SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant þ

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| þ | Soliciting Material Under Rule 14a-12 |

Ethan Allen Interiors Inc.

(Name of Registrant as Specified In Its Charter)

Sandell Asset Management Corp.

Castlerigg Master Investments Ltd.

Castlerigg International Limited

Castlerigg International Holdings Limited

Castlerigg Offshore Holdings, Ltd.

Castlerigg Active Investment Fund, Ltd.

Castlerigg Active Investment Intermediate Fund, L.P.

Castlerigg Active Investment Master Fund, Ltd.

Castlerigg Equity Event and Arbitrage Fund

Thomas E. Sandell

Edward Glickman

Kathy Herbert

Richard Mansouri

Annelise Osborne

Ken Pilot

Alex Wolf

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act | |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

November 12, 2015

Dear Fellow Stockholder of Ethan Allen:

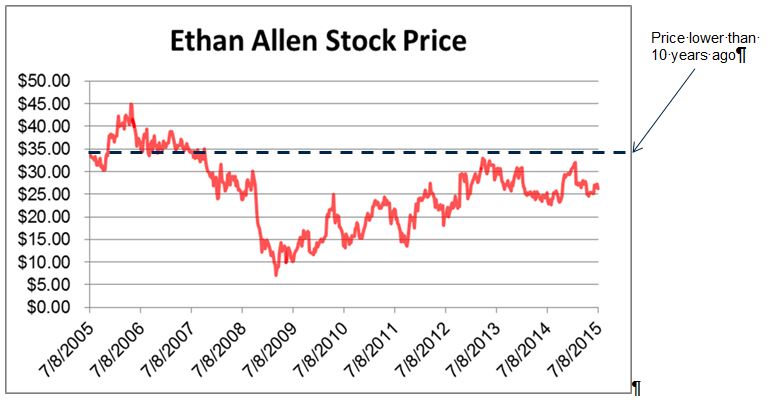

We are investors, like yourselves, in Ethan Allen Interiors Inc. (“Ethan Allen” or the “Company”) (NYSE: ETH). Our firm, Sandell Asset Management Corp. (“Sandell”), is one of the Company’s largest stockholders, having spent well over $40 million of our investors’ money to acquire over 1.5 million shares, or 5.5%, of the total outstanding shares of Ethan Allen. We believe that Ethan Allen shares are worth far more than where they are trading and we are highly concerned by the woeful stock price performance of the Company. As the following graph illustrates, the shares of Ethan Allen are trading below where they were trading 10 years ago:

Source: Bloomberg (as of 7/8/15, the day prior to media reports of private equity interest)

We have sought to engage in dialogue with Ethan Allen in the hopes of devising a strategy that would result in better performance and better stockholder returns for the Company going forward. However, Farooq Kathwari, the Company’s Chairman, CEO and President, has rejected any attempt at reaching a constructive mutual solution aimed at increasing stockholder value.

The Nominees

In order to help address the many problems that have plagued Ethan Allen for so long, we have identified an outstanding group of six highly-qualified individuals that we have nominated as candidates for the Board of Ethan Allen, and we encourage stockholders to vote on the GOLD proxy card in favor of these individuals. The following candidates can bring fresh perspective and new ideas to the Company, with the goal of implementing a comprehensive action plan in order to enhance stockholder value:

Setting the Record Straight

In a sign of growing desperation, Ethan Allen has sought to portray the preceding nominees as inexperienced when in reality these candidates clearly have the expertise and highly-relevant skills that are desperately needed at Ethan Allen. You may have seen certain material sent to you by Ethan Allen, including an Investor Presentation dated November 4, 2015 and a Stockholder Presentation dated November 9, 2015, along with a letter to stockholders dated November 9, 2015. We believe this material contains numerous distortions, half-truths, and

false statements reflecting the Company’s desperate attempt to distort the facts in the days leading up to Ethan Allen’s 2015 Annual Meeting, which is scheduled for November 24.

False Statement #1 – “Ethan Allen has six independent directors”

Truth – We believe that Ethan Allen is distorting the truth by claiming that six of its directors are “independent.” We reject in the strongest terms the notion that many of Ethan Allen’s directors are independent and believe that the Board of Directors (the “Board”) is in fact rife with conflicted individuals:

False Statement #2 - “The

Company’s stock price has traded in line with its peers”

____________________

[1] http://www.wsj.com/articles/ethan-allens-chief-in-fight-of-his-life-1447184156

Truth – Ethan Allen stockholders have suffered material and sustained stock price underperformance versus a host of its peers as well as the general market over almost every time period analyzed.

