discharging its oversight role, the Committee is empowered full access to all books, records, facilities, and personnel of the Company.

Committee Membership

The members of the Audit Committee shall meet the independence, experience and financial expertise requirements of the New York Stock Exchange and Section 10A of

the Securities Exchange Act of 1934, as amended by the Sarbanes-Oxley Act of 2002 and the rules promulgated thereunder.

Directors'

fees (including any committee fees) shall be the only compensation that an Audit Committee member may receive from the Company. The members of the Audit Committee shall serve

until successors are appointed and qualify. The Board shall designate the Chairman of the Audit Committee.

The

Board shall have the power at any time to change the membership of the Audit Committee and to fill vacancies in it, subject to such new member(s) satisfying the independence,

experience and financial expertise requirements.

Authority and Responsibilities

The Audit Committee shall have a clear understanding with management and the independent auditors that the independent auditors are ultimately accountable to the

Board and the Audit Committee, as representative of the Company's shareholders.

The

Audit Committee shall discuss with the auditors their independence from management and the Company and the matters included in the written disclosures required by the Independence

Standards Board, and shall obtain and review a report by the independent auditor describing the firm's internal quality control procedures and any material issues raised by the most recent internal

quality-control review, and steps taken to deal with any such issues.

The

Audit Committee shall have the sole authority to appoint or replace the registered public accountants subject, if applicable, to shareholder ratification, and shall approve all audit

engagement fees and terms, and all non-audit engagements. The Audit Committee shall consult with management, but shall not delegate their responsibilities, except that pre-approval of non-audit

services may be delegated to the Chairman of the Audit Committee.

The

Audit Committee shall be directly responsible for the compensation and oversight over the work of the registered public accounting firm (including resolution of any disagreement

between management

A-1

and

the public accounting firm regarding financial reporting) for the purpose of preparing or issuing an audit report or related work, and the public accounting firm shall report directly to the Audit

Committee.

The

Audit Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee and carry out its duties, and to conduct or authorize

investigations into any

matters within its scope of responsibilities. The Audit Committee shall meet periodically with management, the internal auditors, and registered public accountants in separate executive sessions in

furtherance of its purposes.

The

Audit Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any

members of, or consultants to, the Committee.

The

Audit Committee shall make regular reports to the Board at least once each fiscal year. In performing its oversight function, the Audit Committee, either as a whole or through its

chairman, as the committee shall authorize from time to time, shall undertake those tasks and responsibilities that, in its judgment, would most effectively contribute and implement the purposes of

the Audit Committee. The following functions are some of the common recurring activities that the Audit Committee may undertake in carrying out its oversight responsibilities:

- •

- Review

with the independent accountants and management the proposed scope of the annual audit, past audit experience, the Company's internal audit program, recently

completed internal audits, and other matters bearing upon the scope of the audit, and review any audit problems or difficulties and management's response.

- •

- Review

the annual audited financial statements with management, including major issues regarding accounting and auditing principles and practices including any significant

changes in the Company's selection or application of accounting principles, as well as the adequacy of internal controls that could significantly affect the Company's financial statements, and

recommend to the Board whether the audited financial statements should be included in the Company's Form 10-K.

- •

- Review

any analysis prepared by management and/or the independent auditor of significant financial reporting issues and judgments made in connection with the preparation of

the Company's financial statements and any other significant matters revealed in the course of the audit of the annual financial statements of the Company.

- •

- Discuss,

in general terms, the material content of earnings press releases and financial information and earnings guidance provided to analysts and rating agencies.

- •

- Review

with management and the independent auditor the Company's quarterly financial statements prior to the filing of its Form 10-Q and the Company's Annual Report on Form

10-K, including their judgment about the quality, not just acceptability, of accounting principals, the reasonableness of significant judgments, and the clarity of the disclosures in the financial

statements including the "Management's Discussion and Analysis of Financial Condition and Results of Operations", and the matters required to be disclosed pursuant to Auditing Standards No. 61, prior

to filing of its Form 10-Q, including the results of the registered public accountants' review of the quarterly financials to the extent applicable.

- •

- Meet

periodically with management to review the Company's major financial risk exposures and the steps management has taken to monitor and control such exposures.

- •

- Provide

procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and

for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

A-2

- •

- Review

and approve the report required by the rules of the Securities and Exchange Commission to be included in the Company's annual proxy statement, and annual

certifications to the New York Stock Exchange.

- •

- Annually

review and reassess the Audit Committee's performance and the adequacy of this Charter and recommend any proposed changes to the Charter to the Board for approval.

- •

- Perform

any other activities consistent with this Charter, the Company's by-laws, and governing law, as the Committee or the Board deems necessary or appropriate.

- •

- Review

and discuss with management and the registered public accountants the adequacy of the Company's internal controls and special audit steps adopted in light of material

control deficiencies.

- •

- Obtain

and review a report from the public accountants at least annually regarding (a) the registered public accountants' internal quality control procedures, (b) any

material issues raised by the most recent quality control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five

years respecting one or more independent audits carried out by the firm, (c) any steps taken to deal with any such issues, and (d) all relationships between the public accountants and the Company.

Evaluate the qualifications, performance and independence of the public accountants, including a review and evaluation of the lead partner of the registered public accountant and taking into account

the opinions of management and the Company's internal auditors.

- •

- Ensure

that the lead audit partner of the public accountants and the audit partner responsible for reviewing the audit are rotated at least every five years as required by

the Sarbanes-Oxley Act of 2002.

- •

- Recommend

to the Board policies for the Company's hiring of employees or former employees of the public accountants who were engaged on the Company's account (recognizing

that the Sarbanes-Oxley Act of 2002 does not permit the CEO, controller, CFO or chief accounting officer to have participated in the Company's audit as an employee of the public accountants during the

preceding one-year period).

- •

- Discuss

with management and the public accountants any accounting adjustments that were noted or proposed by the registered public accountants.

- •

- Discuss

with the public accountants the internal audit department and its audit plan, responsibilities, budget and staffing.

- •

- Review

disclosures made by the Company's principal executive officer or officers and principal financial officer or officers regarding compliance with their certification

obligations as required under the Sarbanes-Oxley Act of 2002 and the rules promulgated thereunder, including the Company's disclosure controls and procedures and internal controls for financial

reporting and evaluations thereof.

- •

- Review

any reports of the registered public accountants mandated by Section 10A of the Securities Exchange Act of 1934, as amended, and obtain from the registered public

accountants any information with respect to illegal acts in accordance with Section 10A.

While