False Statement #3 – “Sandell has presented no credible plan or analysis to create value for all stockholders”

Truth – Sandell has presented a comprehensive action plan on pages 46 through 60 in its presentation entitled “Re-Design Ethan Allen: The Case, Candidates and Plan for Change,” which can be found at:

http://www.redesignethanallen.com/content/uploads/2015/11/CaseforChange.pdf

False Statement #4 – “Dividends are quicker and more certain return than share repurchases”

Truth – It is a mathematical fact that every share repurchased at a discount to intrinsic value increases the per share intrinsic value of the remaining shares:

False Statement #5 – Ethan Allen practices “good corporate governance”

Truth – We believe that the many issues plaguing the Company and ultimately responsible for its poor stock price performance can be traced to one root cause, namely poor corporate governance:

| • | Ethan Allen has a stale board whose average Director tenure prior to our active engagement with the Company was 14.4 years and it is our belief that the Company’s recent addition of two new Board members is a cynical half-measure with no practical impact on the Company’s policies. |

| • | The Company’s “dead hand” provision in its Certificate of Incorporation has for 22 years enabled Farooq Kathwari and the Directors who were present in April of 1993, along with their hand-picked successors, to entrench themselves in a manner that undermines the most basic right of stockholders. Only due to our efforts is the Company taking steps to address this issue, 22 years after the fact. |

____________________

[2] http://www.newstimes.com/business/article/Ethan-Allen-CEO-says-share-price-is-going-up-6514827.php

| • | The lack of disclosed succession plans coupled with the granting of a five-year, extendible to seven years, employment agreement to 71-year old Farooq Kathwari, who serves as not only Chairman and CEO, but also President, is a troubling, existential governance issue that in our opinion illustrates how the Board has failed in perhaps its most critical role of ensuring management continuity. |

Vote “GOLD”

You may vote by telephone, Internet or by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided. Your vote is extremely important. Please discard any white proxy cards you have received from Ethan Allen. If you have already returned a white proxy card, you can change your vote simply by signing, dating and returning a GOLD proxy card today. Only your latest dated proxy card will be counted.

Stockholders should not be misled by Ethan Allen’s desperate attempt to distort the truth in the days leading up to Ethan Allen’s 2015 Annual Meeting. Stockholders have been poorly served by the stale and outmoded way of thinking that has characterized the current Board of Directors at Ethan Allen and the Company’s abysmal stock price performance is reflective of this. Vote on the GOLD card to elect a slate of six new, outstanding candidates: Edward Glickman, Kathy Herbert, Richard Mansouri, Annelise Osborne, Ken Pilot, and Alex Wolf. Stockholders are encouraged to access the website entitled “Redesign Ethan Allen,” which is available at www.RedesignEthanAllen.com, for more information.

We thank stockholders for their support and urge you to vote on the enclosed GOLD proxy card today.

Sincerely,

Thomas Sandell, Chief Executive Officer

Sandell Asset Management Corporation

About Sandell Asset Management Corp.

Sandell Asset Management Corp. is a leading private, alternative asset management firm specializing in global corporate event-driven, multi-strategy investing with a strong focus on equity special situations and credit opportunities. Sandell Asset Management Corp. was founded in 1998 by Thomas E. Sandell and has offices in New York and London, including a global staff of investment professionals, traders and infrastructure specialists.

Contact:

Sandell Asset Management Corp.

Adam Hoffman, 212-603-5814

Okapi Partners LLC

Bruce Goldfarb, 212-297-0722 or Chuck Garske, 212-297-0724

Sloane & Company

Elliot Sloane, 212-446-1860 or Dan Zacchei, 212-446-1882

Sandell Asset Management Corp., Castlerigg Master Investments Ltd., Castlerigg International Limited, Castlerigg International Holdings Limited, Castlerigg Offshore Holdings, Ltd., Castlerigg Active Investment Fund, Ltd., Castlerigg Active Investment Intermediate Fund, L.P., Castlerigg Active Investment Master Fund, Ltd., Castlerigg Event Driven and Arbitrage Fund, Thomas E. Sandell (collectively, “Sandell”), Edward Glickman, Kathy Herbert, Richard Mansouri, Annelise Osborne, Ken Pilot and Alex Wolf (collectively with Sandell, the “Participants”), have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying form of proxy card to be used in connection with the solicitation of proxies from the stockholders of Ethan Allen Interiors Inc. (the “Company”) in connection with the Company’s 2015 annual meeting of stockholders. All stockholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants, as they contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying proxy card are being furnished to some or all of the Company’s stockholders and are, along with other relevant documents, available at no charge on the SEC website at http://www.sec.gov/ and at our website at http://www.RedesignEthanAllen.com.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained in the definitive proxy statement on Schedule 14A filed by Sandell Asset Management Corp. with the SEC on November 3, 2015. This document can be obtained free of charge from the sources indicated above.